Economy

Gas Reservices: Nigeria to exploit $257 billion with tax incentives

Nigeria aims to boost the development of its $257 billion non-associated gas (NAG) fields through implementing tax credits, as outlined in the Nigeria Tax Bill 2024.

With an estimated 106.67 trillion cubic feet (Tcf) of NAG, which makes up 51 per cent of the nation’s total gas reserves, the proposed tax benefits under the Nigeria Tax Bill 2024 could encourage investment and expedite the development of these fields. By providing tax credits of up to $1.00 per thousand cubic feet for qualifying fields, the government seeks to stimulate gas projects, particularly in onshore and shallow water areas where infrastructure issues have hindered production.

Nigeria holds the ninth-largest gas reserves globally, estimated at around 209.26 trillion standard cubic feet (Tcf), according to the Nigerian Upstream Petroleum Regulatory Commission (NUPRC). With the base price of gas in Nigeria approximately set at $2.42 per million British thermal units (MBTU), or $2,414 per million standard cubic feet (MMscf), these NAG reserves stand at roughly $257 billion.

The bill, currently under consideration by the House of Representatives, suggests a tax credit ranging from $1.00 to $0.50 per thousand cubic feet of gas sourced from non-associated gas fields. This proposal aligns with the Oil and Gas Companies (Tax Incentives, Exemption, Remission, etc.) Executive Order signed by President Tinubu in February 2024.

Under the bill’s provisions calculate tax credits for non-associated gas fields based on their hydrocarbon liquid content. Fields generating 30 barrels of hydrocarbon liquids or fewer per million standard cubic feet (MMscf) are eligible for a tax credit of $1.00 per thousand cubic feet or 30 per cent of the fiscal gas price, whichever is lower.

On the other hand, fields with hydrocarbon liquids ranging from 30 to 100 barrels per MMscf can qualify for $0.50 per thousand cubic feet or 30 per cent of the fiscal gas price, whichever is also lower. Non-associated gas fields that produce over 100 barrels of hydrocarbon liquids per MMscf are not eligible for the tax credit.

An essential aspect of the bill is that these tax credits apply exclusively to onshore and shallow water non-associated gas developments. The incentives are available for projects that achieve their first commercial gas production from when the Act is enacted until January 1, 2029. Moreover, the gas tax credit will be applicable for 10 years, beginning from the date of first gas production.

Although non-associated gas constitutes most of the gas reserves, it only accounts for 39 per cent of Nigeria’s daily gas output. According to the NUPRC’s annual report 2023, Nigeria’s average daily production was 2.644 billion standard cubic feet (Bcf), whereas the associated gas volumes reached 4.213 Bcf daily.

The tax credit scheme is in effect following the executive order signed in February 2024. Data indicates that Shell Petroleum Development Company (SPDC) is the primary beneficiary of these tax credits, given their status as Nigeria’s largest non-associated gas producer. However, after SPDC’s acquisition is finalized, Renaissance Consortium will take over this benefit.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

