Business

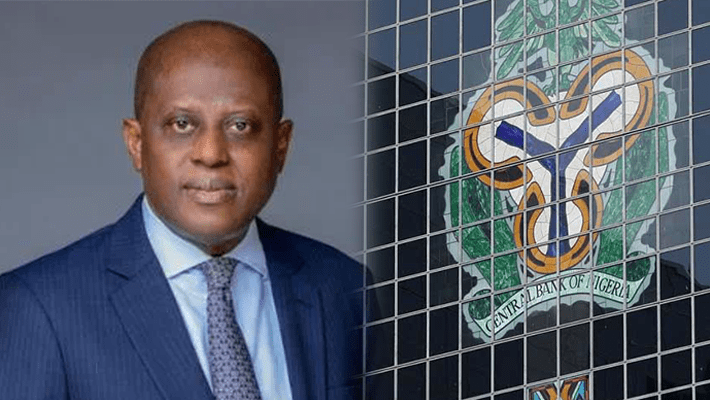

Sacked CBN staff demands N30 billion compensation, reinstatement

The Central Bank of Nigeria, CBN has been dragged to the National Industrial Court, Abuja by sacked staff demanding for the sum of N30 billion compensation.

In a suit filed by the embattled staff at the Court, they are also demanding for the reinstatement of their appointment as well as seeking the Court to declare their sack null and void.

The aggrieved workers of the apex bank in an originating summons filed on July 4, 2024, under the NICN Civil Procedure Rules 2017, raised several issues for the court to determine.

Among issues raised were the lack of fair hearing which was fundamental, but that right was ignored by the CBN management and went ahead to disengage them from service and hence, urged the Industrial Court to determine.

By not allowing fair hearing, the aggrieved staff said, CBN breached it’s o2n internal policies, Nigerian labour laws, and contractual rights.

The claimants—Stephen Gana, Kabiru Idris, Benedict Agbo, Peter Adeyemi, John Yisa, Eleanor Ihua, Stephen Ambore, Edom Obi, Dabo Chundung, Ekpe-Oko Roupa, Alabi Mubarak, Isa Yusuf, Quadru Ralph, Olasupo Adedokun, Dauda Yusuf, Ogidi Tolu, Levi David, Umar Kurba, Christopher Alfred, Gana Nma, Tanko Joel, Iyare Christian, Paul Iza, Alzebeokhai Esiemokhai, Pius Odunze, Isiuwe Uwadiahu, Vivienne Usoro, Imoh Francis, Ofili Lydia, Onunkwor Christopher, Adeshina Nurudeen, Bukar Ahmed, and Ajayi Omosolape—are all represented by Okwudili Abanum in a class action lawsuit.

They argue that the termination process, carried out through letters titled “Reorganisational and Human Capital Restructuring” dated April 5, 2024, violated both the CBN human resources policies and procedures manual and Section 36 of the Nigerian Constitution. The claimants further argue that the process lacked the necessary consultation and fair hearing mandated by law.

The claimants further contended that their termination from service on the grounds of restructuring, were arbitrary, illegal, and unconstitutional and urged the Court to declare as such.

The claimants are requesting a restraining order to prevent the CBN from terminating their employment without following the proper procedures. They are also seeking a declaration for their immediate reinstatement and payment of salaries and benefits from the date of termination.

The suit references Article 16.4.1 of the HRPPM, which mandates consultation with the joint consultative council and adherence to fair procedures before employment actions adversely affect staff. The claimants contend that this provision was flagrantly disregarded, as they were given just three days to vacate their positions and hand over official property.

They are also seeking N30 billion in general damages for psychological distress, hardship, and reputational harm caused by the dismissal, as well as an additional N500 million to cover the cost of the suit.

During the first mention of the suit on November 20, 2024, the court urged the parties involved to attempt an amicable resolution of the matter. Justice O. A. Osaghae noted, “This is a new matter; it is mentioned for the first time. I have looked at the processes, and it is my view that parties should attempt an amicable resolution of this dispute. Accordingly, parties are encouraged, pursuant to section 20 of the NICA 2006, to attempt an amicable settlement.”

