Economy

Lagos Revenue high, hits 106% unique feat in one year amid COVID-19 challenge

Inspite of the biting effects or world revaged pandemic of COVID-19, Lagos State government in the year under review realized an unusual percentage of revenue generation of 106% in its perfomance at the first quarter.

This was made possible through prudent management of resources, pro-activeness, due process and provisions for any eventualities.

It also gave an opportunity to perform more even with the prevalent world ravaged pandemic of COVID-19, through re-focussing, re-directing, re-designing and re-addressing the perfomance indices to soothe the present realities.

The combination of the good leadership led by the State governor, Babajide Sanwo-Olu along with an experience team expert in financial Management and the current Commissioner for Finance, Alhaji Rabiu Olowo Onaolapo speak volumes in the enhancement of perfomance indices of Lagos State.

In this vein, one year in office by the current administration under the indefatigable pilot of Governor Sanwo-Olu is laced with geometric progression.

With the pandemic and its effects which led to slight drop in states IGR, Federal allocation, foreign direct Investement (FDI), with increased pressure on the income and purchasing power of Lagosians, the re-ordered, rejigged and re-prioritised year 2020 budget had further enliven the current Government expenditures

“Although,with the direct impact of the pandemic, it has led to a drop in the State’s IGR and Federal Allocation, potential decline of Foreign Direct Investment (FDI) and increased pressure on income and purchasing power of Lagosians, the present administration had in swift response re-ordered the Year 2020 Budget and re-prioritised its Capital Expenditure to reflect current realities.”

Finance Commissioner, Dr Rabiu Olowo said it became possible for the quantum overshot of revenue expectations to 106% because of strict compliance to government policies as directed by the state government.

With the devastating effects and consequences of the world ravaged pandemic, dwindling oil prices, Lagos State government pro-activeness ensure a well thought out review of 2020 budget in tandem with the current realities.

“In view of the devastating effects of the COVID-19 pandemic and the dwindling Oil prices, which is a twin-shock to the whole of Nigeria, the State Government realised that revenue numbers will be affected and as such, the need arose to review the Year 2020 Budget assumptions.”

This is also in addition to other strategies by the state government to mitigate and serve as temporary measures that will not affect the smooth running of government business during the pandemic.

“Apart from the re-ordering of the Year 2020 Budget, the government has also initiated and adopted some other strategies to manage the impact of the pandemic.”

This was achievable through a comprehensive review of MSME’s loans to include principal and interest moratorium, Lagos State Employement Trust Fund (LSETF), Extension of Tax Filling, provision of dedicated funds for Management of COVID-19, increment and payment of hazards allowance, special peril insurance for frontline health workers and volunteers, to encourage perfomance and dedication to duty.

“These strategies, according to him, include the Principal and Interest moratorium for Small and Medium Scale Enterprises (MSMEs) with loans from the Lagos State Employment Trust Fund (LSETF); Extension of Tax Filling; Management and Control of dedicated funds for COVID-19 response; timely payment of hazard allowance and arrangement of Special Peril Insurance for frontline health workers and volunteers.”

The state government aside new strategies restructure through down ward review from 18%, 20% to 14% to attract cash flows in the state economy and huge savings on loans repayment and commitment of the state

“Dr. Olowo remarked the success recorded in restructuring all existing internal loan facilities previously at the rate of 18%-20% to 14%, brought about huge savings on the State’s loan repayments, thereby increasing cash flows.’

Despite the biting economic situation occassion by the pandemic, the need to jerk up the revenue base was desiring, hence a number of measure was adopted such as Focus on Revenue Creation Everywhere (FORCE), meant to monitor, review and ensure rapid and workable innovations along with providing E-Tax platform to ease payments and remittance on tax matters and administration.

“In the area of Revenue Optimisation, the Commissioner revealed a number of initiatives put in place in the last one year by the present administration such as F.O.R.C.E (Focus On Revenue Creation Everywhere), an initiative conceived to monitor, review and drive innovative revenue performance whilst providing revenue assurance and the deployment of E-Tax platform for tax operations and administration matters, aimed at improving convenience in the payment of taxes to promote compliance.”

