Business

Fidelity Bank launches “Bundles of Joy” Initiative for Children with special needs

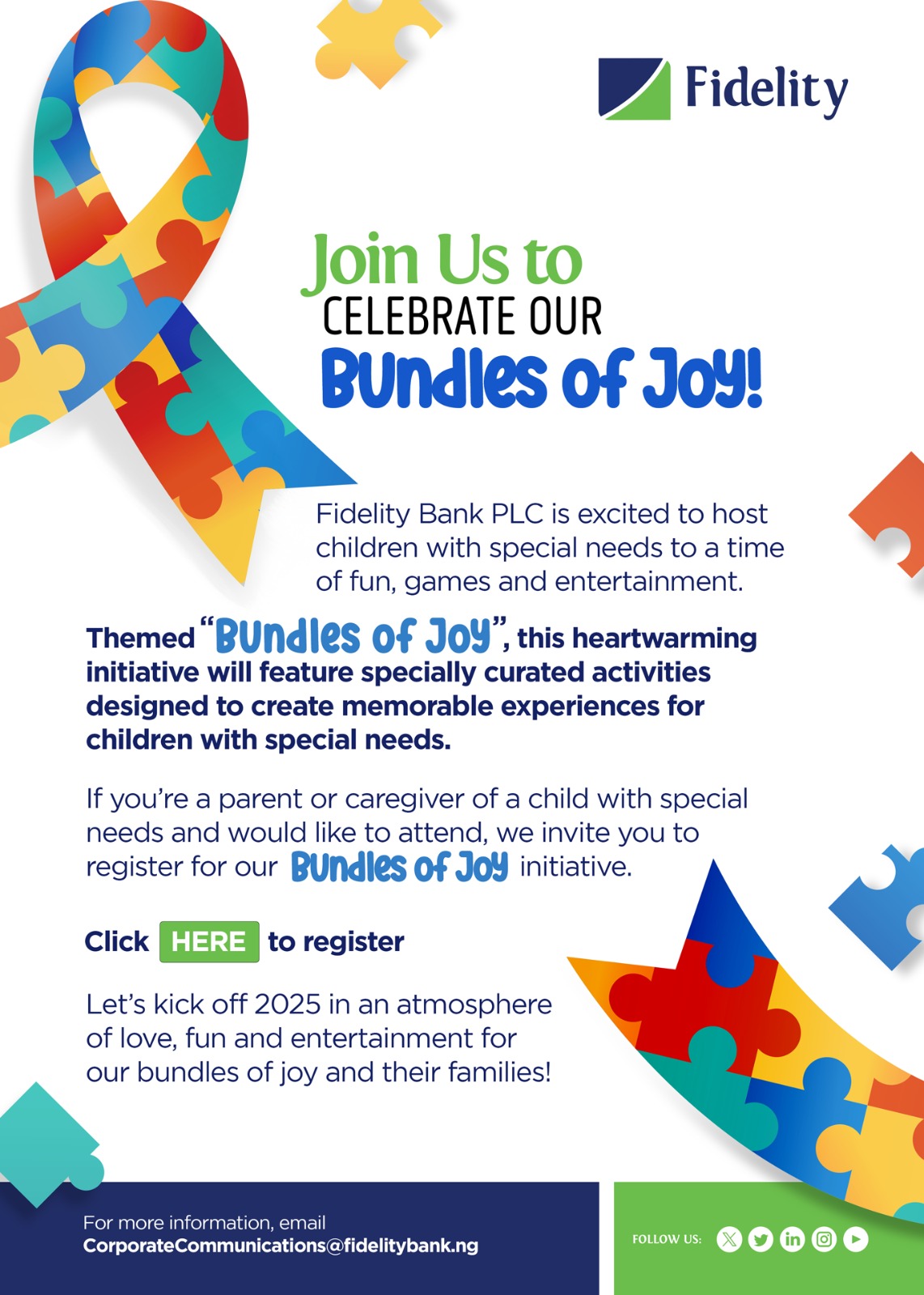

Fidelity Bank Plc, a leading financial institution, has introduced the “Bundles of Joy” initiative, a new program designed to support children with special needs and their families.