Meanwhile, the CBN, represented by a team of lawyers led by Inam Wilson (SAN), informed the court that they had filed a preliminary objection to the claimant’s suit, which was served to the claimants on November 4, 2024.

Following the defendant’s counsel’s submission, Justice Osaghae adjourned the case to January 29, 2025, for the hearing of the preliminary objection.

It is recalled that in 2024, the CBN terminated the appointments of about a thousand staff in four batches between March and May of that year.

Some laid-off staff claimed they received severance payments as low as N5,000, while others said their gratuities were absorbed entirely to offset outstanding loans.

Although the layoff was officially attributed to reorganisation and human capital restructuring, the affected staff argue that the process violated the CBN Act, which mandates board approval for significant employment decisions.

On December 4 last year, the CBN stated that its early exit package was entirely voluntary and without negative repercussions for eligible staff.

Business

Flutterwave, FIRS collaborate to digitize tax collection in Nigeria

A leading African payments technology company, Flutterwave and the Federal Inland Revenue Service, FIRS have concluded collaborative discussion to digitize tax collection in Nigeria.

The collaboration is a step initiated by the FIRS to simplify tax compliance by offering multiple payment options, real-time reporting, and offline capabilities for those with limited internet access.

Meanwhile, Flutterwave CEO Olugbenga ‘GB’ Agboola stressed the firm’s commitment to ensure the using of technology to enhance efficiency, transparency, and economic growth by digitizing government tax collections.

Agboola said: “At Flutterwave, we are committed to leveraging technology to drive efficiency and economic growth. By making tax payments easier and more transparent, we are helping to digitize government collections and support national development which is in line with our mission,” he said

The partnership enables businesses and individuals to pay taxes, levies, and other statutory fees through Flutterwave’s secure and efficient digital infrastructure.

Driving transparency and accessibility

The integration introduces several enhancements, including Flutterwave’s Senior VP, Olufunmilayo Olaniyi, highlighted the importance of public sector collaboration in advancing digital payments, fostering trust, and driving innovation in Nigeria.

“Working with the public sector is pivotal to shaping the future of digital payments in Nigeria. This underscores our commitment to delivering solutions that serve Nigerians better, foster trust, and drive impactful innovation through strategic collaboration.”

What you should know

The Nigerian government has been implementing several measures to enhance tax compliance and efficiency, including digital reporting and e-invoicing systems. In line with these efforts, the Federal Inland Revenue Service (FIRS) is set to pilot its “e-Invoice” platform in July 2025 to streamline invoice management and improve real-time visibility into business transactions.

Amid these regulatory shifts, Flutterwave has been strengthening its presence in Nigeria’s financial ecosystem through strategic collaborations. Beyond facilitating tax payments, the company has expanded its role in digital innovation and security. It recently partnered with the National Information Technology Development Agency (NITDA) and Alami to drive digital transformation and empower SMEs in the tech and creative industries.

Also in 2024, Flutterwave deepened its commitment to financial security by partnering with the Economic and Financial Crimes Commission (EFCC) to establish a Cybercrime Research Center at the EFCC Academy.

Business

20 new millionaires emerge from Fidelity Bank GAIM 6 promo

Fidelity Bank Plc has announced 20 new millionaires at the 2nd and 3rd monthly draws of its Get Alert in Millions Season 6 (GAIM 6) promo held at the bank corporate head office in Lagos.

The 20 lucky winners, randomly selected through an electronic draw across Lagos, North, Abuja, South-West, South-South, and South-East zones, will be rewarded with the sum of one million naira each.

Speaking at the draws, the promo Chairperson and Executive Director for Lagos and South-West, Fidelity Bank Plc, Dr. Ken Opara represented by the Regional Bank Head, Ikoyi, Chetachi Okechukwu, noted that the GAIM 6 promo was designed to reward customers’ loyalty, encourage a savings culture, and promote financial inclusion across the country.

According to Opara, “Fidelity Bank is dedicated to the financial well-being of our customers and this commitment inspired the launch of the GAIM Promo, designed to cultivate a strong culture of savings.

“Through this promo, customers have the chance to win substantial cash prizes up to N10 million by saving and transacting with their Fidelity Bank Savings accounts. In addition to the monetary rewards, winners will receive complimentary financial advisory services to secure and grow their wealth for the future.”

