Economy

House of Representatives amends, approves 2023-2025 MTEF/FSP

The House of Representatives, on Thursday , approved the report of its Committee on Finance on the 2023-2025 Medium Term Expenditure Framework (MTEF) and the Fiscal Strategy Paper (FSP) with some marked differences from the proposal presented to the House by the executive.

In his synopsis before the consideration of the report at the Committee of Supply chaired by the Deputy Speaker, Hon. Ahmed Idris Wase, the Deputy Chairman of the Finance Committee, Hon. Saidu Musa Abdullahi said after extensive consultation with critical stakeholders that led to a 5-day interactive session with Ministries, Departments and Agencies (MDAs), the Committee, among other observations, found out some of the proposed parameters submitted before the House were not in conformity with the prevailing economic realities.

According to Abdullahi, for instance, the daily crude oil production was conservatively projected at 1.69 mbpd, 1.83 mbpd, 1.83 mbpd, in 2023, 2024 and 2025 respectively to ensure budget realism, despite the ambitious post-Petroleum Industry Act (PIA) aspirations of the sector.

Also, he noted that the benchmark oil price of US $70 per barrel proposed for the 2023 appropriation against the backdrop that crude oil price is projected to decrease in subsequent years based on market fundamentals.

He, however, stated that the Committee believed that market sentiments and global economic outlook does not reflect current reality as all indications show the possibility of an increase in the price of oil in the face of the continuous invasion of Ukraine by Russia and other contentious factors.

In addition, he said the current exchange rate of N437.57 proposed in the MTEF document does not reflect the current reality of happenings in the money market vis a vis the official market and parallel market as it is shown in the exchange rate differences of over N300 between the official and parallel market rates and its adverse effect on the economy; GDP growth rate of 3.75%, 3.30% and 3.46% has been estimated for the year 2023 to 2025;

While noting that the inflation growth rate was put at 17.16%, as against the revised average of 16.11% in 2022 while the fiscal deficit of N11.3 trillion (including GOES) in the 2023 proposed budget is astronomically on the high side, and the current debt profile of the country is equally high and the debt servicing is continuously going up as such, some drastic measure must be taken to address the above-mentioned figure of the fiscal deficit.

Concerning borrowings in the 2023 fiscal year, the Committee observed that an estimate of N9.32 trillion (including Foreign and Domestic Borrowing) has been proposed but was yet to receive the details of the borrowing plan to the National Assembly.

“The Committee observed that some revenue generating agencies are not complying with the Fiscal Responsibility Act, hence spending their internally generated revenue without approval and not making full remittances into the Consolidated Revenue Fund Account, in breach of the Constitution of the Federal Republic of Nigeria (as Amended) and FRA 2007.

“Also there is no common electronic platform utilized by the MDAs, Office of the Accountant General and Fiscal Responsibility Commission in reconciling remittances from the MDAs in real-time.

“It was also observed that some agencies relied on certain government circulars to spend their internally generated revenues contrary to the Constitution, Fiscal Responsibility Act and other extant laws”, he added.

Given this, the lawmakers, without any dissenting voice considered the document based on the observations and findings of the Committee and approved the following recommendations.

“That the daily crude oil production of 1.69mbpd, 1.83mbpd, and 1.83mbpd for 2023, 2024 and 2025 respectively, be approved.

“That the oil price of $73 per barrel of crude oil be approved as a result of continuous increase in the oil price in the global oil market and other peculiar situations such as continuous invasion of Ukraine by Russia as this will result in saving of N155 billion.

“That the exchange rate of N437.57 be sustained as contained in the MTEF FSP document with continuous engagement between the Central Bank of Nigeria and Federal Ministry of Finance, Budget and National Planning with the view of bridging the gap between the official market and parallel market.

“That the projected GDP growth rate of 3.75% be approved.

“That the projected Inflation rate of 17.16% be also approved.

“That the projected New Borrowings of N8.437 trillion (including Foreign and domestic Borrowing) be approved, subject to the approval of the provision of details of the borrowing plan by the National Assembly.

The Committee recommended that the cost of petroleum subsidy be capped at N1.7 trillion accordingly and all relevant agencies of the governments be required to take necessary action to keep the petroleum subsidy cost to the government within N1.7 trillion in 2023 as this will save the sum of N737,306, 443,151 which will be used to reduce the fiscal budget deficit.

President Muhammadu Buhari is also expected to present the 2023 Budget estimates to the joint sitting of the National Assembly tomorrow at the temporary chambers of the House of Representatives wing of the National Assembly.

