Economy

Independence: Nigeria celebrating generational debt @ 61 – Former ADP Publicity Secretary

Former National Publicity Secretary of the Action Democratic Party (ADP), Prince Adelaja Adeoye has carpetted President Muhammadu Buhari for leading Nigeria into a generational debt trap, saying that rather than spending tax payers fund to organize 61st Independent celebration, the country should be on a sober reflection.

Adelaja, who was recently appointed into PDP’s national convention organizing committee (NCOC), said it is not a bad thing to borrow, saying that the strongest economies of the world like US, China and England also borrows but for strategic national development sake.

In Nigeria, most of the borrowed funds end up in the pockets of the powerful, through one means or the other, which leaves the country to be fully exposed to her lenders.

Adelaja said when President Obadanjo came to power in 1999, one of his efforts was to get our huge loans, which was accumulated by the Military regimes forgiven, and he achieved that.

The country started on a clean note again after 1999, but it is so worrisome that between that time and now, Nigeria is now in debt to the tune of N33.107 trillion, “which is not reflective in our national development, be it human or instrastructural development.”

The report from Debt Management Office noted that, Nigeria’s Public Debt Stock as at March 31, 2021 which comprises the Debt Stock of the Federal Government of Nigeria (FGN), thirty-six (36) States Governments and the Federal Capital Territory (FCT) stood at N33.107 trillion or USD87.239 billion.

The Debt Stock also includes Promissory Notes in the sum of N940.220 billion issued to settle the inherited arrears of the FGN to State Governments, Oil Marketing Companies, Exporters and Local Contractors compared to the Total Public Debt Stock of N32.916 trillion as at December 31, 2020, the increase in the Debt Stock was marginal at 0.58%.

Worrisomely, when President Buhari came to power, he told the entire world that he met an empty treasury, but shortly after, some States were given what they termed as bail out funds. Nigerians also witnessed that when an election is closer in some APC controlled states, a bail out grant of N20 billion was also extended to them.

When you compare the debt stock before and after President Buhari ascend to power, you would realize that something is fundamentally wrong in the way this current government is accumulating debts and what they are being used for.

“The question that is begging for an answer is, why taking more loans when source of repayment is nosediving, because this is like setting up the next and coming government, which would be spending most of its time grabbling on how to repay these loans.

“Recently, the President transmitted a fresh loan request, to the National Assembly seeking for a legislative approval of $4.179 billion ($4.054 billion and $125 million) and £710 million”, this will add to the existing N33.105 trillion debt stock of the country.

“Currently, the country’s debt service to revenue ratio is standing at 98%, which is not healthy for the country.

“What this means is that a time is coming that Nigeria won’t be able to fund its annual budget by even a percent if care is not taken. These factors affect the economy badly as we can all see that Naira to a dollar is about N580 now.

“Putting all these together, it appears that the government seems not to be listening to experts opinion on this accumulation of loan drives, because Chairman of President Muhammadu Buhari’s Economic Advisory Council (EAC), Dr. Doyin Salami, has also raised an alarm saying that debt service-to-revenue ratio is at 97.7 per cent (January to May 2021), and that the country’s public debt profile was unmaintainable.

“The mainstay of our economy is oil, which is gradually giving way to newer technologies like electric vehicles, renewable energies, solar power and others. The main source of repayment for these loans is now getting alternatives, and instead of dipping more, we need to stop and reflect on our current and future financially.

“What is Nigeria celebrating at 61?”, Adelaja asked.

On VAT controversy, he urged that States be allowed to compete in the collection so that there would use it in payment of workers’ salaries and development of infrastructure instead of going to Abuja to share free money.

In doing that, Adelaja argued, the quest to contest governorship election would decline, saying that anybody who is not competent will be be exposed.

He said: “The current system where money realized from one state is shared with another State, who did not lift a finger or work for it, will continue to aid underdevelopment. What most of the governors practically do in office was to wait for monthly FAAC from Abuja and after then call it a day till next payment. The country must begin to practice true federalism if at all we want real progress, Adelaja concluded.

