Economy

Naira’s free fall due to CBN’s bad economic policies

The performance of the naira and the entire economic sector in the last seven years under President Muhammadu Buhari. World Bank and experts’ assessment of the government’s efforts in stabilising the Naira over the period shows that it could have been better managed

President Muhammadu Buhari, while campaigning in Owerri in March 2015, said his administration will ensure that the Naira was equal to the dollar in value if voted into office. Almost seven years into his regime, Naira, which was between N145 and N170 to a dollar in 2015, is exchanged for N580 in the parallel market while it is N416 in the official market.

That is a 300 percent increase from what was obtainable about seven years ago.

Immediately he got into office as elected President, Buhari also vowed that he will resist pressure from the International Monetary Fund (IMF) and World Bank to devalue the currency and remove fuel subsidy but after a few months in office, he changed the tune.

Significantly, the Nigerian economy has been pummeled by falling oil earnings that have led to a near-collapse of the economy. The IMF had long indicated its readiness to support Nigeria’s economy with credit liquidity but insisted on Nigeria devaluing its currency. President Buhari had insisted on numerous occasions, before and after his election, that he would never devalue the naira.

A day after the Buhari administration increased the price of the pump price of fuel by 67 percent, from N86.5 to N145 a liter, the administration agreed to demands by the International Monetary Fund (IMF) that he significantly devalue the Nigerian currency as the Naira was devalued to N290 to one dollar.

Officially at the E & I window, a dollar is N416.36 while it is N580 in the parallel market.

The Central Bank of Nigeria (CBN) had in 2017 opened a new special forex window dedicated to investors, exporters and end-users. In a circular titled ‘Establishment of Investors and Exporters Window,’ the CBN claimed this new window was introduced to boost liquidity in the FX market and ensure timely execution and settlement of eligible transactions.

The window will specifically serve eligible transactions that are classified as invincible in nature as well as transactions for Bills of Collection. According to the CBN, rates will be determined exclusively by willing buyers and sellers. The CBN did not provide any rates and did not also mention any preferred band. To provide price discovery for the market (obtain prevailing FX rates), the FMDQ OTC will be mandated to poll buying and selling rates and other relevant information from major participants in the market.

This basically means that the FMDQOTC will be asking banks and other authorised FX dealers how much they bought or sold dollars daily and then use that to determine the average rates and depth of the market. Think of it as a survey for rates.

Several efforts were made by the Central Bank of Nigeria (CBN) to boost Nigeria’s foreign exchange reserves. In 2018, the CBN came up with the idea of reducing the pressure on the foreign exchange market with demands for dollars of services and things that Nigeria has the potential to produce. The CBN imposed a ban on access to dollars from the forex market on the items.

The 41 items are: rice, cement, margarine, palm kernel/palm oil products/vegetable oils, meat and processed meat products, vegetables and processed vegetable products, poultry – chicken, eggs, turkey, private airplanes/jets, Indian incense, tinned fish in sauce (geisha)/sardines, cold-rolled steel sheets, galvanised steel sheets, roofing sheets, wheelbarrows, head pans, metal boxes and containers

Others are enamelware, steel drums, steel pipes, wire rods (deformed and not deformed), iron rods and reinforcing bars, Wire mesh, Steel nails, Security and razor wire, Wood particle boards and panels, Wood fibre boards and panels, Plywood boards and panels, Wooden doors, Furniture, Toothpicks, Glass and Glassware, Kitchen utensils, Tableware, Tiles – vitrified and ceramic, Textiles, Woven fabrics, Clothes, Plastic and rubber products, polypropylene granules, cellophane wrappers, Soap and cosmetics, Tomatoes/tomato pastes, Eurobond/foreign currency bond/ share purchases, Fertilizer, Dairy/milk, Maize and Sugar

The Governor, Central Bank of Nigeria (CBN), Godwin Emefiele, while justifying the ban on forex on the 41 items said the apex bank’s decision to restrict access to the foreign exchange (forex) official window for the importation of 41 items, is in the best interest of the Nigerian economy.

He said that the selective protection policy on forex restriction to some imports was carefully positioned, with a view to reversing the numerous challenges of dwindling foreign reserves, contracting Gross Domestic Product (GDP), recession, and the embarrassing rise of unemployment that confronted the nation.

He maintained that the implementation of the policy on the 41 items contributed greatly to getting the Nigerian economy out of recession, citing growth in the real GDP, and improved reserve accretion as success indicators. He further rationalised that the 41 items were an unnecessary drain on the country’s forex reserve, saying the policy is aimed at stimulating the domestic economy to enhance domestic production and protect local industries from undue foreign competition and take-over.

