Economy

How to manage risk with the business continuity plan

There are many uncertainties in business and the more a business begins to grow, the more there is an increase in the number of uncertainties, which could be expanding to a new geographical location, promoting team members to handle more challenging task, engaging in the production of a new line of products or seeking partnerships to strengthen the market share.

All these uncertainties are risk factors associated with businesses. The ability of the business owner to ensure business can continue its operations in spite of the numerous risks at any point in time could determine whether a business would go bankrupt or evolve from the unforeseen instances.

What Is the Business Continuity Plan?

The business continuity plan is a document that outlines what actions or measures should be taken should there be a disruption in the form of an associated risk such as fire outbreak, loss of equipment, death of the business owner or a collapsed building.

The ability to get back into business despite the disruption is key as customers will continue to demand for the products and services being offered and inability to meet these demands would lead to a huge loss in market share and more efforts to win them back if it takes a longer time for the business to get back on its feet.

A business continuity plan is significant in the following ways

1. Availability and Accessibility: A business is sustained and can continue to offer its products and services most especially if they depend on the use of Information Technology (IT) infrastructures such as cloud computing that helps to save and backup all documents online in real time such as receipts, invoices, purchase orders, bank transactions, log sheets of staff etc. and most especially ability to access documents that can aid the functioning of the human resources, suppliers, procurement, operations and all the different aspects that contributes most to the direct impact the business makes to all stakeholders.

2. Uninterrupted operations: the systems that governs the smooth operations of a business and the easier they can be installed immediately after the disruption ensures that operations can continue seamlessly.

3. Disaster recovery: A secondary source of ensuring a business can sustain itself back into operations is key when it comes to disaster recovery and its management. Disaster recovery could be the ability to get back from where everything stopped. A website that has experienced cyber attack and is the major source of engaging customers should have a sub-domain being hosted separately so that getting back live aids the recovery process and minimizes loss.

Processes for designing business continuity plan

While planning to have a holistic document for the business continuity plan, the following metrics are important to ensure a robust design is carried out.

1. Business prioritization: The starting point for planning a business continuity plan is to identify and quantify the risks, threats and vulnerabilities. This should be done across all platforms and departments.

2. Adoption into IT: Take the input from business prioritization and perform an overall business continuity program design. Information Technology gives a competitive advantage when it comes to risk management as it provides the infrastructure to safeguard and ensure easy recovery and accessibility to files saved with the aid of cloud computing. The risks identified from the business prioritization should be adopted into workable IT systems.

3. Manage: Ability to begin to utilize what has been designed prior to a gap caused by a breach requires discipline to enhance building the capacity of the team to utilize the systems designed effectively by updating files regularly on a routine basis.

The key components of business continuity are:

Strategy: Strategy helps to create a secondary system in place while ensuring that the day-to-day operation runs smoothly.

Organization: Objects that are related to the structure, skills, communications and responsibilities of its employees. Organization of the key components of the internal and external resources that keeps the system running, most especially the human resources, their responsibilities and opportunity to communicate output through a regular assessment of all systems ensures organization of the overall plan for business continuity.

Software applications and management: Any Software applications that are used regularly used for business operations, a backup of the software for possible set-up and availability for its implementation.

Processes: Documentation of all processes with specific terms in the form of a flow chart or process map, such that any team member can begin to deploy the knowledge from the files without needing a third party to make explanations.

Technology: Every form of technology that supports the overall existence of the business, such as the infrastructures for production, maintenance, repairs, use of energy etc should be documented.

A business continuity plan is important because it becomes a reference point should any form of disaster occur and helps to provide the framework for recovery to deal with different form of risk and ability to return to operating again.