Lagos State government also diversify as a measure to sustain the economy of the state post COVID-19 automation of the operations of Lagos State Lottery Board along others to stabilize the revenue base to enable the new Lagos State fund infrastructure, provide social services and, create jobs and relive the economy.

‘He averred that the automation of the operations of Lagos State Lottery Board are among the improvements that will guarantee sustainable revenue optimisation to aid the finance infrastructural projects that will improve the lives of Lagosians, create jobs and stimulate the economy through government spending.’

Another outlets was in the area of the current reforms on Land Use Charge(LUC),geared towards optimum perfomance,so as to address agitations and reduce financial pressure on citizens,as government decision will be on the same page with the citzens by reverting to the pre-2018 upward review.

‘Government’s reform in the area of Land Use Charge (LUC), Dr. Olowo stated that the LUC reform is necessary to accommodate the agitations of Lagosians and to reduce the financial pressure on citizens.’

According to him,As we are aware, in 2018, there was an increase in LUC rate and at the same time a revaluation of property; this twin-shock had a sporadic increase in LUC assessment. The soon to be revealed reform will among other things, reverse the rate to pre-2018 rate.’

He explained that the intention of the State government is to keep economic activities going, without necessarily causing any untold hardship that will further aggravate the present financial hardship confronting all sectors of the State’s economy.

He says under the Sanwo-Olu administration, partnering of the finance Ministry with others and MDAs had been robust that ensured people oriented policy formulation,and exectuon as a Credible Financial Partner’ (CFP).

“The Commissioner reiterated the partnering posture of the Ministry and its effective working relationship with other MDAs as an important element to deliver Mr. Governor’s agenda, saying that “Every decision is a Financial Decision, hence, we have to work with all MDAs from policy formulation to execution as a Credible Finance Partner”.’

This is achieved through the implementation of the 30,000 minimum wage, employers Contributory pension, retirement benefits, capital projects analysis, PPP arrangements, 8,000 capacity hostel for Lagos State University, implementation of Health insurance scheme through remittance of 75% share among others

“A few deliveries of the partnering functions are the implementation of the minimum wage, employers contributory pension, retirement benefits; capital project analysis; public private partnerships, signup of Lagos State University 8,000 capacity hostel, Implementation of the Health insurance scheme by remitting the State Government’s 75% share etc.’

The state government efforts include signing up in January the largest bond in subnational entity in the country, amounting to 500 Billion bond issuance Programme as 100 Billion had been assessed, meant to achieve infrastructural breakthrough, both in Health, Raods, Environment among others.

‘While recalling that Governor Babajide Sanwo-Olu had in January this year, signed the Issuance of N100bn Series III Bond (the largest Bond Issuance ever raised by any Sub-National entity in the country) under its N500 Billion Bond Issuance Programme, the Commissioner said it was a timely intervention that will assist the State to meet its huge infrastructure needs in critical sectors across Health, Environment and Roads, among others.’

To guarantee efficiency and management, Lagos State government had upgraded the debt management office to semi-autonomous unit to be headed by a Permanent Secretary to promote governance, efficiency and controls of the new office.

“Dr. Olowo also informed that the Debt Management Office has been upgraded by the present administration into a full-fledged semi-autonomous Unit headed by a Permanent Secretary to promote Governance, Efficiency and Controls in the management of the State’s Debt.’

This is an encouragement of public service and its employees, having achieved so much in one year of office.