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

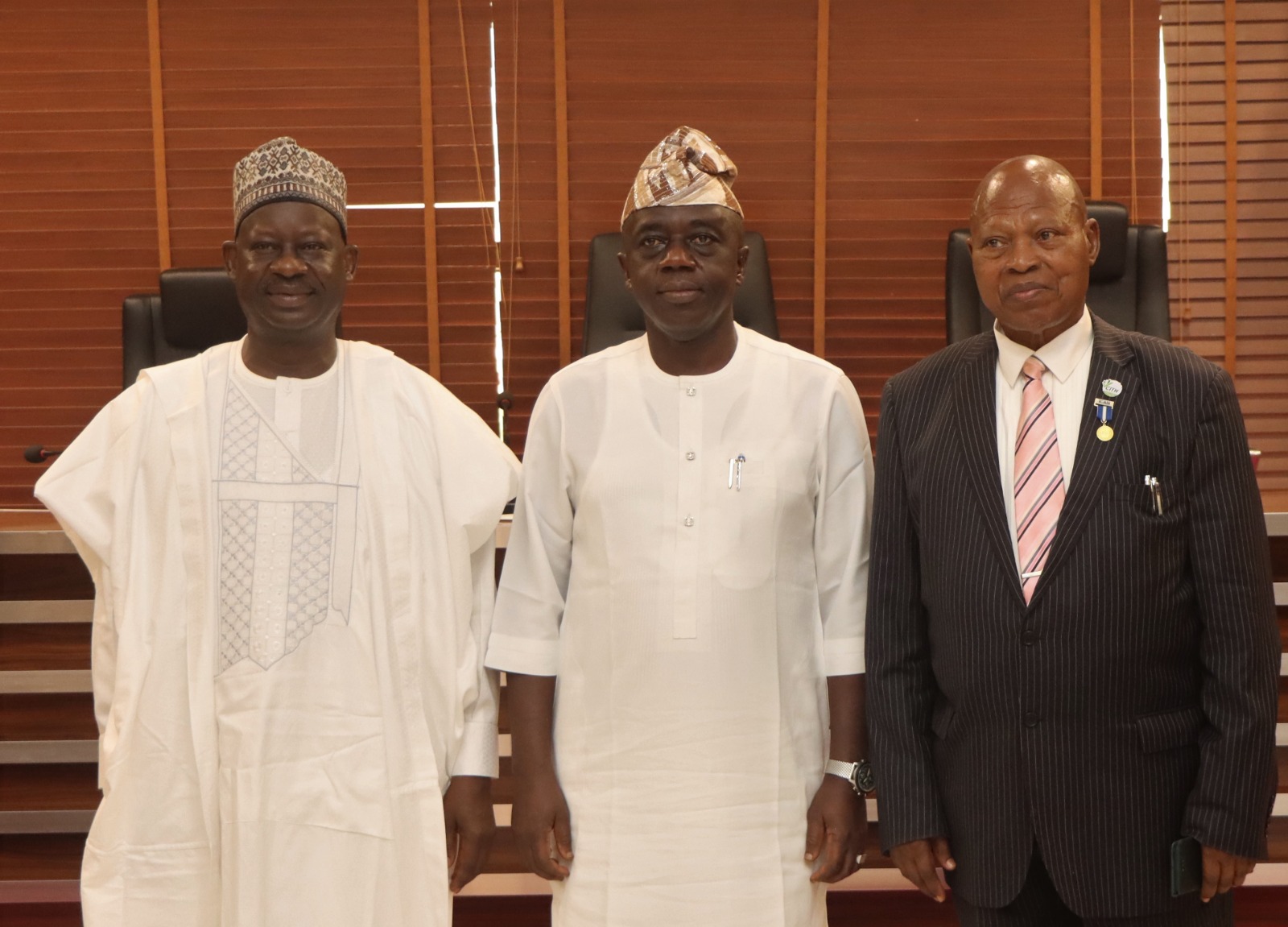

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

News4 days ago

News4 days agoSenators Natasha, Abbo unite in peddling dangerous falsehood against me – Akpabio

-

News3 days ago

News3 days agoEchocho provides food items, cash to victims of windstorm in Kogi East

-

Politics4 days ago

Politics4 days agoAbure’s Supreme Court Sack: Peter Obi, Nenadi Usman, LP faction react

-

News1 week ago

News1 week agoKogi government bans rallies ahead of Natasha’s homecoming slated for Tuesday

-

News2 days ago

News2 days agoAt 76, Governor Ododo extols Ibrahim Idris’ statesmanship, service to Kogi

-

News1 week ago

News1 week agoIran may secure a deal before Trump’s deadline – or face Israeli strikes in Tehran – analysis

-

Energy and Power4 days ago

Energy and Power4 days agoMinister of Power signs performance contract with agencies

-

News1 week ago

News1 week agoWindstorm at Itobe, Others: Echocho assure victims of urgent intervention