Economy

Nigeria’s chronic debtors and politics

By Abubakar Yuauf

In the last six decades, soon after Nigeria’s independence in 1960, the country as one of the leading nations in the African subregion and the world had being grappling with so many problems.

These problems varies from economic, social and infrastructural deficits not on the basis of misgovernance, but a lot of negative variables from both players and its handlers.

In either way, government was charged with the obligations of creating an enabling environment that allowed all sectors to thrive amidst daunting challenges from all angles.

The positive development of government interventions readily brought to fore the activities of the banking sector overtime in the management of the economy, social and infrastructural development of the country.

The Banking sector placed with the burden of availing resources for businesses that enabled a deregulated and a thriving economy both from individuals, institutions, organised private sectors and the public entities.

It became subject of abuses both from insiders and collaborators, that led to a well contrived arrangements for a better economy, gave way to all sorts of manipulations both from the public and private sectors involved, with dire consequences on the banking industry after some times.

The negative development reared its head when funds availed both public and private sectors for businesses were no longer returned, diverted and mismanaged as against the financial regulations or conditions precedent to draw down, and it’s large toll on Nigeria’s economy, investors confidence and investments.

The ugly trend became manifest in the early 90s, when Banks in Nigeria could no longer sustain it’s operations or met their financial obligations to both legitimate and other customers, that led to the deregulated financial sector through the proliferation of Banks to go down ,having failed to manage it’s successes.

It resulted to job losses, affected negatively the robust and thriving economy that rose as a result of oil boom and favourable economy between late 80s and early 90s, as Bank debtors reneged from payment of monies released to both private and public sectors of the economy.

With robust economy, not much was felt from the unfortunate situations, as the debt profile continue to haunt the once high performance economy till 2000, when the then CBN came up with a policy of minimum deposit and or Banks liquidation, as a result of heavy burden of unserviceable debts and at many times uncollateralized loans by customers that affected the once thriving economy.

The CBN management then pegged minimum deposit from Banks operation in Nigeria to N1 billion as deposit with the apex Bank or merge with others, and at it’s worst go down put of business.

The visible government policies was as a result of unserviceable bad loans from chronic Nigeria debtors cut across all facets of the economy from oil, aviation, properties, communication, among many others, that took it’s toll on our Banks.

In early 2000, it was becoming unbearable with obvious manifest on the country’s economy, as many Banks operating in Nigeria could not meet their basic obligations weighed down by huge debt burden ,which led to a CBN policy of ‘Nationalisation’ of some of the Banks, mostly the new generation Banks as well as some old generation Banks with heavy loans burden, that had made most of it’s activities moribund.

The multiplier effects on the economy led to the taken over of some Banks in Nigeria, and subsequently the convening of Asset Management Corporation of Nigeria AMCON in 2010 , that bought over or took over the bad loans in trillions from Eligible financial institutions (EFI ),and Eligible Banks Assets (EBI) in the country.

The new AMCON that came on board in 2010 through an act of the law took over over 12, OOO Banks debts/ debtors exposures , that brought the banking sector and Banks from leaping and its lost glory back on track, and restored both customers , investors confidence, and the economy.

Between 2010 and 2020 ,it had recovered borrowed funds from Nigeria’s obligors in trillions and reduced the exposure from 12,000 to about 7,000 in 2022. these efforts are readily available in the public domain which involved series of litigations, agreements and disagreements in line with it’s mandate.

AMCON had on two occasions sought an amendment to it’s act in 2015 ,2019 as the last was signed into law by President Muhammadu Buhari in 2021, that gave a legal backing to all it’s actions with regards to borrowers and debtors exposures to AMCON via Nigeria Banks.

The determination of the corporation to recover the balance of over N4 trillion stuck with only 350 obligors including individuals, companies and their directors representing 83% of the entire exposures, with just negligible 16% fully collaterised, making AMCON to crisscrossed 244 courts in pursuit of recovery of the Non Perfoming Loans NPFL’s out of 350.

These recoveries cut across businesses, politicians ,oil and gas , construction, properties, aviation who were hitherto not showing any positive signs of repayments.

It is on record that AMCON through the courts took over the highly rated airline in Nigeria, Arik, Aero and others and created another airline, NG Eagle.

