News

Danbatta speaks on NCC’s role in combating e-fraud

The Nigerian Commissions Commission has a crucial role to play in combating electronic fraud in the telecom sector and in Nigeria’s economy, the Executive Vice Chairman and Chief Executive Officer, Prof. Umar Danbatta has said.

Speaking while presenting a keynote address titled ‘Combating E-Fraud on Telecom Platforms and Building Consumer Confidence in the Digital Economy’ at the 2nd Quarter 2023 Industry Consumer Advisory Forum (ICAF) in Lagos, he said, as a regulator, the NCC must establish comprehensive legal frameworks for the protection of telecom operators.

These legal frameworks, according to him must focus on data protection, privacy and incident response, ensuring that operators are held accountable for any lapses in security on their respective networks.

He stressed that the Commission will collaborate with Mobile Network Operators to ensure the safety of their networks and conducts regular audits and assessments to verify compliance and encourage a culture of cybersecurity within the industry.

“The NCC as the regulator of the communications sector has a crucial role to play in combatting e-fraud,” he said.

He disclosed that part of the efforts of the NCC in combating e-fraud include type-approving communications equipment to ensure that they conform to global standards and are interoperable with various relevant technologies.

“In accordance with the Nigerian Communications Act 2003, telecom operators have a responsibility to ensure the security and integrity of their networks and to prevent it from being used in, or in relation to, the commission of any offense under any law in operation in Nigeria,” he added.

Meanwhile speaking to Journalists on the sideline, Prof. Danbatta admitted that with the increasing uptake of digital financial services and the advent of disruptive technologies, the issue of cybersecurity has become increasingly important.

He advised telecom operators to invest in robust infrastructure, employ state-of-the-art security measures, and conduct regular audits to identify and address vulnerabilities promptly.

“Operators should implement stringent authentication protocols, two-factor authentication and encryption mechanisms to safeguard customer data and prevent unauthorized access,” he advised.

Answering questions from Journalists on the concern about how personal data is collected, stored, shared and exploited, the former University lecturer stated that fortunately, NDEPS 2020-2030 adequately addresses the protection of telecom consumers against the threats of cybercrime, encouraging them to embrace digital finance and supporting them to contribute to the Digital Economy.

“Pillar #6 of the NDEPS, which deals with soft infrastructure, has proven to be proactive. The soft infrastructure pillar focuses on strengthening public confidence in using digital technologies and participation in the Digital Economy. The pillar will address the importance of cybersecurity and other standards, frameworks, and guidelines that encourage citizens to embrace a digital culture.

Data privacy and the deployment of technologies like the public key infrastructure are addressed in this pillar,” he explained.

