Business

Fidelity Bank ranked amongst top Banks in ESG Rating

A recent survey commissioned by the Independent Project Monitoring Company (IPC) Limited has ranked Fidelity Bank Plc fourth out of 29 Nigerian banks in Environmental, Social and Governance (ESG) practices and reporting. The bank achieved a score of 57.73%.

The result shows that ahead of Fidelity Bank, Zenith Bank was ranked first at 65.22%, followed by Access Bank at 60.33% and Stanbic IBTC Bank at 60.16%.

The United Bank for Africa (UBA) was ranked fifth at 57.19%.

In a post hosted on MSN.com, the IPC stated that the ratings were benchmarked against the leading global ESG rating companies such as S & P Global and MSCI Sustainability Ratings.

These weightings were determined following a comprehensive analysis of both global rating standards and the specific nuances of the Nigerian business landscape, resulting in allocations of 13 percent for environmental factors, 43 percent for social factors and 44 percent for governance factors.

In his welcome address at the launch of the ESG report in Lagos, Managing Director IPMC, Mr Robert Ode Odiachi, said the Nigerian banking and insurance sector have played key roles in the economy stability of the country.

He said in the midst of growing challenges facing the two sectors, there is growing need for banks to integrate Environmental, Social and Governance (ESG) practices into their operations especially in the area of risk management and reporting.

“This proactive approach helps them stay adaptive to changing regulations, amidst the rising expectations of consumers,” he stated.

Also speaking at the event themed, ‘Driving Impact: Harnessing ESG for Sustainable Finance’, Rukaiya el-Rufai, Special Adviser to the President on NEC and Climate Change, said companies that prioritise ESG are not only contributing to a more sustainable and an equitable world but are also positioning themselves for value creation that not only ensures greater financial performance but embeds value levers that will sustain the performance.

According to el-Rufai, corporates must ensure that they attain the fine balance of creating sustainable value for their enterprises as well as for society in what is understood as share value creation.

This means that corporates must look beyond themselves to seek to understand and incorporate what value means to their stakeholders.

“Corporates can leverage frameworks, standards, ratings and guidelines to establish clear expectations and avoid blind spots in their operations.

“Companies that proactively address these issues through sustainable practices, such as reducing carbon footprints, investing in renewable energy and promoting circular economies, are better positioned to thrive in a resource-constrained world,” she stated.

It would be recalled that in November 2023, Fidelity Bank became an official signatory of the UN Principles for Responsible Banking – a single framework for a sustainable banking industry developed through a collaboration between banks worldwide and the United Nations Environment Programme Finance Initiative (UNEP FI).

Ranked as one of the best banks in Nigeria, Fidelity Bank is a full-fledged commercial bank with over 8.3 million customers serviced across its 251 business offices in Nigeria and the United Kingdom as well as on digital banking channels.

The bank has won multiple local and international awards including the Export Finance Bank of the Year at the 2023 BusinessDay Banks and Other Financial Institutions (BAFI) Awards, the Best Payment Solution Provider Nigeria 2023 and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards; Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023; and Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

