News

Tax Reform Bill would be looked into in best interest of Nigerians – Speaker Abbas

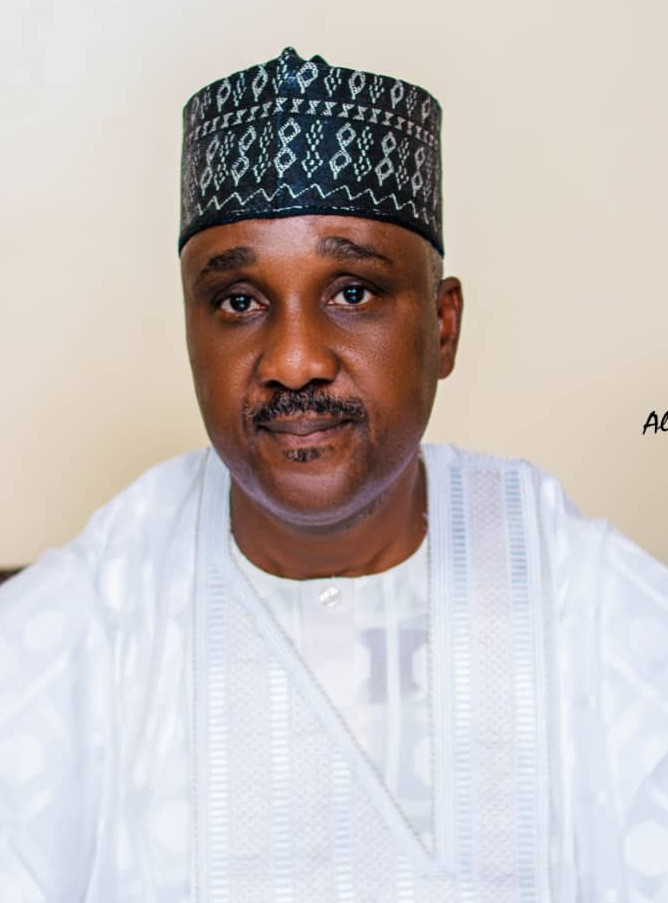

As criticisms continue to trail the Tax Reform Bill presented to the two arms of the legislature, the Speaker of the House of Representatives, Rt. Hon. Tajudeen Abbas said, the lower legislative Chamber would scrutinize the bill in the best interest of Nigerians.

The Speaker who made this known in Abuja on Monday at ‘The People’s House Interactive Session on Tax Reform Bills’ organised by the House, noted that the controversies surrounding the bills “are a reflection of their importance,” adding that such debates are “healthy and necessary in a democracy.”

He added that the session was to channel those discussions into productive outcomes, stressing that it is critical that the House listens to diverse perspectives, asks probing questions, and seeks clarity on any unclear provisions.

The Speaker explained that the bills represent critical proposals from the executive to expand Nigeria’s tax base, improve compliance, and establish sustainable revenue streams for the nation’s development.

He further explained that the Tax Reform Bills aim to diversify the country’s revenue base, promote equity, and foster an enabling environment for investment and innovation.

Speaker Abbas noted that the purpose of the session was to provide members of the House with “a comprehensive understanding of the proposed bills.”

Speaker Abbas noted that tax reforms are a cornerstone of the 10th House’s Legislative Agenda “because of their central role in achieving sustainable economic growth and development.”

The Speaker stated that in every modern state, taxes are the bedrock of public revenue, providing the resources required to deliver education, healthcare, infrastructure, and security.

In the same vein, the Deputy Speaker of the House of Representatives, Hon. Benjamin Okezie Kalu assured Nigerians that tax reform bills will undergo public scrutiny to allow citizens evaluate them and make input.

In his welcome remarks at the Interactive Session on Tax Reform Bills today in Abuja, Kalu emphasized the need for clear articulation of necessary provisions to ensure equity, economic growth, inclusivity and also the promotion of sustainable development for the nation.

Kalu added that the reforms should be rooted in the collective aspiration to create a tax regime that works for all Nigerians, regardless of their economic standing.

The Deputy Speaker however said that more insight into how the tax reforms incentivize the digital economy, support small businesses and low-income households, and more importantly, how the Zero-Rated Value Added Tax works or should work was expected from all the stakeholders.

Speaking further, Kalu added “In this regard, we expect more insight into how the tax reforms incentivize the Digital Economy, support small businesses and low-income households, and more importantly, how the Zero-Rated Value Added Tax works or should work.”

He further notes that I t is crucial for these provisions to be articulated clearly, highlighting how they align with the overarching goal of engendering equity, driving economic growth, and ensuring that no section of society is left behind.