Economy

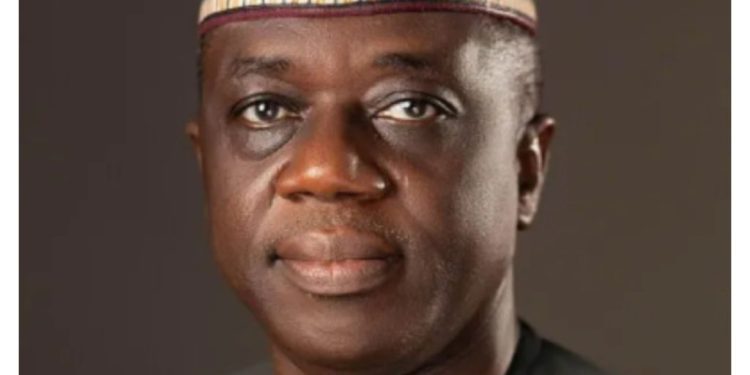

Newly appointed Accountant-General, Ogunjimi assumes office, pledges fairness to staff

The Accountant General of the Federation, Shamsedeen Babatunde Ogunjimi who was appointed by President Bola Ahmed Tinubu last week has assumed office on Monday.

In a brief ceremony marking his assumption at the Treasury Office in Abuja, he promised to be fair to staff of the office which he said, they would not be intimidated or victimized during his tenure of office.

In his maiden address to the entire staff of the Office of the Office of the Accountant General of the Federation, he called for unity, professionalism and commitment in order to achieve the objectives of the office.

He recalled how he suffered victimisaton in hands of previous Chief Executives where he worked, he promised that it would not be the case as he was elevated as the Accountant General of the Federation.

He said: “It is good to be back, this is our home, nobody will drive us out. I want everybody to have the spirit of togetherness.

“I am not in any group, I am not going to polarize the house.

“If I fail, everyone here has failed. I am ready to commit myself to the service of the public.”

The Accountant General called on staff to let the past go and forge a new spirit in order to move the office forward for the good of the nation and the current administration.

“During my interview for this job, when I was asked what I would do differently to change the image of the Treasury House, I wanted to put the question back to you.

“What will you do differently to correct the image of the OAGF? The question is to all staff members.

“Everyone of us must work to change the perception of the country’s treasury.

“I have been a victim of the chief executive officer firing directors he or she doesn’t like.

He assured the staff of the Treasury House of cooperation they haven’t seen in their lifetime professional career, saying, ‘I don’t like him. Please remove him’, I am not going to be that leader,” he said.

CAPITAL POST recalled that President Bola Tinubu last week approved the appointment of had last week approved the appointment of Mr Babatunde Ogunjimi as the country’s new Accountant General thereby putting to rest the guesswork of who should be the next occupier of the Treasury House.

Economy

NASENI embarks on nationwide campaign to promote Made-in-Nigeria products

The National Agency for Science and Engineering Infrastructure (NASENI) has announced plans to launch a nationwide sensitization campaign to promote the adoption of Made-in-Nigeria products, highlighting the transformative impact of locally engineered innovations on the nation’s economy.

As part of the initiative, the agency is organizing strategic focus group meetings across the six geopolitical zones of the country to galvanize support for indigenous products.

Speaking at the North Central zonal meeting in Abuja on Wednesday, the Coordinator, Implementation and Management Office (IMO) of NASENI, Yusuf Kasheem, emphasized the importance of supporting local products to drive economic growth.

“When Nigerians embrace the initiative, we do more than purchase goods—we invest in our future. We create jobs, stimulate economic growth, and reduce our reliance on imported alternatives,” Kasheem said.

He further highlighted that the widespread adoption of locally made products is a step toward a stronger, more self-sufficient Nigeria.

Kasheem reiterated NASENI’s dedication to leveraging technology and innovation to boost national prosperity.

“In just over a year, through strategic partnerships both locally and internationally, NASENI has introduced 35 commercially viable Made-in-Nigeria products. These innovations span critical sectors and reflect our commitment to excellence and self-reliance, he said”

Among the highlighted products are Solar Irrigation Systems, Home Solar Systems, Lithium Batteries, Electric Vehicles, Laptops, Smartphones, Animal Feed Mill Machines, and Energy-Efficient Street Lamps—each designed to improve various aspects of the economy and daily life.