Dwelling on the success recorded in the area of import reduction, specifically on rice importation, in addition to other policy actions of the bank, Emefiele urged Nigerians to support the policy on the 41 items to further reduce pressure on the Naira.

Though as laudable as these efforts seem, many analysts believed that the CBN was actually defending the dollar and not protecting the Naira.

Steven Iloba, a Lagos-based economist, is of the opinion that the Federal Government, instead of looking at how to look for avenues where a non-oil sector of the economy is boosted to be able to bring the needed foreign exchange, all attention of government was in the direction of looking for loans to fund the budget.

He said, “A serious government will look for ways of developing the SME sector to be able to attract foreign exchange to boost the economy, but instead the government was busy looking for avenues to borrow money. I am not surprised that the Naira is losing its value. It will continue to do so until the right steps are taken to attract more foreign exchange.”

Tola Abimbola, an investment analyst, said the CBN in 2016 should have allowed the Naira to float like it was done in Egypt and that by now, Nigeria should be reaping the fruit of that sacrifice. “I said in 2016 that the CBN should just allow the Naira to float instead of the veiled floating it did by creating several windows. Look at Egypt, they allowed the currency to float and they are reaping the fruits now. I will still say that we still don’t know the value of a dollar. What we have is what the CBN tells us”.

Mustafa Chike-Obi, former managing director of the Assets Management Corporation of Nigeria (AMCON) and, currently, the executive vice-chairman of Alpha African Advisory Limited, a financial advisory and fundraising firm said, “Our currency has been appreciating in real terms over the last few years. The naira has been stronger than the dollar by about 40 percent. So, that has to be addressed.

“It is technical and you need to understand it. If you go to America today and borrow $100, let’s say I pay two percent for one year. At the end of the year, I owe the bank $102. If, however, I change that $100 to naira, I will get N36, 000. I use that N36,000 to buy treasury bills in Nigeria at 10 percent. At the end of the year, I will have N39, 600. If I convert it back to dollars, I will have $110.

“So, it will pay back the $102 and I will keep $8. I have just made an $8 profit for doing nothing right? That is an appreciation. But for me to get the same $102 value, what should the naira be? It has to go to a level where at the end of the year, it is still $102 so that I don’t make any profit from doing nothing. And that rate is N396 to a dollar. At the end of the year, the naira should go to N396 per $1 so as to remove that differential and stop that arbitrage. But instead of that, Nigeria continues to defend it to remain at N360 to the dollar.”

Kingsley Moghalu, former Deputy Governor of the CBN, is of the opinion that forex liquidity constraints persist because foreign investors remain on the sidelines, and the gap between the parallel and interbank markets remains wide.

“Typical of our national patterns, we are seeking quick fixes to the currency’s malaise without fully assessing the interlocking challenges that confront it. The naira’s problems are symptoms of deeper economic, governance and institutional malfunctions. Without confronting these problems, our quest for solutions may be skirting the real issues. There are eight specific challenges we must address,” Moghalu said.

He added that the fundamental problem is the absence of a productive economy. “Two most important aspects of this challenge are electric power to support the growth of a productive, manufacturing industrial economy, on the one hand, and removing the obstacles international trade policy places on our industrialisation prospects by stymieing the viability of our local industries, on the other. Cheaper foreign manufacturers have easy access to our markets.

“Conversely, our own manufacturers are unable to access foreign markets because value-added goods from our country are blocked by high tariffs imposed by our trading partners (but our raw materials for their own industries are welcome and attract low tariffs!). Quality standardisation concerns also dog Nigerian exports,” Moghalu explained.

The World Bank, in its assessment, said the travails besetting the naira are caused by the Central Bank of Nigeria (CBN). It blamed the way the CBN handles foreign exchange (FX) for the current FX crisis in which the naira exchange rate fluctuates widely daily. Officially, it sold for N411 to the dollar on Thursday, but N580 in the black market.

It said the CBN’s FX policy reduces supply in the market thus affecting investor confidence and leading to a ditch of the official market for the black market. “The way the exchange rate was managed limited access to FX and thus adversely affected investor confidence and investment appetite,” the bank said.

Going forward, Moghalu said we need to shift from the never-ending quicksand of gas-based power to a focus on renewable (solar, wind, geothermal and biomass) energy for household consumption and hydro and coal-based power for industrial production.

