Economy

FIRS reveals NLNG, NNPC, others as top-tax paying companies

The Federal Inland Revenue Service (FIRS) has revealed the names companies in Nigeria that are topmost in payment of taxes for the year, 2021 which made the agency to exceed the N6 trillion threshold.

The Federal Inland Revenue Service is the agency of the Federal government that collects taxes.

In a statement by the Executive Chairman of FIRS, Muhammad Nami, the agency listed top-performing companies as the Nigeria Liquefied Petroleum Gas Company Limited which was placed as the most supportive taxpayer while the NNPC was listed as the highest taxpayer.

The statement noted that the FIRS exceeded it’s N6 trillion threshold for the first time as a result of tax commitment of the agencies, while appreciated the taxpayers for their understanding, adding that they immensely contributed funds into the coffers of the Federal government.

The statement said: “The FIRS is pleased to celebrate the top-performing taxpayers who contributed to her success in 2021,”

“The Service surpassed its tax collection target in 2021, and in doing so, crossed the N6 trillion threshold for the first time,” he said.

Nami pointed out that the leadership platform created by President Muhammadu Buhari further deepened activities of the FIRS which made it to realize a tax revenue collection of N6.405 trillion in 2021, as well as support from the Ministry of Finance, Budget and National Planning, and the National Assembly.

“To everyone who contributed to FIRS’ success in 2021, we say thank you.

He was emphatic in his commendation of tax paying Companies and stakeholders as a result of the harsh global economic conditions brought about by the lingering COVID-19 pandemic, which didn’t affect the performance of FIRS.

Other highly placed Performing Taxpayers, he said, includes Mobil Producing Limited, Star Deep Water Petroleum, MTN Nigeria Communications Plc, Shell Petroleum Development Company Limited, Chevron Nigeria Limited, Total E & P Nigeria Limited, Airtel Networks Limited, Nigeria Petroleum Development Company Limited, Nestle Nig. Plc, Dangote Cement, Nigeria Breweries Plc, Total Upstream Nigeria Ltd, Indorama Eleme Petrochemicals Ltd, NIG Agip Oil Co. Ltd, British American Tobacco Marketing, Guaranty Trust Bank Plc, Stanbic IBC Bank Plc and Lafarge Africa Plc.

The FIRS also appreciated the Northern Cables Processing and Manufacturing Limited (NOCACO) and Ikeja Electric Plc for being the most improved in tax filing and VAT compliance respectively.

The revenue authority urged taxpayers to join hands with the FIRS to make taxation the pivot of the nation’s development and economic growth.

Recall that the country’s top-performing taxpayers were scheduled to be unveiled, recognized and awarded by President Muhammadu Buhari at an exclusive dinner during the FIRS 2022 National Tax Week; this was however canceled in honor of the victims of the unfortunate attack on the Kaduna-Abuja railway on the 28th of March, 2022.

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

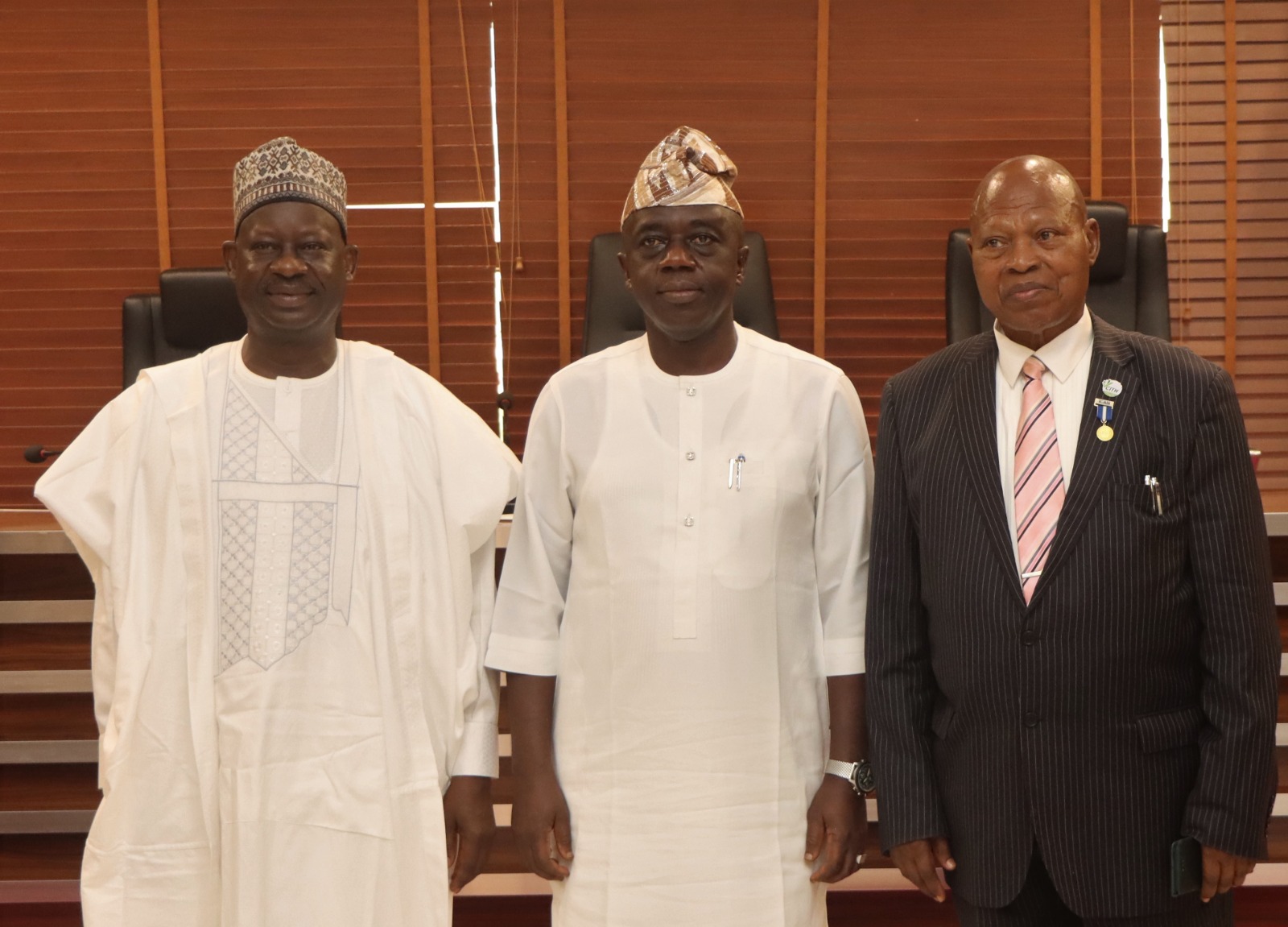

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

News1 week ago

News1 week agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

News1 week ago

News1 week agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

News1 week ago

News1 week agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News1 week ago

News1 week agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Sports1 week ago

Sports1 week agoMerino gives Arsenal win over Chelsea

-

Politics6 days ago

Politics6 days agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

Interview1 week ago

Interview1 week agoSenators Natasha-Akpabio saga should have been resolved privately – Rev. Mrs Emeribe

-

News1 week ago

News1 week agoNatasha uncovers arrest plot after reported Akpabio to IPU in New York