Economy

EcoBank’s innovative strides amidst the economic downturn

Our keen interest in the Banking sector is borne out of the special interest we have in you our teeming readers and supporters. It is pertinent, we put to you the opportunities which abound in the banking industry and the thin differences embedded in each financial institution.

Financial institutions in Nigeria have played vital roles in putting substantial measures in places particularly, through the process of allocation of funds to those areas they think would be more productive.

The roles played by the financial institutions have made it possible for members of the public to access financial products and services from the banking industry.

Especially as it relates with the development of technological banking in the country today.

The significance of the financial institutions to the economy can not be ignored. Quite interestingly, financial institutions would make enough funds available, during recession such that, it will help drive economic growth, in the event, where there are economic upturns, while during economic down-turns, these financial institutions are so prudent, that they control the spate at which they lend members of the public money.

The topic, Financial institutions and the public is an inexhaustible one. Especially when we consider how these institutions fund small scale businesses. They all have keyed into this, providing short term credit or what small scale businesses called ‘working capital’ has helped small enterprises run their day to day business by securing facilities for the purpose of buying raw materials and paying off bills and other over-head expenditure.

These institutions have provided financial services to individuals or households. They have made great impacts on small and medium enterprises. Financial institutions have also made so many impacts on few households, as well as, some individuals.

We would take a quick look at a financial institution, which has embraced the Technological advances in the financial world. This has helped the bank to stand out as a leading institution in the country, despite the dwindling economy.

Interestingly, Ecobank is one of the largest banks in Nigeria and indeed Africa today, Ecobank has made its impact felt in the shores of Africa, especially as it concerns financial development and introduction of a wide range of products into the polity.

Ecobank Transnational Inc. (ETI), who prides itself as a pan-African banking conglomerate, with banking operations in 36 African countries has succeeded in endearing itself to its customers through a range of products and services that melts the heart. A leading independent regional banking group in West Africa and Central Africa, serving wholesale and retail customers, Ecobank has introduced a wide range of products and has its tentacles spread in all African regions in the world.

The Specialized subsidiary companies of Ecobank include the following: EBI SA Groupe Ecobank – Paris, France; EBI SA Representative Office – London, United Kingdom; Ecobank Development Corporation (EDC) – Lomé, Togo; EDC Investment Corporation – Abidjan, Côte d’Ivoire; EDC Investment Corporation – Douala, Cameroon; EDC Securities Limited – Lagos, Nigeria.

Appointed in July 2018, as the Managing Director and Regional Executive of Ecobank Nigeria, Patrick Akinwuntan has done splendid wonders in the enlargement of the Bank’s tentacles across Africa. Mr. Patrick Akinwuntan, who once served as the Head of Commercial Bank for 3 years, before rising through the ranks to become the MD, helped in pushing the Bank’s ambition of being present in 13 countries to being operational in 30 countries.

To achieve scale and improve the efficiency of local distribution, Akinwuntan led EcoBank in putting a strategy that allowed the bank operate one platform across the group. Patrick was tasked with the responsibility of building a pan-African technology platform, building Pan-African switch and having one common domain; ecobank.com.

With other services such as EDC Stockbrokers Limited – Accra, Ghana; Ecobank Asset Management – Abidjan, Côte d’Ivoire; e-Process International SA – Accra, Ghana; Ecobank Asset Management Company P/L – Harare, Zimbabwe, Eco bank maintains subsidiaries in Eastern and Southern Africa.

Ecobank has two specialised subsidiaries: Ecobank Development Corporation (EDC) and eProcess International (eProcess). EDC was incorporated with a broad mandate to develop Ecobank’s investment banking and advisory businesses throughout the countries where Ecobank operates.

The Development Corporation operates brokerage houses on all 3 stock exchanges in West Africa and has obtained licences to operate on the two stock exchanges in Central Africa: the Douala Stock Exchange in Cameroon and the Libreville Exchange in Gabon.

While the mandate of eProcess is to manage the Group’s information technology function with a view to ultimately centralising the Group’s middle and back office operations to improve efficiency, service standards and reduce costs.

Categorically, Ecobank boasts to have one of the largest networks of Branches and ATMs across the nation.

With a branch network of 1, 305 and networked ATM numbering 1,981 across Nigeria, Ecobank definitely is a large financial services provider. With offices in 36 countries around the world, and presence in 36 sub-Saharan countries, Ecobank’s customer base was estimated at 13.7 million across the globe, with 9.6 million (70.2%), located in Nigeria, the continent’s most populous nation.

They have made it easy for agencies to access grants or loans from the financial institutions, and these loans and grants come in form of support service to these agencies who work for the development and promotion of the nation.

However, there is a need for a suitable framework such that will foster speed and the ability to act promptly, by these banks. In as much as we appreciate their services and products, a swifter means of delivery would be appreciated. This would make their services more effective, and this would avoid any adverse condition that could have impacted negatively on the financial institutions.

It is believed that, by virtue of the role played by the financial institutions in growing the nation’s economy, the regulatory body, CBN would ensure ultimate improvement in stabilizing the financial institutions and the economy by providing considerate prerequisite for their operations. If financial markets, like the bond market, and the stock market, and the foreign exchange market are well functioning, the likelihood is that such an arrangement will bring about high economic growth.

