Economy

FG’s borrowing from CBN rose to N19.91 trillion in June

The total amount of N19.91 trillion has been borrowed to the Federal government by the Central Bank of Nigeria (CBN) through Ways and Means Advances.

Data from CBN showed that the amount rose from N17.46 trillion in December 2021 to N19.91 trillion in June 2022, with the sum of N2.45 trillion in six months.

Meanwhile, the Debt Management Office (DMO) has revealed that the total debt stock of the Federal government stood at N41.60 trillion.

It said the sum of N19.91 trillion outstanding debt the country owed the CBN wasn’t part of it.

The public debt stock only includes the debts of the Federal Government of Nigeria, the 36 state governments, and the Federal Capital Territory.

Ways and Means Advances is a loan facility through which the CBN finances the shortfalls in the government’s budget.

According to Section 38 of the CBN Act, 2007, the apex bank may grant temporary advances to the Federal Government with regard to temporary deficiency of budget revenue at such rate of interest as the bank may determine.

The Act read in part, “The total amount of such advances outstanding shall not at any time exceed five per cent of the previous year’s actual revenue of the Federal Government.

“All advances shall be repaid as soon as possible and shall, in any event, be repayable by the end of the Federal Government financial year in which they are granted and if such advances remain unpaid at the end of the year, the power of the bank to grant such further advances in any subsequent year shall not be exercisable, unless the outstanding advances have been repaid.”

However, the CBN has said on its website that the Federal Government’s borrowing from it through the Ways and Means Advances could have adverse effects on the bank’s monetary policy to the detriment of domestic prices and exchange rates.

“The direct consequence of central banks’ financing of deficits are distortions or surges in monetary base leading to adverse effect on domestic prices and exchange rates i.e macroeconomic instability because of excess liquidity that has been injected into the economy,” it said.

The World Bank had, in November last year, warned the Nigerian government against financing deficits by borrowing from the CBN through the Ways and Means Advances, saying this put fiscal pressures on the country’s expenditures.

Despite warnings from experts and organisations, the Federal Government has kept borrowing from the CBN to fund budget deficits.

According to report by The PUNCH, the Federal Government paid an interest of N2.03tn from January 2020 to November 2021 on the loans it got from the CBN through the Ways and Means Advances.

It was also reported that Federal Government paid an interest of N405.93bn from January 2022 to April 2022 on the loans it got from the CBN.

The Managing Director/Chief Executive Officer, Cowry Asset Management Limited, Mr Johnson Chukwu, said the central bank lending put pressure on the exchange rate and the inflation rate, with “liquidity that has no productivity attached to it coming into the system.”

A development economist, Aliyu Ilias, said the refusal of the government to remove petrol subsidy had significantly increased expenditure, forcing the government to resort to borrowing to close its widening fiscal deficit.

He advised the government to seek better ways of generating revenue, such as widening its tax net and privatising its assets.

Economy

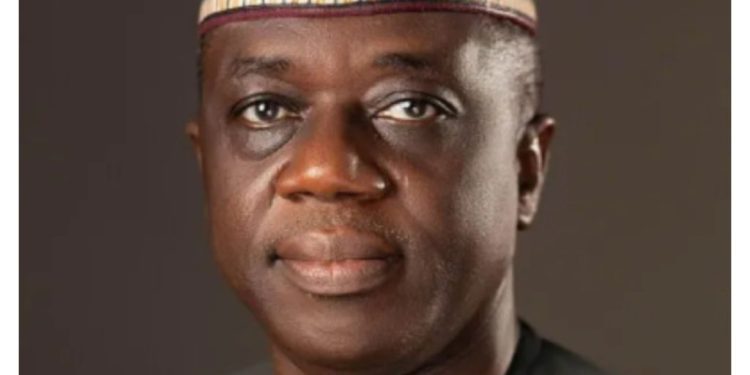

Newly appointed Accountant-General, Ogunjimi assumes office, pledges fairness to staff

The Accountant General of the Federation, Shamsedeen Babatunde Ogunjimi who was appointed by President Bola Ahmed Tinubu last week has assumed office on Monday.

In a brief ceremony marking his assumption at the Treasury Office in Abuja, he promised to be fair to staff of the office which he said, they would not be intimidated or victimized during his tenure of office.

In his maiden address to the entire staff of the Office of the Office of the Accountant General of the Federation, he called for unity, professionalism and commitment in order to achieve the objectives of the office.

He recalled how he suffered victimisaton in hands of previous Chief Executives where he worked, he promised that it would not be the case as he was elevated as the Accountant General of the Federation.

He said: “It is good to be back, this is our home, nobody will drive us out. I want everybody to have the spirit of togetherness.

“I am not in any group, I am not going to polarize the house.

“If I fail, everyone here has failed. I am ready to commit myself to the service of the public.”

The Accountant General called on staff to let the past go and forge a new spirit in order to move the office forward for the good of the nation and the current administration.

“During my interview for this job, when I was asked what I would do differently to change the image of the Treasury House, I wanted to put the question back to you.

“What will you do differently to correct the image of the OAGF? The question is to all staff members.

“Everyone of us must work to change the perception of the country’s treasury.

“I have been a victim of the chief executive officer firing directors he or she doesn’t like.

He assured the staff of the Treasury House of cooperation they haven’t seen in their lifetime professional career, saying, ‘I don’t like him. Please remove him’, I am not going to be that leader,” he said.

CAPITAL POST recalled that President Bola Tinubu last week approved the appointment of had last week approved the appointment of Mr Babatunde Ogunjimi as the country’s new Accountant General thereby putting to rest the guesswork of who should be the next occupier of the Treasury House.