“We need to impose smart protectionism through high tariffs that can be justified under the rules of the World Trade Organisation, on imports from foreign markets that are snuffing out our local industries in several sectors such as textiles. If we combine these policies with a flexible exchange rate policy that makes export-oriented value-added products more profitable than importation, the naira will ultimately realise a beneficial effect from its inevitable devaluation,” Moghalu emphasised.

Credit: Independent

Economy

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

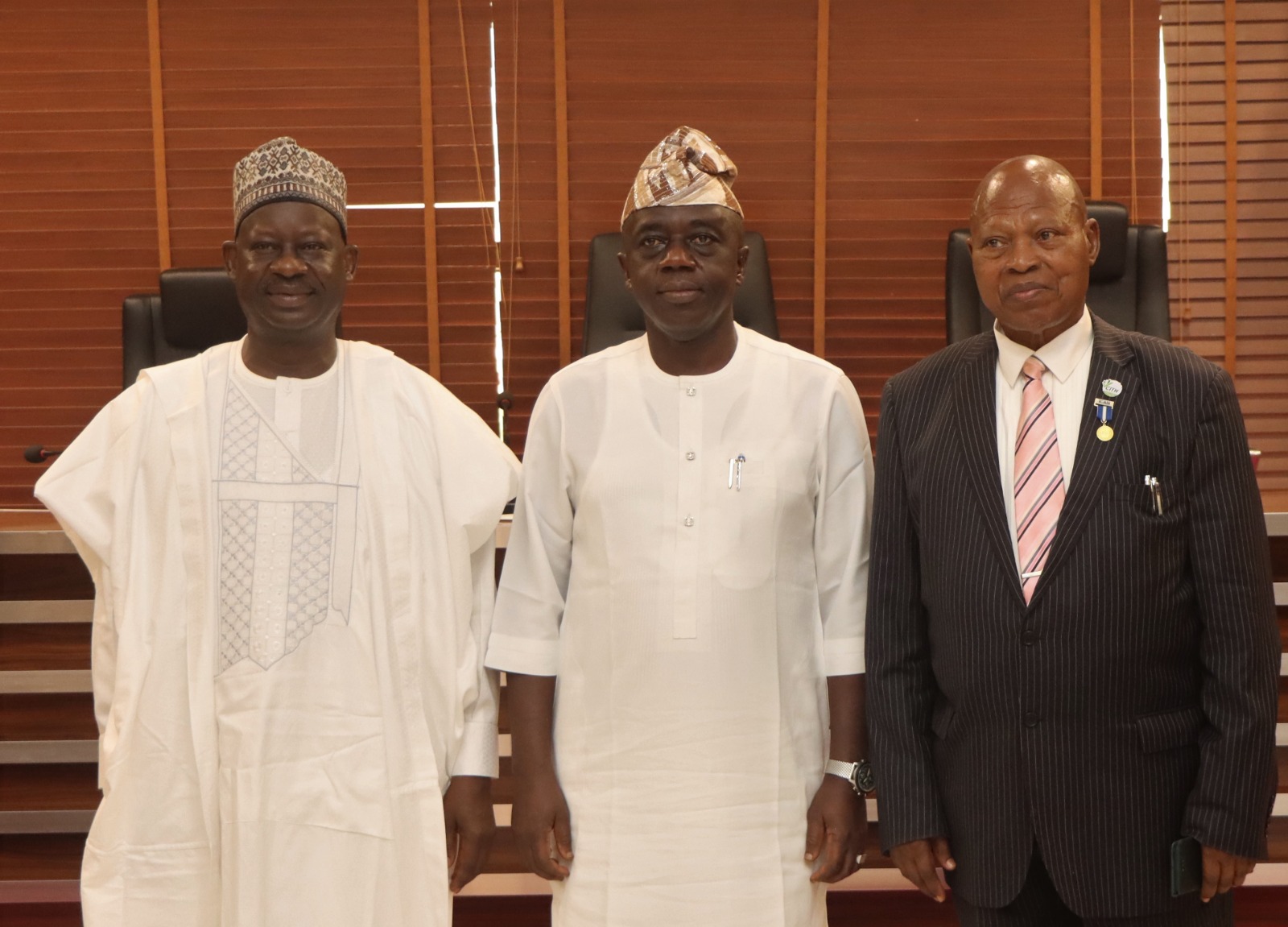

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

Economy

Newly appointed Accountant-General, Ogunjimi assumes office, pledges fairness to staff

The Accountant General of the Federation, Shamsedeen Babatunde Ogunjimi who was appointed by President Bola Ahmed Tinubu last week has assumed office on Monday.