Economy

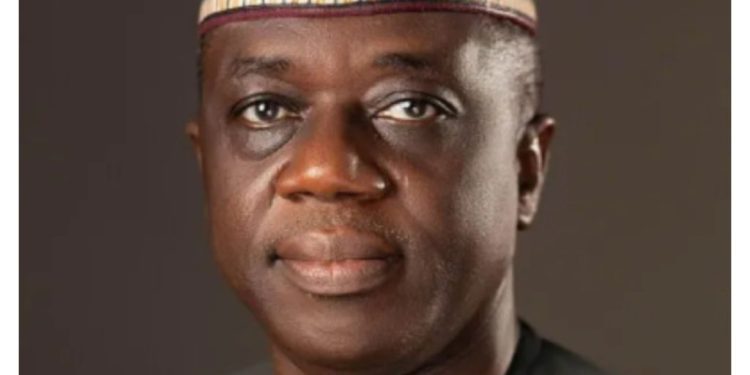

Newly appointed Accountant-General, Ogunjimi assumes office, pledges fairness to staff

The Accountant General of the Federation, Shamsedeen Babatunde Ogunjimi who was appointed by President Bola Ahmed Tinubu last week has assumed office on Monday.

In a brief ceremony marking his assumption at the Treasury Office in Abuja, he promised to be fair to staff of the office which he said, they would not be intimidated or victimized during his tenure of office.

In his maiden address to the entire staff of the Office of the Office of the Accountant General of the Federation, he called for unity, professionalism and commitment in order to achieve the objectives of the office.

He recalled how he suffered victimisaton in hands of previous Chief Executives where he worked, he promised that it would not be the case as he was elevated as the Accountant General of the Federation.

He said: “It is good to be back, this is our home, nobody will drive us out. I want everybody to have the spirit of togetherness.

“I am not in any group, I am not going to polarize the house.

“If I fail, everyone here has failed. I am ready to commit myself to the service of the public.”

The Accountant General called on staff to let the past go and forge a new spirit in order to move the office forward for the good of the nation and the current administration.

“During my interview for this job, when I was asked what I would do differently to change the image of the Treasury House, I wanted to put the question back to you.

“What will you do differently to correct the image of the OAGF? The question is to all staff members.

“Everyone of us must work to change the perception of the country’s treasury.

“I have been a victim of the chief executive officer firing directors he or she doesn’t like.

He assured the staff of the Treasury House of cooperation they haven’t seen in their lifetime professional career, saying, ‘I don’t like him. Please remove him’, I am not going to be that leader,” he said.

CAPITAL POST recalled that President Bola Tinubu last week approved the appointment of had last week approved the appointment of Mr Babatunde Ogunjimi as the country’s new Accountant General thereby putting to rest the guesswork of who should be the next occupier of the Treasury House.

Economy

NASENI embarks on nationwide campaign to promote Made-in-Nigeria products

The National Agency for Science and Engineering Infrastructure (NASENI) has announced plans to launch a nationwide sensitization campaign to promote the adoption of Made-in-Nigeria products, highlighting the transformative impact of locally engineered innovations on the nation’s economy.

As part of the initiative, the agency is organizing strategic focus group meetings across the six geopolitical zones of the country to galvanize support for indigenous products.

Speaking at the North Central zonal meeting in Abuja on Wednesday, the Coordinator, Implementation and Management Office (IMO) of NASENI, Yusuf Kasheem, emphasized the importance of supporting local products to drive economic growth.

“When Nigerians embrace the initiative, we do more than purchase goods—we invest in our future. We create jobs, stimulate economic growth, and reduce our reliance on imported alternatives,” Kasheem said.

He further highlighted that the widespread adoption of locally made products is a step toward a stronger, more self-sufficient Nigeria.

Kasheem reiterated NASENI’s dedication to leveraging technology and innovation to boost national prosperity.

“In just over a year, through strategic partnerships both locally and internationally, NASENI has introduced 35 commercially viable Made-in-Nigeria products. These innovations span critical sectors and reflect our commitment to excellence and self-reliance, he said”

Among the highlighted products are Solar Irrigation Systems, Home Solar Systems, Lithium Batteries, Electric Vehicles, Laptops, Smartphones, Animal Feed Mill Machines, and Energy-Efficient Street Lamps—each designed to improve various aspects of the economy and daily life.