Business

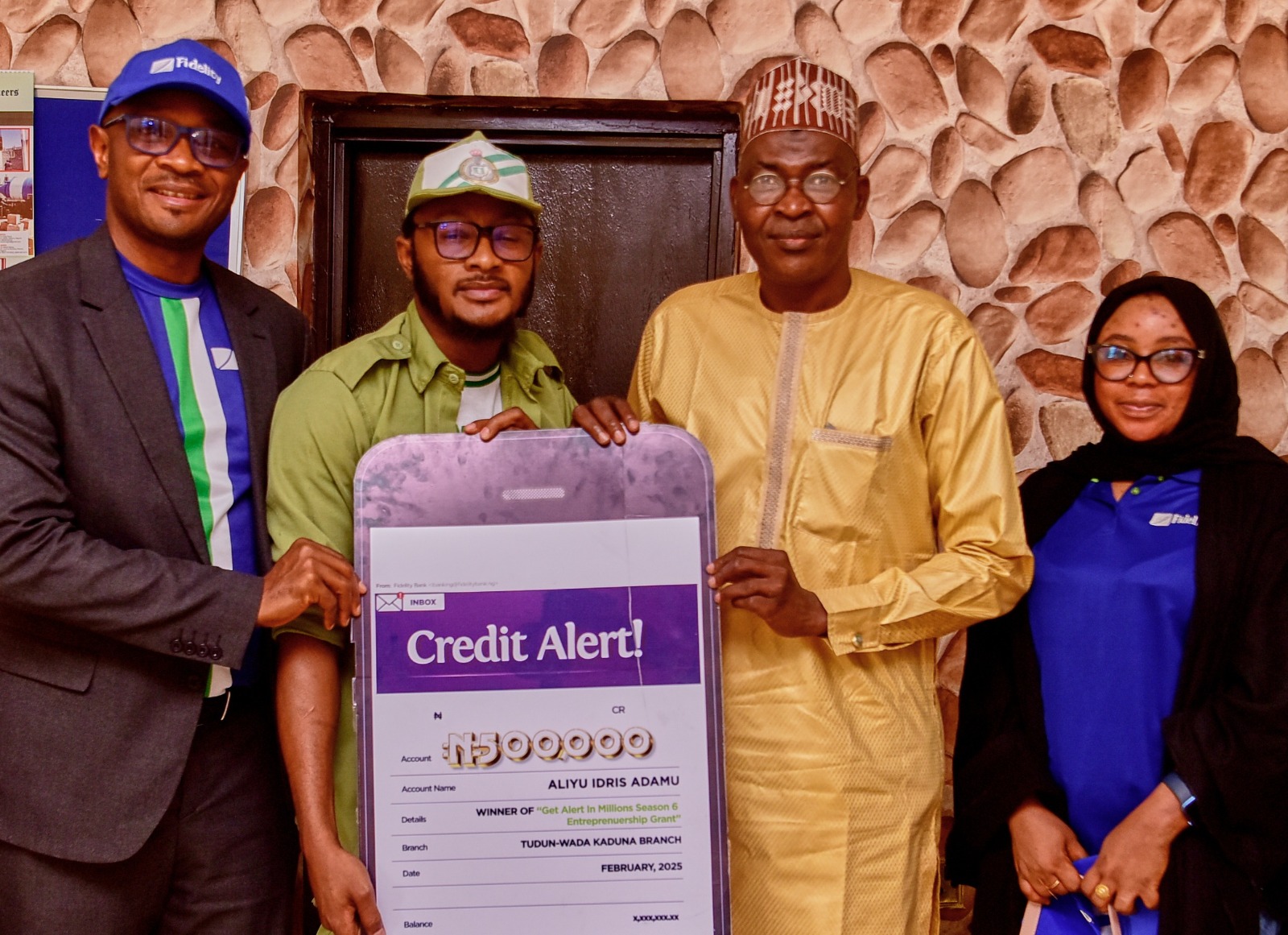

NYSC members win millions in Fidelity GAIM 6 Promo

Fidelity Bank Plc has reaffirmed its commitment to financial inclusion, youth empowerment, and promoting a healthy savings culture by rewarding nine National Youth Service Corps (NYSC) members with N500,000 business grants each.

The grants were awarded under the Get Alert in Millions Season Six (GAIM 6) promo, an initiative designed to reward loyal customers with cash prizes totalling N159 million.

The promo, which runs from November 2024 to August 2025, targets various categories of customers, including NYSC members, students, and general customers.

Mr. Osita Ede, Divisional Head of Product Development at Fidelity Bank Plc, stated that this season of the GAIM promo aims to enhance the opportunities for loyal customers to win.

“When we launched the GAIM 6 promotion in November 2024, we unequivocally stated that this campaign season is intended to promote inclusivity. Consequently, we have increased the total prize money to N159 million and added additional draws, beyond the weekly and monthly draws featured in previous seasons.

“Now, we have specific draws catering to various segments of our customer base including women, students, youth corps members, and traders. It is important to note that these categories of customers also stand the chance to win millions of naira in the monthly and grand draws which we will be hosting till 20 August 2025,” explained Ede.

Nine NYSC customers were selected through a random electronic draw in the first quarter of the GAIM 6 campaign across the country. They are: Oluwatosin Emmanuel Olowolayemo and Ekpeno Aniekan George, both Youth Corps members in Akwa Ibom State; Derryk Chidubem Okafor, Enugu State; Aliyu Idris Adamu, Kaduna State; Bomane-Aziba Koromo, FCT_Abuja; Asabe Grace Adamu, Bornu State; David Agbai Agwu, Osun State; Abdullahi Opeyemi Olajuwon, Lagos State and Eghosa George Orhue, Ekiti State.

Expressing his gratitude and excitement, one of the recipients of the entrepreneurship grant, Chidubem Okafor, appreciated Fidelity Bank for the grant, noting that the funds will enable him to achieve his entrepreneurial dreams.