In a brief ceremony marking his assumption at the Treasury Office in Abuja, he promised to be fair to staff of the office which he said, they would not be intimidated or victimized during his tenure of office.

In his maiden address to the entire staff of the Office of the Office of the Accountant General of the Federation, he called for unity, professionalism and commitment in order to achieve the objectives of the office.

He recalled how he suffered victimisaton in hands of previous Chief Executives where he worked, he promised that it would not be the case as he was elevated as the Accountant General of the Federation.

He said: “It is good to be back, this is our home, nobody will drive us out. I want everybody to have the spirit of togetherness.

“I am not in any group, I am not going to polarize the house.

“If I fail, everyone here has failed. I am ready to commit myself to the service of the public.”

The Accountant General called on staff to let the past go and forge a new spirit in order to move the office forward for the good of the nation and the current administration.

“During my interview for this job, when I was asked what I would do differently to change the image of the Treasury House, I wanted to put the question back to you.

“What will you do differently to correct the image of the OAGF? The question is to all staff members.

“Everyone of us must work to change the perception of the country’s treasury.

“I have been a victim of the chief executive officer firing directors he or she doesn’t like.

He assured the staff of the Treasury House of cooperation they haven’t seen in their lifetime professional career, saying, ‘I don’t like him. Please remove him’, I am not going to be that leader,” he said.

CAPITAL POST recalled that President Bola Tinubu last week approved the appointment of had last week approved the appointment of Mr Babatunde Ogunjimi as the country’s new Accountant General thereby putting to rest the guesswork of who should be the next occupier of the Treasury House.

Economy

NASENI embarks on nationwide campaign to promote Made-in-Nigeria products

The National Agency for Science and Engineering Infrastructure (NASENI) has announced plans to launch a nationwide sensitization campaign to promote the adoption of Made-in-Nigeria products, highlighting the transformative impact of locally engineered innovations on the nation’s economy.

As part of the initiative, the agency is organizing strategic focus group meetings across the six geopolitical zones of the country to galvanize support for indigenous products.

Speaking at the North Central zonal meeting in Abuja on Wednesday, the Coordinator, Implementation and Management Office (IMO) of NASENI, Yusuf Kasheem, emphasized the importance of supporting local products to drive economic growth.

“When Nigerians embrace the initiative, we do more than purchase goods—we invest in our future. We create jobs, stimulate economic growth, and reduce our reliance on imported alternatives,” Kasheem said.

He further highlighted that the widespread adoption of locally made products is a step toward a stronger, more self-sufficient Nigeria.

Kasheem reiterated NASENI’s dedication to leveraging technology and innovation to boost national prosperity.

“In just over a year, through strategic partnerships both locally and internationally, NASENI has introduced 35 commercially viable Made-in-Nigeria products. These innovations span critical sectors and reflect our commitment to excellence and self-reliance, he said”

Among the highlighted products are Solar Irrigation Systems, Home Solar Systems, Lithium Batteries, Electric Vehicles, Laptops, Smartphones, Animal Feed Mill Machines, and Energy-Efficient Street Lamps—each designed to improve various aspects of the economy and daily life.

In her remarks, the Executive Director of Business Development at NEXIM Bank, Hon. Stella Okotete, described the promotion of Made-in-Nigeria products as a national imperative.

“By increasing the quality, branding, and competitiveness of our products, we enhance our foreign exchange earnings, create jobs, and strengthen the value chain across key sectors such as manufacturing, agriculture, solid minerals, and services,” Okotete stated.

To support the initiative, Okotete disclosed that NEXIM Bank had introduced targeted interventions such as single-digit interest loans for export manufacturing and value addition, along with export credit facilities to improve financing access for Small and Medium Enterprises (SMEs).

The campaign aims to foster a culture of pride and reliance on locally made products, positioning Nigeria as a hub for technological innovation and economic self-sufficiency.

-

News3 days ago

News3 days agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

Security1 week ago

Security1 week agoNigerian Coast Guard: Citizens warned against extortion as passage of bill is being awaited

-

Politics1 week ago

Politics1 week agoRetired military officer, colonel Gbenga Adegbola, joins APC with 13,000 supporters

-

Politics1 week ago

Politics1 week agoCPDPL accuses Adeyanju of orchestrating smear campaign against FCT Minister Wike

-

News3 days ago

News3 days agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News3 days ago

News3 days agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

News3 days ago

News3 days agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

Sports4 days ago

Sports4 days agoMerino gives Arsenal win over Chelsea