Economy

Nigeria facing weakening economy, highest cost of living – IMF Report

The International Monetary Fund, IMF and the global lending organization has revealed that the West African country, Nigeria is facing the worsening and weakening economy and economic crisis.

This was disclosed in a new report titled, “IMF Executive Board Concludes Post Financing Assessment with Nigeria.”

According to the IMF, stalled per-capita growth, poverty, and high food insecurity have exacerbated the ongoing cost-of-living crisis in Nigeria.

The report came amid rising inflation, an exchange crisis, weak economic growth, and business shutdowns.

According to the report, low revenue collection has hampered the provision of services and public investment.

It noted that headline inflation reached 27 percent year-on-year in October (food inflation was 32 percent), reflecting the effects of fuel subsidy removal, exchange rate depreciation, and poor agricultural production in the country.

The report partly reads, “Nigeria faces a difficult external environment and wide-ranging domestic challenges. External financing (market and official) is scarce, and global food prices have surged, reflecting the repercussions of conflict and geo-economic fragmentation.

“Per-capita growth in Nigeria has stalled; poverty and food insecurity are high, exacerbating the cost-of-living crisis. Low reserves and very limited fiscal space constrain the authorities’ option space.

“Against this backdrop, the authorities’ focus on restoring macroeconomic stability and creating conditions for sustained, high, and inclusive growth is appropriate.”

The report noted that on January 12, 2024, the Executive Board of the International Monetary Fund concluded the Post Financing Assessment and endorsed the Staff Appraisal on a lapse-of-time basis.

It added that Nigeria’s capacity to repay the IMF is adequate.

The IMF also expressed optimism that the new administration had made a strong start, tackling deep-rooted structural issues in challenging circumstances.

Immediately, it adopted two policy reforms that its predecessors had shied away from: fuel subsidy removal and the unification of the official exchange rates.

It added, “The new CBN team has made price stability its core mandate and demonstrated this resolve by dropping its previous role in development finance. On the fiscal side, the authorities are developing an ambitious domestic revenue mobilisation agenda.”

According to data from the Debt Management Office, Nigeria currently owes the IMF $2.8 billion. The Federal Government, in its 2024 budget, plans to spend about N8.2 trillion on debt servicing.

In a new report, professional services firm PricewaterhouseCoopers warned that Nigeria’s rising debt service costs might affect the country’s debt servicing ability, credit rating outlook, and borrowing costs.

PwC said debt service could rise from N8.25tn in 2024 to N9.3tn in 2025 and further to N11.1tn in 2026.

“With a high debt servicing to revenue ratio, the government aims to increase domestic debt in 2024 to meet its deficit funding requirements,” the report read in part.

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

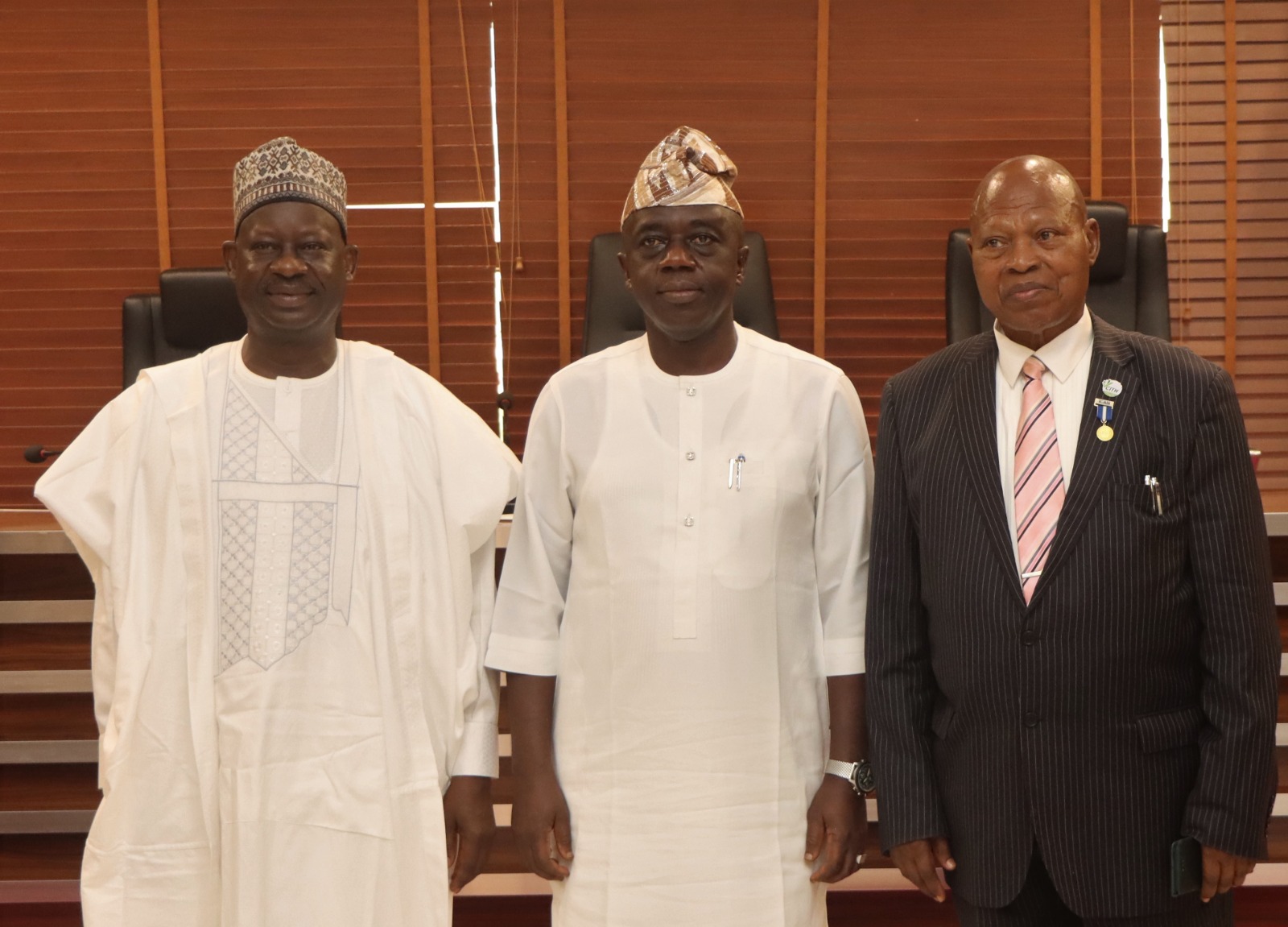

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

News6 days ago

News6 days agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

Politics1 week ago

Politics1 week agoCPDPL accuses Adeyanju of orchestrating smear campaign against FCT Minister Wike

-

News6 days ago

News6 days agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

News6 days ago

News6 days agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News5 days ago

News5 days agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Sports7 days ago

Sports7 days agoMerino gives Arsenal win over Chelsea

-

Interview6 days ago

Interview6 days agoSenators Natasha-Akpabio saga should have been resolved privately – Rev. Mrs Emeribe

-

Politics3 days ago

Politics3 days agoOpposition leaders announce coalition to challenge Tinubu in 2027