His words, “At first, I thought it was a scam when they introduced the initiative at our orientation camp, but today, I am truly honored to receive this support from Fidelity Bank. This grant will go a long way in helping me achieve my entrepreneurial dreams, and I promise to make the most of it,”

Similarly, David Agwu, who also emerged a winner in the draw, expressed his surprise at the unexpected win, saying, “When I received the call, I thought it was a prank. I never applied for anything, so it was hard to believe. But when they sent me proof, I realized it was real. I am truly grateful for this opportunity. My plan is to invest the money in vocational training and digital skills development, particularly in fashion and painting in order to establish a sustainable business”.

Beyond the N500,000 entrepreneurship grant, the winners will also enjoy free business advisory and training sessions at the newly launched Fidelity SME Hub, located at 22, Lanre Awolokun Street, Gbagada Phase 2, Lagos.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 251 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards. It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

Business

NNPCL dismisses reports of termination of Naira Crude deal with Dangote

The Nigerian National Petroleum Company Limited (NNPCL) has dismissed reports that it has terminated Naira Crude deal with Dangote unilaterally.

In a statement on Monday, the NNPCL explained that the Cude Sales Agreement with Dangote Refinery was still subsistence, clarifying that the existing contract, which allowed crude oil sales in Naira, was structured as a six-month agreement, contingent on availability, and is set to expire at the end of March 2025.

NNPCL said discussions with Dangote for fresh contractual agreement will soon take place.

The statement which was signed by the Director of Corporate Communications of the NNPCL, Mr Segun Soneye disclosed that the NNPCL has supplied Crude Oil to Dangote since October 2024, with 48 million barrels.

He said the supplies was under the Naira contract which in total, the company has provided more than 84 million barrels to the refinery since it commenced operations in 2023.

NNPCL reaffirmed its commitment to supporting local refining, ensuring a steady crude oil supply based on mutually agreed terms.

Business

Edo State IRS denies revenue drop claims

The Edo State Internal Revenue Service has refuted claims of its February, 2025 revenue drop by one, Mr Ifaluyi Isibor saying, it’s a misrepresentation of facts.

In a statement issued on Sunday by the Head of Corporate Communications of Edo IRS, Courage Eboigbe, lamented the deliberate distortion of facts by those who supposed to know, but decided to mislead the populace for whatever reasons they think they wanted to achieve.

The statement obtained by CAPITAL POST in Abuja reads: “It is disheartening and disingenuous that supposedly educated Edo State citizens would spew out such nonsense for political expediency. Such actions not only mislead the public, but they also undermine the efforts of those working tirelessly to ensure sustainable economic development in our State.

“His claims are far from the truth. The only truth is that the Revenue Service has attained and is sustaining an average of N10 billion to date.

In view of the above, we hereby state that the IGR Report for February is very impressive and stands at over N9.5b, a figure never attained by Isibor’s paymasters.

“That the EIRS firmly dismisses the claim of revenue drop of Edo’s IGR falling from ₦4.7 billion in January to ₦3.4 billion in February, labelling Isibor’s narrative as dubious, deliberately misleading, and dishonest. Our record confirms a stable upward trajectory, which starkly contrasts the narrative put forth by the mischievous Isibor.

“That the EIRS denounces the misinformation, criticizes Isibor for allegedly spreading unverified figures, and insists that the IGR remains on an upward trajectory.

“That the EIRS rejects the notion of separate IGR sources, emphasizing that all government revenue is consolidated into a single figure irrespective of revenue stream.

“That the Revenue Service reiterates its commitment to tackling illegal revenue collection by unauthorized individuals while urging the public to remain vigilant and report any suspicious activities by non-state actors.

“Overall, this statement aims to restore public confidence, reject alleged misinformation, and reaffirm the agency’s professionalism in revenue collection.”

-

Politics1 week ago

Politics1 week agoBenue APC: Support group leaders accuses Benue Chief Judge of interference

-

News1 week ago

News1 week agoSexual Harassment: Social media abuzz as Natasha hails ex-Gov Fayemi for standing for the truth

-

Opinion1 week ago

Opinion1 week agoEmbattled Natasha: Again, where have the elders in Kogi gone?

-

Politics1 week ago

Politics1 week agoAnambra guber: APC opts for indirect primary

-

Security3 days ago

Security3 days agoNigerian Coast Guard: Citizens warned against extortion as passage of bill is being awaited

-

Crime1 week ago

Crime1 week agoEdo Gov’t demolishes kidnappers’ hideouts in Ekpoma, Uromi

-

News1 week ago

News1 week agoAnambra Primaries: INEC warns against sudden changes

-

Foreign6 days ago

Foreign6 days agoNorth Korea: A country not like others with 15 strange things that only exist