News

CSOs demand urgent probe into ex-Rivers HoS allegations against Gov. Fubara

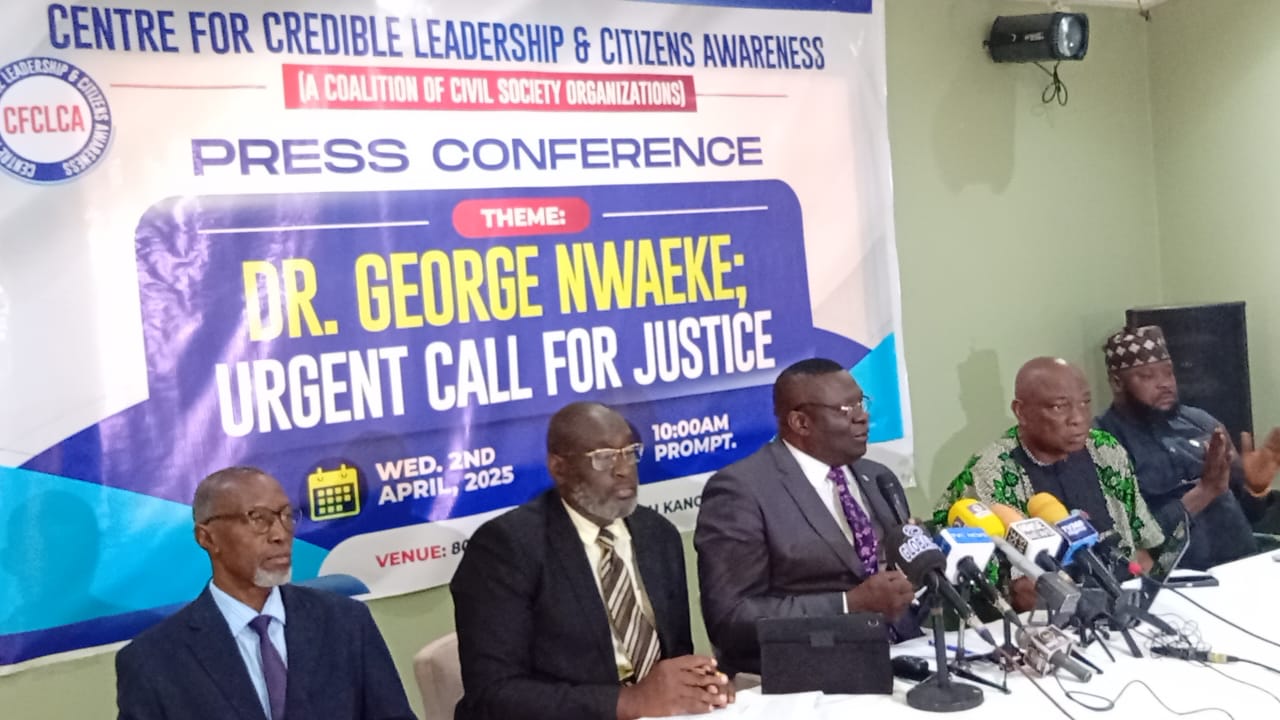

A coalition of civil rights organizations, the Centre for Credible Leadership and Citizens Awareness (CCLCA), has called for an immediate and thorough investigation into the allegations leveled against suspended Rivers State Governor, Siminalayi Fubara, by Dr. George Nwaeke, the former Head of Service of the state.

During a press briefing in Abuja on Wednesday, Dr. Gabriel Nwambu, Director General of the CCLCA, urged the Nigerian Police Force (NPF), Department of State Services (DSS), and the Economic and Financial Crimes Commission (EFCC) to take swift action in probing the allegations. He emphasized that if proven true, these claims pose serious risks to governance and democracy.

The coalition, comprising 30 civil society organizations, stands in solidarity with Dr. Nwaeke, who has expressed willingness to provide evidence of alleged corruption and constitutional breaches involving Governor Fubara and his Chief of Staff, Mr. Edison.

“We collectively urge the relevant authorities to act swiftly and transparently. Addressing these allegations is critical to restoring public confidence in governance at both the state and national levels,” Dr. Nwambu stated.

He commended President Ahmed Bola Tinubu for his intervention in Rivers State, which led to the declaration of a state of emergency, a move he described as crucial for stabilizing the region.

Dr. Nwaeke’s accusations against Governor Fubara include:

Arson and Sabotage: Allegedly instructing his Chief of Staff to burn down the Rivers State House of Assembly to prevent impeachment proceedings, a violation of Section 14(2)(b) of the 1999 Constitution.

Corruption and Financial Misconduct: Claims of large sums of money being used for personal and illegal activities, contravening Section 15(5) of the Constitution.

Threats to Public Safety: Alleged plans to sabotage state infrastructure, potentially inciting public disorder, which falls under Section 1 of the Terrorism Prevention Act (2011).

Collusion with Militant Groups: Alleged meetings between the governor, his Chief of Staff, and militant leaders, posing a threat to national security and violating Section 43 of the Constitution.

Suppression of Labour Rights: Alleged attempts to bribe labour leaders to silence dissent, contravening Section 40 of the Constitution, which guarantees freedom of assembly.

The coalition has urged law enforcement agencies to ensure a thorough, transparent, and expedited investigation into these allegations.

News

Deputy Speaker, Kalu appoints Hart as new Chief of Staff

Deputy Speaker of the House of Representatives, Rt. Hon. Benjamin Okezie Kalu has appointed Sam Ifeanyi Hart, Esq. as his new Chief of Staff (CoS).

Hart replaces Hon. Toby Okechukwu who was recently appointed Executive Director, Projects of the newly established South East Development Commission (SEDC).

Prior to his appointment, Hart served as Special Adviser to the Deputy Speaker on Public Affairs and has an extensive background in training and consultancy.

Hart also previously served as Director-General, Abia State Marketing and Quality Management Agency from 2019 to 2023 after occupying other appointive positions.