The monthly draws was monitored by the representatives of relevant regulatory bodies, including the South-West Zonal Coordinator, Federal Competition and Consumer Protection Council (FCCPC), Mrs. Aboluwade Margaret; and the Principal Legal Officer, Lagos State Lotteries and Gaming Authority, Oyinkan Kusamotu.

Since the campaign launched in November 2024, Fidelity Bank has disbursed N19.75 million to 869 customers across different categories. The GAIM 6 campaign, which will run until August 2025, is set to reward lucky customers with a total of N159 million.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards. It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

Business

NYSC members win millions in Fidelity GAIM 6 Promo

Fidelity Bank Plc has reaffirmed its commitment to financial inclusion, youth empowerment, and promoting a healthy savings culture by rewarding nine National Youth Service Corps (NYSC) members with N500,000 business grants each.

The grants were awarded under the Get Alert in Millions Season Six (GAIM 6) promo, an initiative designed to reward loyal customers with cash prizes totalling N159 million.

The promo, which runs from November 2024 to August 2025, targets various categories of customers, including NYSC members, students, and general customers.

Mr. Osita Ede, Divisional Head of Product Development at Fidelity Bank Plc, stated that this season of the GAIM promo aims to enhance the opportunities for loyal customers to win.

“When we launched the GAIM 6 promotion in November 2024, we unequivocally stated that this campaign season is intended to promote inclusivity. Consequently, we have increased the total prize money to N159 million and added additional draws, beyond the weekly and monthly draws featured in previous seasons.

“Now, we have specific draws catering to various segments of our customer base including women, students, youth corps members, and traders. It is important to note that these categories of customers also stand the chance to win millions of naira in the monthly and grand draws which we will be hosting till 20 August 2025,” explained Ede.

Nine NYSC customers were selected through a random electronic draw in the first quarter of the GAIM 6 campaign across the country. They are: Oluwatosin Emmanuel Olowolayemo and Ekpeno Aniekan George, both Youth Corps members in Akwa Ibom State; Derryk Chidubem Okafor, Enugu State; Aliyu Idris Adamu, Kaduna State; Bomane-Aziba Koromo, FCT_Abuja; Asabe Grace Adamu, Bornu State; David Agbai Agwu, Osun State; Abdullahi Opeyemi Olajuwon, Lagos State and Eghosa George Orhue, Ekiti State.

Expressing his gratitude and excitement, one of the recipients of the entrepreneurship grant, Chidubem Okafor, appreciated Fidelity Bank for the grant, noting that the funds will enable him to achieve his entrepreneurial dreams.

His words, “At first, I thought it was a scam when they introduced the initiative at our orientation camp, but today, I am truly honored to receive this support from Fidelity Bank. This grant will go a long way in helping me achieve my entrepreneurial dreams, and I promise to make the most of it,”

Similarly, David Agwu, who also emerged a winner in the draw, expressed his surprise at the unexpected win, saying, “When I received the call, I thought it was a prank. I never applied for anything, so it was hard to believe. But when they sent me proof, I realized it was real. I am truly grateful for this opportunity. My plan is to invest the money in vocational training and digital skills development, particularly in fashion and painting in order to establish a sustainable business”.

Beyond the N500,000 entrepreneurship grant, the winners will also enjoy free business advisory and training sessions at the newly launched Fidelity SME Hub, located at 22, Lanre Awolokun Street, Gbagada Phase 2, Lagos.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 251 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards. It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

-

News6 days ago

News6 days agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

Politics1 week ago

Politics1 week agoCPDPL accuses Adeyanju of orchestrating smear campaign against FCT Minister Wike

-

News6 days ago

News6 days agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

News6 days ago

News6 days agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News5 days ago

News5 days agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Sports1 week ago

Sports1 week agoMerino gives Arsenal win over Chelsea

-

Interview7 days ago

Interview7 days agoSenators Natasha-Akpabio saga should have been resolved privately – Rev. Mrs Emeribe

-

Politics3 days ago

Politics3 days agoOpposition leaders announce coalition to challenge Tinubu in 2027