In her remarks, the Executive Director of Business Development at NEXIM Bank, Hon. Stella Okotete, described the promotion of Made-in-Nigeria products as a national imperative.

“By increasing the quality, branding, and competitiveness of our products, we enhance our foreign exchange earnings, create jobs, and strengthen the value chain across key sectors such as manufacturing, agriculture, solid minerals, and services,” Okotete stated.

To support the initiative, Okotete disclosed that NEXIM Bank had introduced targeted interventions such as single-digit interest loans for export manufacturing and value addition, along with export credit facilities to improve financing access for Small and Medium Enterprises (SMEs).

The campaign aims to foster a culture of pride and reliance on locally made products, positioning Nigeria as a hub for technological innovation and economic self-sufficiency.

Economy

FAAC: N1.703 trillion revenue shared among FG, states, LGCs for January

A total sum of N1.703 trillion from the Federation Account Allocation Committee (FAAC) was shared among the Federal, States and Local Government Councils as the January 2025 Federation Account Revenue.

This was disclosed at the FAAC meeting held in Abuja on Friday.

The N1.703 trillion total distributable revenue comprised distributable statutory revenue of N749.727 billion, distributable Value Added Tax (VAT) revenue of N718.781 billion, Electronic Money Transfer Levy (EMTL) revenue of N20.548 billion and Augmentation of N214 billion.

A communiqué issued by FAAC stated that total gross revenue of N2.641 trillion was available in the month of January 2025.

The total deduction for the cost of collection was N107.786 billion, while total transfers, interventions, refunds, and savings were N830.663 billion.

According to the communiqué, gross statutory revenue of N1.848 trillion was received for the month of January 2025. This was higher than the sum of N1.226 trillion received in the month of December 2024 by N622.125 billion.

Gross revenue of N771.886 billion was available from VAT in January 2025. This was higher than the N649.561 billion available in the month of December 2024 by N122.325 billion.

The communiqué stated that from the N1.703 trillion total distributable revenue, the federal government received a total sum of N552.591 billion, and the State Governments received a total sum of N590.614 billion.

The Local Government Councils received a total sum of N434.567 billion, and a total sum of N125.284 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N749.727 billion distributable statutory revenue, the communiqué stated that the Federal Government received N343.612 billion, and the State Governments received N174.285 billion.

The Local Government Councils received N134.366 billion, and the sum of N97.464 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N718.781 billion distributable VAT revenue, the Federal Government received N107.817 billion, the State Governments received N359.391 billion, and the Local Government Councils received N251.573 billion.

A total sum of N3.082 billion was received by the federal government from the N20.548 billion Electronic Money Transfer Levy (EMTL). The State Governments received N7.192 billion, and the Local Government Councils received N10.274 billion.

From the N214 billion Augmentation, the Federal Government received N98.080 billion, and the State Governments received N49.747 billion.

The Local Government Councils received N38.353 billion, and a total sum of N27.820 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

In January 2025, VAT, Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies increased significantly while Electronic Money Transfer Levy (EMTL) and Oil and Gas Royalty decreased considerably.

-

News2 days ago

News2 days agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

Security7 days ago

Security7 days agoNigerian Coast Guard: Citizens warned against extortion as passage of bill is being awaited

-

Entertainment1 week ago

Entertainment1 week agoActor Baba Tee apologises to Ijoba Lande for having sex with his wife

-

Foreign1 week ago

Foreign1 week agoNorth Korea: A country not like others with 15 strange things that only exist

-

Politics7 days ago

Politics7 days agoRetired military officer, colonel Gbenga Adegbola, joins APC with 13,000 supporters

-

Politics6 days ago

Politics6 days agoCPDPL accuses Adeyanju of orchestrating smear campaign against FCT Minister Wike

-

News2 days ago

News2 days agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

Features1 week ago

Features1 week agoBruno Fernandes: Mikel Arteta credits ‘smart’ Man Utd captain for free-kick as Gary Neville says wall ‘too far back’