Economy

Tax Reform Bills and the economic outlook for 2025

By Abiodun KOMOLAFE

The Year 2024 has been flogged to death! With 2025 now underway, it’s clear that this year will be crucial for Nigeria and Nigerians. To ensure a game-changing year, the government must develop a comprehensive framework to address the economic, social and political challenges ahead.

To begin with, President Bola Tinubu should leverage his political expertise to facilitate a consensus-driven approach to the Tax Reform Bills currently before the National Assembly. This requires negotiating with regional stakeholders, addressing politically-driven concerns, and finding common ground to ensure the Bills’ successful passage.

The Tax Reform Bills are to be commended as the much-needed attempt to get the country back to where it was before the suspension of the 1963 Republican Constitution by a misguided set of people in 1965. Yes, Nigeria must become a producer nation again! This is the only way to pull tens of millions out of poverty, create jobs and nurture a political economy based on shared economic prosperity.

The fantasy coming from some people that Nigeria can continue to defy the law of gravity and go on with the assumption-based political economy must be consigned to the dustbin. So, the Federal Government has a responsibility to push upfront an economic spokesperson who can present its economic position with the clear lucidity necessary to shift the territory of the debate in favour of its own position. This has to be done with the sense of urgency that the current situation demands!

When President Tinubu took office, Nigeria faced significant challenges, including widespread insecurity, underdeveloped infrastructure and a debt service-to-revenue ratio of 97%. The country also struggled with a massive Forex backlog of $7 billion and many state governments’ inability to pay salaries. These pressing issues underscored the need for urgent reforms to get the country back on track.

By 2025, Nigeria’s economy is poised for growth, driven by increased oil production, projected to reach two million barrels per day, and enhanced domestic refining capabilities. Building on recent momentum, Nigeria has achieved notable economic gains, with its Gross Domestic Product (GDP) growing by 3.46% and unemployment rates decreasing to 4.3%. The country’s fuel imports are also declining rapidly, and it has begun exporting Premium Motor Spirit (PMS) to West Africa and Europe.

Contrary to former Vice President Atiku Abubakar’s claims, Nigeria has made significant strides in managing its debt. The country has reduced its revenue-debt service ratio from over 90% to 64%, indicating a marked improvement in its debt management. Furthermore, Nigeria’s foreign reserves have increased substantially to over $40 billion, despite the challenges of servicing external debts and clearing foreign exchange backlogs. These positive developments are expected to strengthen the naira, ultimately leading to a reduction in the cost of goods and services.

Infrastructure development is another area where Nigeria is making progress. The Lagos-Calabar coastal road is under construction and it’ll soon be the turn of the Sokoto-Badagry highway. Likewise, initiatives such as the student loan scheme by NELFUND and consumer credit by CrediCorpNG are gaining traction, providing financial support to individuals and businesses.

The Tinubu-led government is taking steps to promote autonomy for local governments, modernize the livestock industry and restructure social investment programs. Efforts to address insecurity, such as (the detention of) Simon Ekpa, banditry and farmers-herders clashes, are also yielding positive results, indicating improved social cohesion.

To effectively address inflation in 2025, the government should consider implementing a comprehensive Inflation Reduction Act. But then, this would require strong political will! Key components of the Act should include cost-efficiency measures, such as implementing the Oronsaye Report and designating a cost-efficiency czar – preferably the Minister of State in the Ministry of Finance or the Secretary to the Government of the Federation. This czar would be responsible for overseeing the implementation of performance-based budgeting, ensuring the budget is aligned with specific timelines and objectives.

The National Assembly should adopt a Performance Planning Budgeting System for its oversight functions. It is alarming that, since 1999, the Assembly has not established a Congressional Budgeting Office to provide technical expertise. This oversight contributes to Nigeria’s underperformance, and the current Assembly must address this flaw. To tackle economic challenges, implementing the Inflation Reduction Act and declaring a State of Emergency in ports and trade facilitation systems could help streamline trade processes, reduce inflation, and stimulate growth.

Nigeria must revamp its trade facilitation mechanisms. There’s no alternative! This overhaul should be accompanied by an Inflation Reduction Act that fosters partnerships with the states and local governments to revamp rural roads and promote integrated rural development. To combat food price inflation, the president should reinvigorate his commitment to creating an enabling environment for modern commodity exchanges. These exchanges are a crucial tool in reducing inflation and addressing the current economic challenges. Ultimately, the government must prioritize inflation reduction in its economic policy and ensure this goal is reflected in the 2025 budget.

It is our belief that there’s already a Technical Committee in progress, examining what will be the signs and wonders of the Trump Presidency in terms of the global cost of oil prices and the effects of proposed tariff hikes on international trade. Since we are not God, instead of questioning Donald Trump’s character, we must be as proactive as we were in responding to the devaluation of the British Pound Sterling in 1967. Nigeria’s response to the British devaluation as a member of the Sterling Group earned the country great plaudits and admiration across the world. Essentially therefore, there must be a plan! Before we start clapping for Trump, there must be strategies in place to project his policies rather than his character!

A Trump Presidency begins on January 20; and, like the Boy Scout, Nigeria must be prepared! It is to be hoped that a savvy international trade negotiating team is already in place. It is going to be very hard! We must be prepared!