In her remarks, the Executive Director of Business Development at NEXIM Bank, Hon. Stella Okotete, described the promotion of Made-in-Nigeria products as a national imperative.

“By increasing the quality, branding, and competitiveness of our products, we enhance our foreign exchange earnings, create jobs, and strengthen the value chain across key sectors such as manufacturing, agriculture, solid minerals, and services,” Okotete stated.

To support the initiative, Okotete disclosed that NEXIM Bank had introduced targeted interventions such as single-digit interest loans for export manufacturing and value addition, along with export credit facilities to improve financing access for Small and Medium Enterprises (SMEs).

The campaign aims to foster a culture of pride and reliance on locally made products, positioning Nigeria as a hub for technological innovation and economic self-sufficiency.

Economy

FAAC: N1.703 trillion revenue shared among FG, states, LGCs for January

A total sum of N1.703 trillion from the Federation Account Allocation Committee (FAAC) was shared among the Federal, States and Local Government Councils as the January 2025 Federation Account Revenue.

This was disclosed at the FAAC meeting held in Abuja on Friday.

The N1.703 trillion total distributable revenue comprised distributable statutory revenue of N749.727 billion, distributable Value Added Tax (VAT) revenue of N718.781 billion, Electronic Money Transfer Levy (EMTL) revenue of N20.548 billion and Augmentation of N214 billion.

A communiqué issued by FAAC stated that total gross revenue of N2.641 trillion was available in the month of January 2025.

The total deduction for the cost of collection was N107.786 billion, while total transfers, interventions, refunds, and savings were N830.663 billion.

According to the communiqué, gross statutory revenue of N1.848 trillion was received for the month of January 2025. This was higher than the sum of N1.226 trillion received in the month of December 2024 by N622.125 billion.

Gross revenue of N771.886 billion was available from VAT in January 2025. This was higher than the N649.561 billion available in the month of December 2024 by N122.325 billion.

The communiqué stated that from the N1.703 trillion total distributable revenue, the federal government received a total sum of N552.591 billion, and the State Governments received a total sum of N590.614 billion.

The Local Government Councils received a total sum of N434.567 billion, and a total sum of N125.284 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N749.727 billion distributable statutory revenue, the communiqué stated that the Federal Government received N343.612 billion, and the State Governments received N174.285 billion.

The Local Government Councils received N134.366 billion, and the sum of N97.464 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N718.781 billion distributable VAT revenue, the Federal Government received N107.817 billion, the State Governments received N359.391 billion, and the Local Government Councils received N251.573 billion.

A total sum of N3.082 billion was received by the federal government from the N20.548 billion Electronic Money Transfer Levy (EMTL). The State Governments received N7.192 billion, and the Local Government Councils received N10.274 billion.

From the N214 billion Augmentation, the Federal Government received N98.080 billion, and the State Governments received N49.747 billion.

The Local Government Councils received N38.353 billion, and a total sum of N27.820 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

In January 2025, VAT, Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies increased significantly while Electronic Money Transfer Levy (EMTL) and Oil and Gas Royalty decreased considerably.

-

Politics1 week ago

Politics1 week agoBenue APC: Support group leaders accuses Benue Chief Judge of interference

-

Opinion1 week ago

Opinion1 week agoEmbattled Natasha: Again, where have the elders in Kogi gone?

-

Politics1 week ago

Politics1 week agoAnambra guber: APC opts for indirect primary

-

Security4 days ago

Security4 days agoNigerian Coast Guard: Citizens warned against extortion as passage of bill is being awaited

-

Foreign7 days ago

Foreign7 days agoNorth Korea: A country not like others with 15 strange things that only exist

-

News1 week ago

News1 week agoAnambra Primaries: INEC warns against sudden changes

-

Entertainment6 days ago

Entertainment6 days agoActor Baba Tee apologises to Ijoba Lande for having sex with his wife

-

News1 week ago

News1 week agoNigerian Christian Youths unite for national transformation