Economy

NASENI embarks on nationwide campaign to promote Made-in-Nigeria products

The National Agency for Science and Engineering Infrastructure (NASENI) has announced plans to launch a nationwide sensitization campaign to promote the adoption of Made-in-Nigeria products, highlighting the transformative impact of locally engineered innovations on the nation’s economy.

As part of the initiative, the agency is organizing strategic focus group meetings across the six geopolitical zones of the country to galvanize support for indigenous products.

Speaking at the North Central zonal meeting in Abuja on Wednesday, the Coordinator, Implementation and Management Office (IMO) of NASENI, Yusuf Kasheem, emphasized the importance of supporting local products to drive economic growth.

“When Nigerians embrace the initiative, we do more than purchase goods—we invest in our future. We create jobs, stimulate economic growth, and reduce our reliance on imported alternatives,” Kasheem said.

He further highlighted that the widespread adoption of locally made products is a step toward a stronger, more self-sufficient Nigeria.

Kasheem reiterated NASENI’s dedication to leveraging technology and innovation to boost national prosperity.

“In just over a year, through strategic partnerships both locally and internationally, NASENI has introduced 35 commercially viable Made-in-Nigeria products. These innovations span critical sectors and reflect our commitment to excellence and self-reliance, he said”

Among the highlighted products are Solar Irrigation Systems, Home Solar Systems, Lithium Batteries, Electric Vehicles, Laptops, Smartphones, Animal Feed Mill Machines, and Energy-Efficient Street Lamps—each designed to improve various aspects of the economy and daily life.

In her remarks, the Executive Director of Business Development at NEXIM Bank, Hon. Stella Okotete, described the promotion of Made-in-Nigeria products as a national imperative.

“By increasing the quality, branding, and competitiveness of our products, we enhance our foreign exchange earnings, create jobs, and strengthen the value chain across key sectors such as manufacturing, agriculture, solid minerals, and services,” Okotete stated.

To support the initiative, Okotete disclosed that NEXIM Bank had introduced targeted interventions such as single-digit interest loans for export manufacturing and value addition, along with export credit facilities to improve financing access for Small and Medium Enterprises (SMEs).

The campaign aims to foster a culture of pride and reliance on locally made products, positioning Nigeria as a hub for technological innovation and economic self-sufficiency.

Economy

FAAC: N1.703 trillion revenue shared among FG, states, LGCs for January

A total sum of N1.703 trillion from the Federation Account Allocation Committee (FAAC) was shared among the Federal, States and Local Government Councils as the January 2025 Federation Account Revenue.

This was disclosed at the FAAC meeting held in Abuja on Friday.

The N1.703 trillion total distributable revenue comprised distributable statutory revenue of N749.727 billion, distributable Value Added Tax (VAT) revenue of N718.781 billion, Electronic Money Transfer Levy (EMTL) revenue of N20.548 billion and Augmentation of N214 billion.

A communiqué issued by FAAC stated that total gross revenue of N2.641 trillion was available in the month of January 2025.

The total deduction for the cost of collection was N107.786 billion, while total transfers, interventions, refunds, and savings were N830.663 billion.

According to the communiqué, gross statutory revenue of N1.848 trillion was received for the month of January 2025. This was higher than the sum of N1.226 trillion received in the month of December 2024 by N622.125 billion.

Gross revenue of N771.886 billion was available from VAT in January 2025. This was higher than the N649.561 billion available in the month of December 2024 by N122.325 billion.

The communiqué stated that from the N1.703 trillion total distributable revenue, the federal government received a total sum of N552.591 billion, and the State Governments received a total sum of N590.614 billion.

The Local Government Councils received a total sum of N434.567 billion, and a total sum of N125.284 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N749.727 billion distributable statutory revenue, the communiqué stated that the Federal Government received N343.612 billion, and the State Governments received N174.285 billion.

The Local Government Councils received N134.366 billion, and the sum of N97.464 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N718.781 billion distributable VAT revenue, the Federal Government received N107.817 billion, the State Governments received N359.391 billion, and the Local Government Councils received N251.573 billion.

A total sum of N3.082 billion was received by the federal government from the N20.548 billion Electronic Money Transfer Levy (EMTL). The State Governments received N7.192 billion, and the Local Government Councils received N10.274 billion.

From the N214 billion Augmentation, the Federal Government received N98.080 billion, and the State Governments received N49.747 billion.

The Local Government Councils received N38.353 billion, and a total sum of N27.820 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

In January 2025, VAT, Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies increased significantly while Electronic Money Transfer Levy (EMTL) and Oil and Gas Royalty decreased considerably.

-

News4 hours ago

News4 hours agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

Security5 days ago

Security5 days agoNigerian Coast Guard: Citizens warned against extortion as passage of bill is being awaited

-

Entertainment1 week ago

Entertainment1 week agoActor Baba Tee apologises to Ijoba Lande for having sex with his wife

-

Foreign1 week ago

Foreign1 week agoNorth Korea: A country not like others with 15 strange things that only exist

-

Politics1 week ago

Politics1 week agoGanduje, Barau receive Atiku support groups in 19 Northern States as APC Chairman declares death sentence on PDP, NNPP

-

Health1 week ago

Health1 week agoPresident Tinubu appoints Chief Medical Directors for medical centres across the country

-

Politics5 days ago

Politics5 days agoRetired military officer, colonel Gbenga Adegbola, joins APC with 13,000 supporters

-

Opinion1 week ago

Opinion1 week agoAkpoti-Uduaghan and the emerging controversies