The initiative focuses on creating inclusive spaces and activities for children aged 4 to 11 with conditions such as autism, Down syndrome, and cerebral palsy. It aims to address the challenges families face in integrating their children into society.

“This initiative underscores Fidelity Bank’s commitment to fostering a more inclusive society for children with special needs,” said Dr. Meksley Nwagboh, Divisional Head of Brand and Communications at Fidelity Bank Plc.

“Through the Bundles of Joy program, we are providing a variety of engaging activities, including sensory rooms, outdoor play stations, and obstacle courses, all tailored to help improve mobility and social skills. Additionally, we offer resources and information to help parents and caregivers better support their children”, he explained.

Families can participate by registering their children online at www.fidelitybank.ng/bundlesofjoy/.

During the registration process, parents are required to provide their name, their child’s name, and details about their child’s needs. Fidelity Bank will then reach out to arrange a special outing for each child in January 2025.

The Bundles of Joy program is part of Fidelity Bank’s broader commitment to corporate social responsibility (CSR) and its efforts to promote inclusivity for children with special needs.

Recently, Fidelity Bank staff supported the Patrick Speech and Language Centre in Ikeja, Lagos State—a facility dedicated to the education and socio-economic development of children and young adults with autism. Their contributions included a cash donation and the provision of gift items to enhance the learning experience of students at the center.

With the Bundles of Joy initiative, Fidelity Bank continues to demonstrate its dedication to creating meaningful impacts and fostering a society where every child is given the opportunity to thrive.

The bank has won multiple local and international awards including the Export Financing Bank of the Year and Excellence in Digital Transformation & MSME Banking at the 2024 BusinessDay Banks and Other Financial Institutions (BAFI) Awards; the Best Payment Solution Provider Nigeria 2023 and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards; Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023; and Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

Business

Fidelity Bank equips entrepreneurs for global trade success with EMP 18

Tier-one lender, Fidelity Bank Plc, has once again highlighted the importance of promoting non-oil exports as it recently hosted the 18th edition of its dedicated capacity development training tagged Export Management Programme (EMP 18). The programme, which was held recently in Lagos provided a platform for entrepreneurs interested in exploring global trade opportunities to scale and acquire relevant expertise.

Hosted in partnership with the Lagos Business School (LBS), the 5-day intensive program focused on equipping entrepreneurs with the skills and knowledge needed to explore international market opportunities and strengthen their capacity to thrive in the export sector.

“At Fidelity Bank, our strategy to enhance non-oil exports is guided by the significant opportunities it offers to our customers and the national economy. This is why we offer a comprehensive suite of financial, advisory, and market-access solutions for businesses aiming to engage in international trade.

“Our market-access initiative, EMP, launched in 2016, has trained over 1,600 entrepreneurs. Today, we completed the 18th cohort with high-caliber participants and a 150% oversubscription. This indicates a promising future for Nigeria’s non-oil exports,” explained Isaiah Ndukwe, Divisional Head of Export and Agriculture at Fidelity Bank Plc.

Facilitated by key industry experts in the exports space, EMP 18 took participants through several sessions focused on critical areas in global trade such as Export Finance Instruments, Export Documentation, Accessibility of Export Markets, amongst others.

A key feature of the training was a facility tour of one of Nigeria’s busiest Export Processing Terminals (EPT) located in Ikorodu, Lagos state. The full-day visit, which was anchored by officials of the Nigerian Customs Service (NCS), gave participants a first-hand feel of the necessary procedure and requirements for securing regulatory approval for exporting from Nigeria.

One of the program participants, Patrick Ulayi Awu-Patricks, Managing Director/Chief Executive Officer, Alliance & Frontier Limited, commended Fidelity Bank for its leadership in deploying capacity-building initiatives in the non-oil exports sector. In a discussion with journalists, he stated that EMP 18 provided invaluable exposure to the opportunities in the export business noting that, “There are lots of non-oil exports opportunities and entrepreneurs must be able to identify and capitalize on these to be able to play effectively in the international trade space. This course has given me insights into the power of data which is essential for strategic decision-making.”