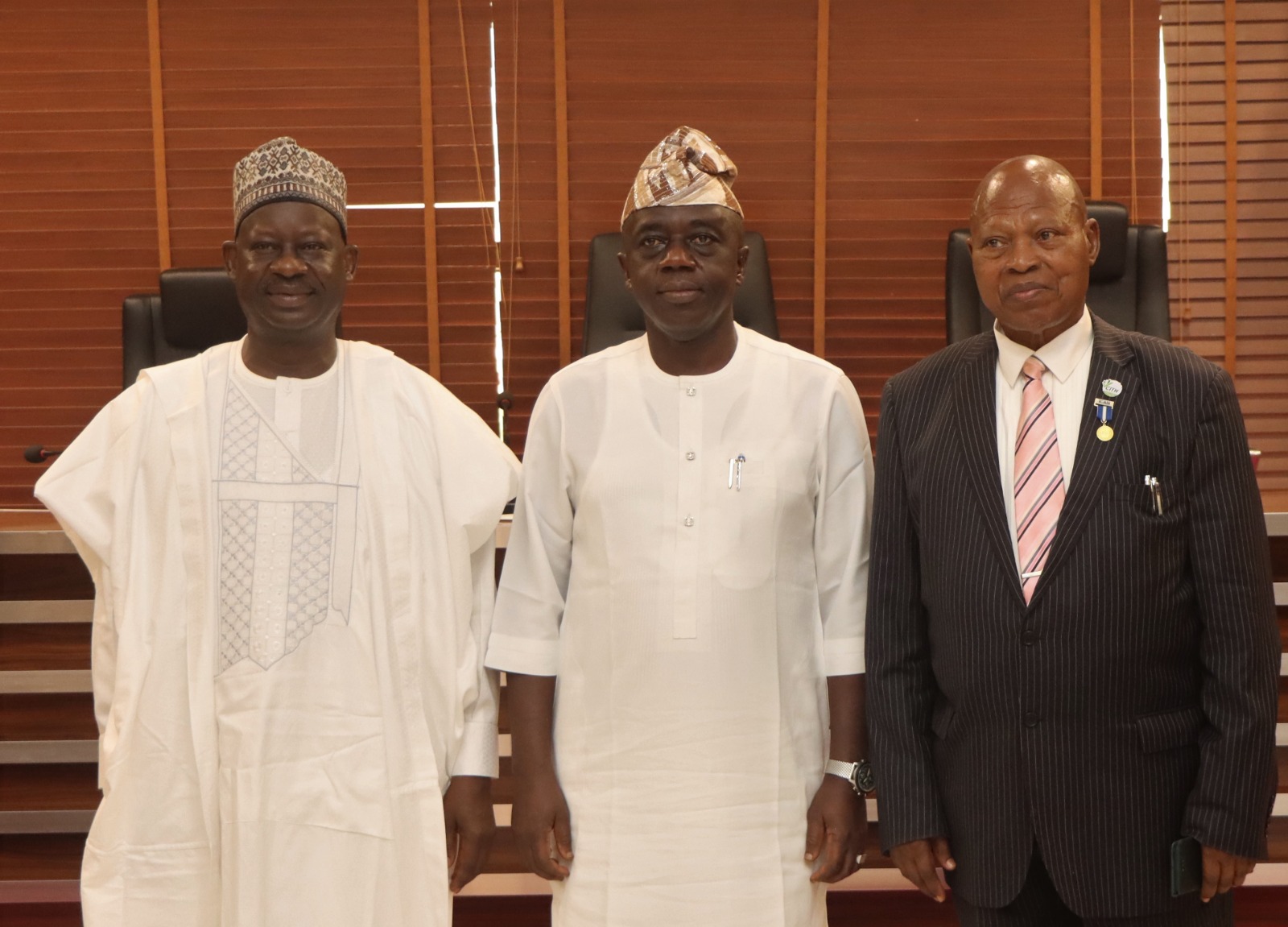

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

Economy

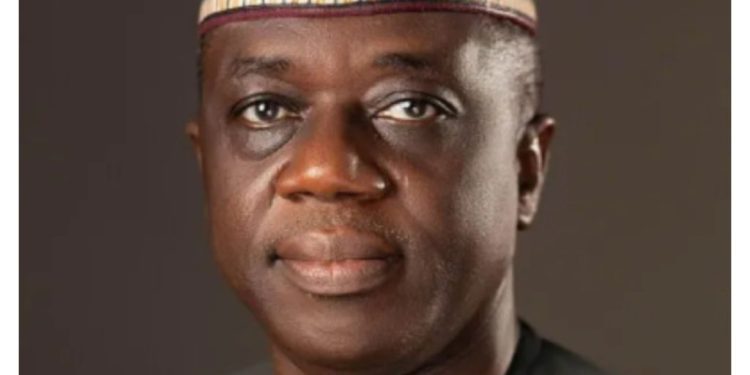

Newly appointed Accountant-General, Ogunjimi assumes office, pledges fairness to staff

The Accountant General of the Federation, Shamsedeen Babatunde Ogunjimi who was appointed by President Bola Ahmed Tinubu last week has assumed office on Monday.

In a brief ceremony marking his assumption at the Treasury Office in Abuja, he promised to be fair to staff of the office which he said, they would not be intimidated or victimized during his tenure of office.

In his maiden address to the entire staff of the Office of the Office of the Accountant General of the Federation, he called for unity, professionalism and commitment in order to achieve the objectives of the office.

He recalled how he suffered victimisaton in hands of previous Chief Executives where he worked, he promised that it would not be the case as he was elevated as the Accountant General of the Federation.

He said: “It is good to be back, this is our home, nobody will drive us out. I want everybody to have the spirit of togetherness.

“I am not in any group, I am not going to polarize the house.

“If I fail, everyone here has failed. I am ready to commit myself to the service of the public.”

The Accountant General called on staff to let the past go and forge a new spirit in order to move the office forward for the good of the nation and the current administration.

“During my interview for this job, when I was asked what I would do differently to change the image of the Treasury House, I wanted to put the question back to you.

“What will you do differently to correct the image of the OAGF? The question is to all staff members.

“Everyone of us must work to change the perception of the country’s treasury.

“I have been a victim of the chief executive officer firing directors he or she doesn’t like.

He assured the staff of the Treasury House of cooperation they haven’t seen in their lifetime professional career, saying, ‘I don’t like him. Please remove him’, I am not going to be that leader,” he said.

CAPITAL POST recalled that President Bola Tinubu last week approved the appointment of had last week approved the appointment of Mr Babatunde Ogunjimi as the country’s new Accountant General thereby putting to rest the guesswork of who should be the next occupier of the Treasury House.

-

News5 days ago

News5 days agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

Security1 week ago

Security1 week agoNigerian Coast Guard: Citizens warned against extortion as passage of bill is being awaited

-

Politics1 week ago

Politics1 week agoRetired military officer, colonel Gbenga Adegbola, joins APC with 13,000 supporters

-

Politics1 week ago

Politics1 week agoCPDPL accuses Adeyanju of orchestrating smear campaign against FCT Minister Wike

-

News4 days ago

News4 days agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News5 days ago

News5 days agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

News4 days ago

News4 days agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Sports5 days ago

Sports5 days agoMerino gives Arsenal win over Chelsea