Abubakar Yusuf writes from Abuja

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

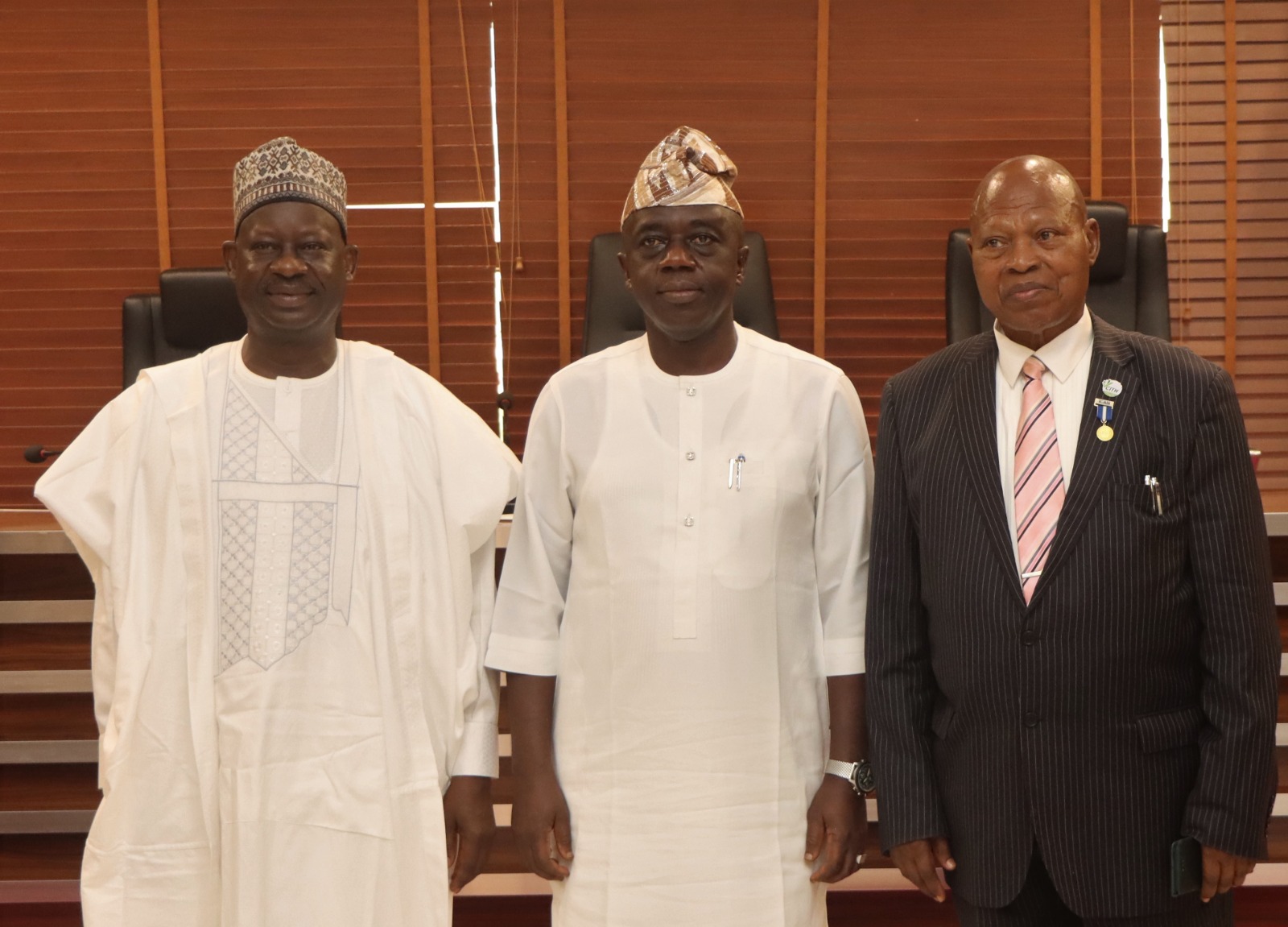

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

Politics1 week ago

Politics1 week agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

Foreign6 days ago

Foreign6 days agoHouthis declare Ben-Gurion Airport ‘no longer safe’ after renewed Gaza fighting

-

Politics1 week ago

Politics1 week agoYahaya Bello deceptively arranging recall of Senator Natasha, desperate to replace her – Constituents

-

Politics1 week ago

Politics1 week agoAtiku, El-rufai, Obi condemn Tinubu’s suspension of Rivers Governor, demand reversal

-

News1 week ago

News1 week agoWhy Christ Embassy’s Pastor Chris holds Abuja mega crusade – Fisho

-

News7 days ago

News7 days agoUmeh denies receiving $10,000 with other 42 Senators to support state of emergency in Rivers

-

Crime1 week ago

Crime1 week agoGhana’s anti-drug agency nabs Nigerian drug kingpin, Uchechukwu Chima, seizes $2.1m worth of cocaine, heroin

-

Business1 week ago

Business1 week agoFlutterwave, FIRS collaborate to digitize tax collection in Nigeria