Subsequently, when there is an immense extension of the financial instruments, there would be lessening in transaction costs which in return would grow our economy.

Olamide Adeniji is a member of the Editorial Board of TheScript Newspapers.

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

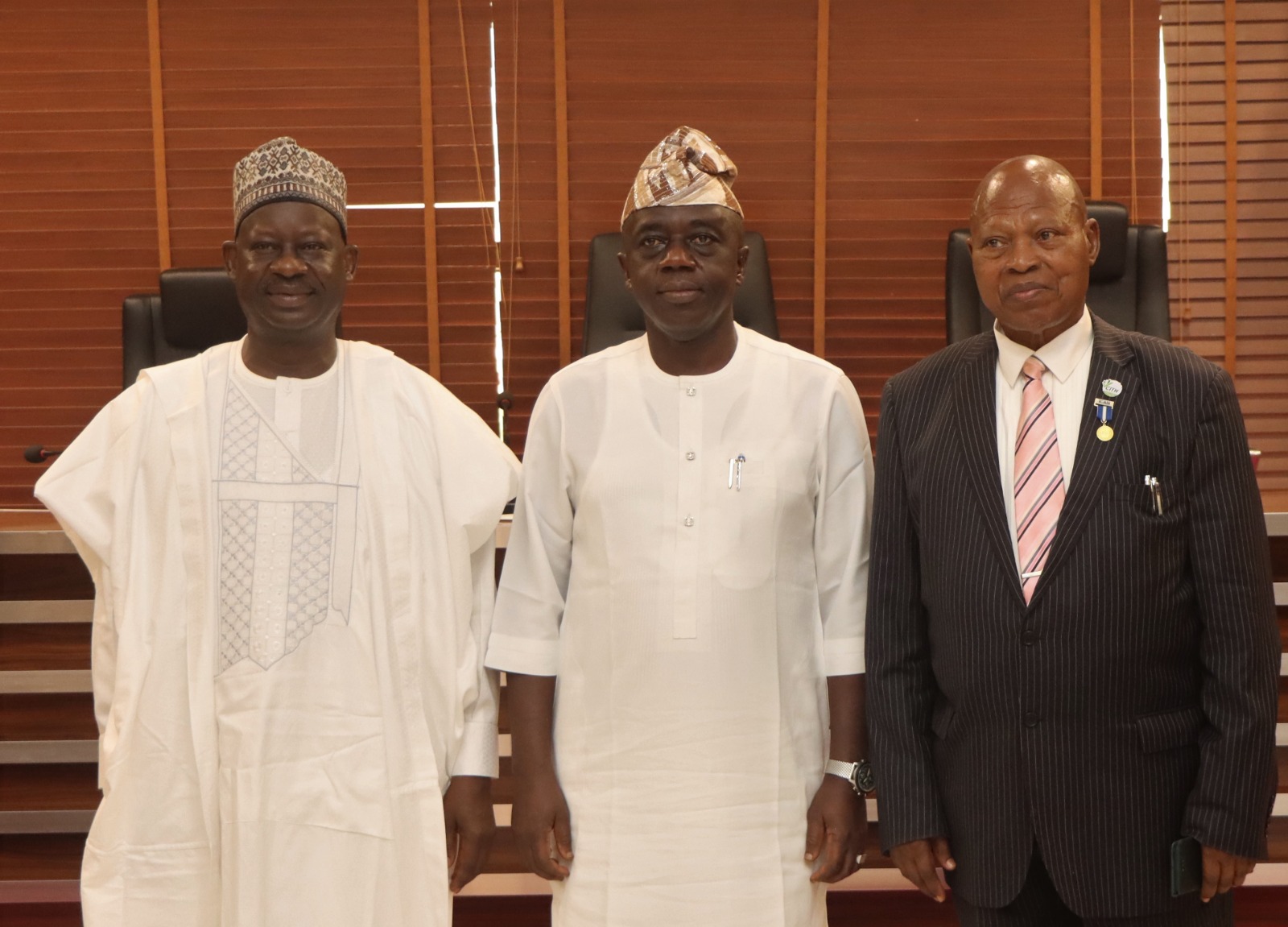

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

Security6 days ago

Security6 days agoNew Commissioner of Police in Niger, Elleman sends strong warning to criminals

-

News5 days ago

News5 days agoAbia: LG Chairman, Iheke accused of using soldiers to detain IRS agent, claims Governor Otti’s support

-

News6 days ago

News6 days agoKogi Governor, Ahmed Usman Ododo salutes Tinubu at 74

-

News3 days ago

News3 days agoKogi government bans rallies ahead of Natasha’s homecoming slated for Tuesday

-

News6 days ago

News6 days agoPlateau LP stakeholders endorses Barr Gyang Zi’s defection to APC

-

News3 days ago

News3 days agoIran may secure a deal before Trump’s deadline – or face Israeli strikes in Tehran – analysis

-

News6 days ago

News6 days agoAkpabio pays historic visit to office of SA to President on Senate Matters

-

Business6 days ago

Business6 days agoFCT Minister reveals how he would aggressively pursue revenue collection, tours infrastructure