With over 1000 chronic Nigeria debtors cut across all areas to the tune of N4 trillion naira of tax payers money, that will reduce to the barest minimum, the borrowings from other sectors.

This prompted the assent to it’s new act through amendment, after due diligence from the National Assembly, creation of special courts by the judiciary through the Federal High Court known as ‘AMCON proceeding rules 2020’.

This will fast tracked the legal processed, leverage on enforcement and granting of exparte orders (EO’s), to accelerate fast recovery from the recalcitrant borrowers.

The positive development had brought both the executive, legislative and judiciary on the same page of returning banks in Nigeria into good stead considering the time line of giving to AMCON to recover all exposures in accordance with it’s sunset.

Having achieved this much in it’s enforcement, by taking over some multinationals like NICON Luxury Hotels and NICON Re- insurance Nigeria, state governments, private sectors and with renewed zeal to publish names of unrepentant debtors to come forward for a proposal of repayments, there is no doubt that AMCON will hit it’s sunset of recovery and winding down in the shortest possible time.

The one month notice of repayments plans had elapsed between December 6th 2021 to January 5th 2022, with AMCON not going back on it’s plans, not minding whose ox is gored and no matter how highly placed individuals and their conglomerates that are involved in the exposures.

Coming at a good time when the 2023 elections is around the corner, it is high time the electoral umpire INEC ,anti graft agencies EFCC, ICPC collaborate to fight Nigeria’s common criminals that took loans from Banks and lackadaisical in payments through a robust institutional framework and disposition.

The mandate of ICPC, EFCC is to fight corruption and corrupt elements in Nigeria, hence charged with recovery of ill gotten wealth, the refusal of Banks obligors to offset their exposures to AMCON is also tantamount to criminality and corruption against the state, therefore, the agencies will assist one another greatly.

To rid Nigeria of corruption and corrupt elements, the political class charged with the running of the country, are expected to be corrupt free, as most of the Bank exposures involved the political class at all levels.

Therefore, INEC should not only demand the assets of those aspiring for political offices from councillors to President, but their exposures to Banks and other financial institutions, so as to build a sane and egalitarian society that will be conducive for all Nigerians.

The growing need for partnership between the anti corruption agencies and AMCON is here, as the inclusion as prerequisites to give a clean bill to anyone seeking for political offices should start from solvency to Nigeria Banks, assets and liabilities.

Most of our political class are directly or indirectly involved in borrowings from Banks, using their names, companies and institutions as collateral, towards achieving their aims.

AMCON should remained undaunted by going ahead to publish names of it’s obligors no matter how highly placed for public consumption, so as to encourage and elicit positive response from the affected politicians, and to also display institutional independence.

Politics is meant to grow the country, politically, economically, socially and infrastructural breakthroughs, anything sort of this , will be a disservice to Nigeria.

AMCON need not to hesitate by going ahead in the few days to make public it’s intention on the deliquent debtors to avoid over flogging the issue of recovery of Banks money in Nigeria.

For a thriving nation is a debtor free nation, all hands must be on deck by AMCON, no matter the distraction and frustration to ensure it recovered the huge tax payers resources stuck in the hands of few Nigerians and their collaborators.

For AMCON, it will be failing in it’s responsibility, not to go ahead to recover and remit the huge amount to government, but only through making public the names of the affected Nigerians, their companies and Institutions.