May the Lamb of God, who takes away the sin of the world, grant us peace in Nigeria!

*KOMOLAFE wrote from Ijebu-Jesa, Osun State, Nigeria (ijebujesa@yahoo.co.uk)

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

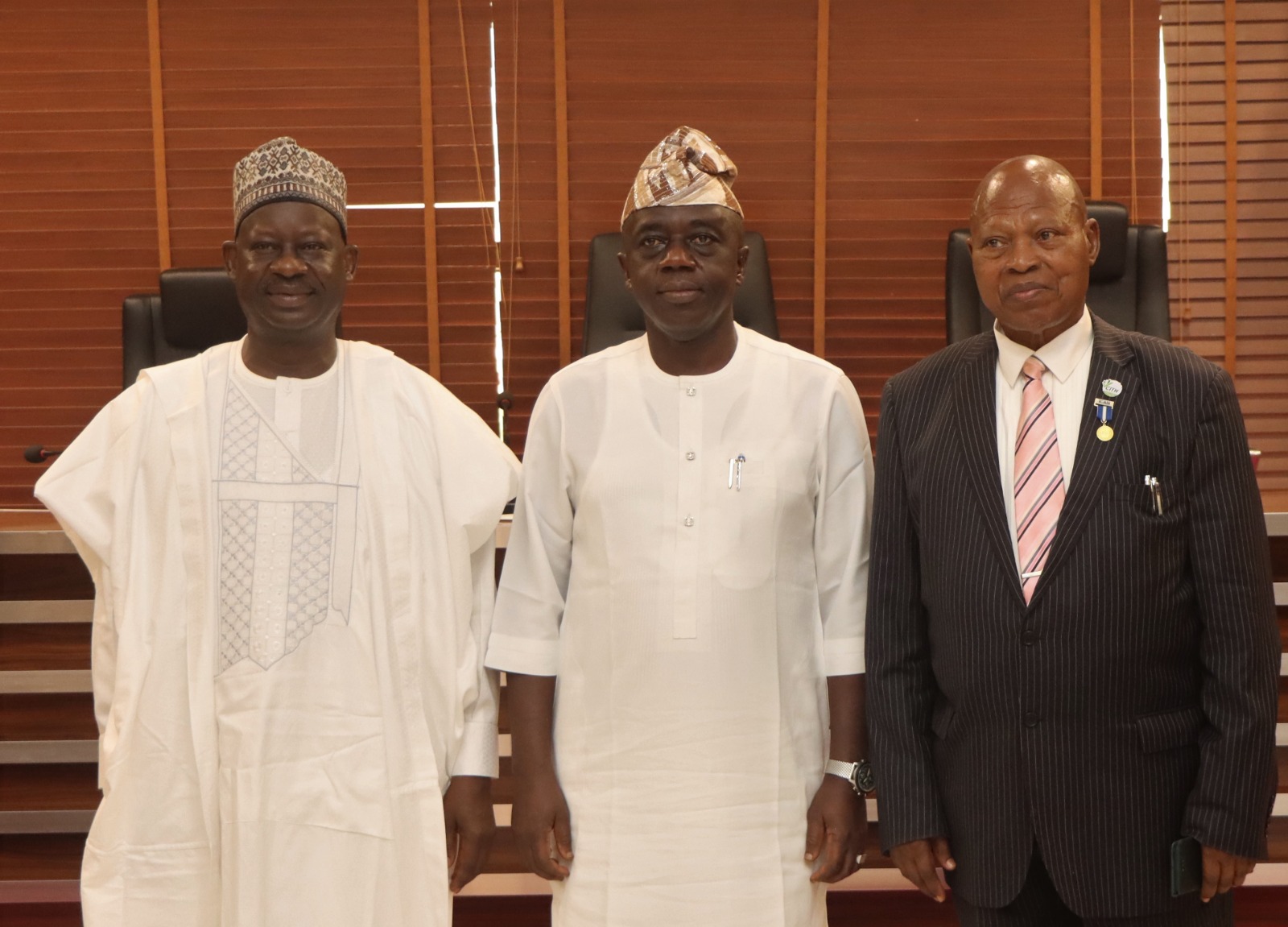

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

News1 week ago

News1 week agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Politics1 week ago

Politics1 week agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

Foreign6 days ago

Foreign6 days agoHouthis declare Ben-Gurion Airport ‘no longer safe’ after renewed Gaza fighting

-

Politics1 week ago

Politics1 week agoYahaya Bello deceptively arranging recall of Senator Natasha, desperate to replace her – Constituents

-

Politics1 week ago

Politics1 week agoAtiku, El-rufai, Obi condemn Tinubu’s suspension of Rivers Governor, demand reversal

-

News1 week ago

News1 week agoWhy Christ Embassy’s Pastor Chris holds Abuja mega crusade – Fisho

-

News6 days ago

News6 days agoUmeh denies receiving $10,000 with other 42 Senators to support state of emergency in Rivers

-

Crime1 week ago

Crime1 week agoGhana’s anti-drug agency nabs Nigerian drug kingpin, Uchechukwu Chima, seizes $2.1m worth of cocaine, heroin