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards. It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

Business

“Retirees need no connections to receive benefits” – Kogi Pension Boss

The Kogi State Government has assured retirees that pension and gratuity payments are now processed transparently, eliminating the need for personal connections or lobbying before benefits are paid to retirees.

Director-General of the Kogi State Pension Commission, Mariam Abedo, disclosed this in an Exclusive Chat with the Special Adviser on Media, Ismaila Isah who was on a courtesy visit to her office in Lokoja.

She explained that the government has introduced a technology-driven payment system that ensures fairness and efficiency.

“Once a retiree’s documentation is complete, their payment is processed without any influence. We currently process over 200 retirees daily,” she stated.

Abedo further disclosed that the commission has significantly cleared pension arrears as the state has consistently made funds available to meet obligations of retirees.

She emphasized that transparency and accountability have improved the commission’s operations, making the payment process smoother and more reliable.

Abedo also warned retirees against falling victim to individuals who claim they can influence payments of benefits, stressing that all entitlements are processed strictly on merit.

She commended Governor Ahmed Usman Ododo for prioritizing the welfare of pensioners and reassured retirees that payments would continue as funds are available to the commission to pay benefits to retirees in the state.

Business

Flutterwave, FIRS collaborate to digitize tax collection in Nigeria

A leading African payments technology company, Flutterwave and the Federal Inland Revenue Service, FIRS have concluded collaborative discussion to digitize tax collection in Nigeria.

The collaboration is a step initiated by the FIRS to simplify tax compliance by offering multiple payment options, real-time reporting, and offline capabilities for those with limited internet access.

Meanwhile, Flutterwave CEO Olugbenga ‘GB’ Agboola stressed the firm’s commitment to ensure the using of technology to enhance efficiency, transparency, and economic growth by digitizing government tax collections.

Agboola said: “At Flutterwave, we are committed to leveraging technology to drive efficiency and economic growth. By making tax payments easier and more transparent, we are helping to digitize government collections and support national development which is in line with our mission,” he said

The partnership enables businesses and individuals to pay taxes, levies, and other statutory fees through Flutterwave’s secure and efficient digital infrastructure.

Driving transparency and accessibility

The integration introduces several enhancements, including Flutterwave’s Senior VP, Olufunmilayo Olaniyi, highlighted the importance of public sector collaboration in advancing digital payments, fostering trust, and driving innovation in Nigeria.

“Working with the public sector is pivotal to shaping the future of digital payments in Nigeria. This underscores our commitment to delivering solutions that serve Nigerians better, foster trust, and drive impactful innovation through strategic collaboration.”

What you should know

The Nigerian government has been implementing several measures to enhance tax compliance and efficiency, including digital reporting and e-invoicing systems. In line with these efforts, the Federal Inland Revenue Service (FIRS) is set to pilot its “e-Invoice” platform in July 2025 to streamline invoice management and improve real-time visibility into business transactions.

Amid these regulatory shifts, Flutterwave has been strengthening its presence in Nigeria’s financial ecosystem through strategic collaborations. Beyond facilitating tax payments, the company has expanded its role in digital innovation and security. It recently partnered with the National Information Technology Development Agency (NITDA) and Alami to drive digital transformation and empower SMEs in the tech and creative industries.

Also in 2024, Flutterwave deepened its commitment to financial security by partnering with the Economic and Financial Crimes Commission (EFCC) to establish a Cybercrime Research Center at the EFCC Academy.

-

News1 week ago

News1 week agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

News1 week ago

News1 week agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News1 week ago

News1 week agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

News1 week ago

News1 week agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Sports1 week ago

Sports1 week agoMerino gives Arsenal win over Chelsea

-

Politics5 days ago

Politics5 days agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

Interview1 week ago

Interview1 week agoSenators Natasha-Akpabio saga should have been resolved privately – Rev. Mrs Emeribe

-

News1 week ago

News1 week agoNatasha uncovers arrest plot after reported Akpabio to IPU in New York