Abubakar Yusuf writes from Abuja

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

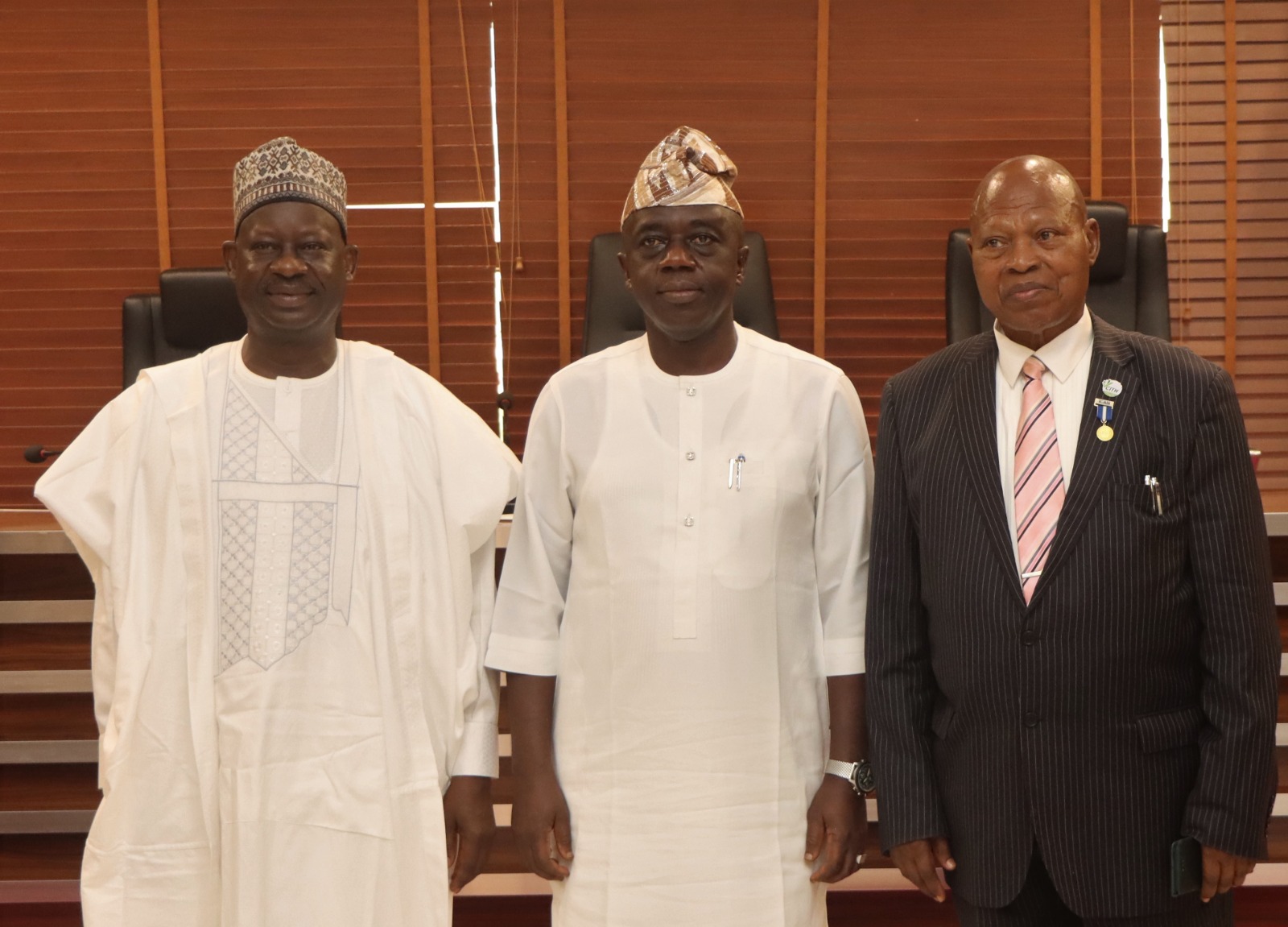

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

Politics1 week ago

Politics1 week agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

Foreign7 days ago

Foreign7 days agoHouthis declare Ben-Gurion Airport ‘no longer safe’ after renewed Gaza fighting

-

Politics1 week ago

Politics1 week agoYahaya Bello deceptively arranging recall of Senator Natasha, desperate to replace her – Constituents

-

News1 week ago

News1 week agoWhy Christ Embassy’s Pastor Chris holds Abuja mega crusade – Fisho

-

Politics1 week ago

Politics1 week agoAtiku, El-rufai, Obi condemn Tinubu’s suspension of Rivers Governor, demand reversal

-

Business1 week ago

Business1 week ago20 new millionaires emerge from Fidelity Bank GAIM 6 promo

-

News1 week ago

News1 week agoUmeh denies receiving $10,000 with other 42 Senators to support state of emergency in Rivers

-

Business1 week ago

Business1 week agoFlutterwave, FIRS collaborate to digitize tax collection in Nigeria