He was also a member of National Institute for Policy and Strategic Studies (NIPPS), Kuru where he attended the Senior Executive Course 45, serving as Course Secretary-General.

He has also served on the Boards of several corporate and non-governmental entities.

Hart brings a wealth of knowledge and experience to his new role, with a distinguished career spanning law, leadership, and public service.

A lifelong learner, he holds multiple academic qualifications, including a Master’s Degree in Environmental Law (LLM) and a Bachelor’s Degree in Law (LLB) from Abia State University.

The new Chief of Staff is also currently pursuing a Doctorate Degree in Law.

A seasoned professional, Hart has attended prestigious institutions, including the GOTNI Leadership Centre, National Institute for Policy and Strategic Studies (NIPPS), and the School of Politics, Policy and Governance (SPPG).

He is also a member of several professional bodies, including the Chartered Institute of Directors of Nigeria (M.IoD), Nigerian Institute of Chartered Arbitrators (ACIArb), and the Nigerian Bar Association (NBA).

As Chief of Staff, Hart will provide strategic guidance and support to the Deputy Speaker legislative activities, leveraging his expertise to drive policy initiatives and promote good governance.

News

Beware of ATM Card Swap: A Growing concern in Nigeria

By Abah Benjamin Eneojoh

As Nigerians continue to rely on Automated Teller Machines (ATMs) for their daily financial transactions, a new trend of card swapping has emerged, leaving many victims bewildered and financially vulnerable. In this article, we will explore the root of this issue and provide guidance on how to avoid falling prey to this scam.

The Modus Operandi

The scam typically occurs when an ATM user inserts their card into the machine, only to have it retained or spat out. In many cases, the machine may appear to malfunction, prompting the user to remove their card and reinsert it. However, unbeknownst to the user, the machine may have swapped their card with a different one, often with a similar appearance.

The Consequences

When the user attempts to use the swapped card, they will inevitably encounter difficulties, as the card will not match their password or PIN. This can lead to frustration, financial losses, and even identity theft.

Implementation and Prevention

To avoid falling victim to this scam, it is essential to be vigilant when using ATMs. Here are some preventive measures to take:

1. Verify the card*: Before reinserting your card into the ATM, ensure it is indeed your card. Check the name, card number, and expiration date to confirm its authenticity.

2. Be cautious of malfunctioning ATMs*: If the ATM appears to be malfunctioning or retains your card, do not attempt to reinsert it. Instead, contact your bank or the ATM operator to report the issue.

3. Monitor your account activity*: Regularly check your account statements to detect any suspicious transactions.

4. Use ATMs at secure locations*: Opt for ATMs located in well-lit, secure areas, such as bank branches or shopping malls.

Tracing the Root of Card Swap

While the exact cause of card swapping is still unclear, it is believed to be the result of a combination of factors, including:

1. ATM maintenance and repair: Poorly maintained or repaired ATMs may be more prone to card swapping.

2. Card skimming and shimming: Criminals may use card skimming or shimming devices to steal card information and swap cards.

3. Insider involvement: In some cases, bank employees or ATM technicians may be complicit in the card swapping scheme.

Conclusion

Card swapping is a growing concern in Nigeria, and it is essential for ATM users to be aware of the risks and take preventive measures. By verifying the card, being cautious of malfunctioning ATMs, monitoring account activity, and using ATMs at secure locations, Nigerians can reduce their chances of falling victim to this scam. Remember, vigilance is key to protecting your financial security.

Eneojoh writes from Lokoja, Kogi State, Nigeria

-

Security4 days ago

Security4 days agoNew Commissioner of Police in Niger, Elleman sends strong warning to criminals

-

News3 days ago

News3 days agoAbia: LG Chairman, Iheke accused of using soldiers to detain IRS agent, claims Governor Otti’s support

-

News4 days ago

News4 days agoKogi Governor, Ahmed Usman Ododo salutes Tinubu at 74

-

News4 days ago

News4 days agoPlateau LP stakeholders endorses Barr Gyang Zi’s defection to APC

-

News2 days ago

News2 days agoKogi government bans rallies ahead of Natasha’s homecoming slated for Tuesday

-

News4 days ago

News4 days agoAkpabio pays historic visit to office of SA to President on Senate Matters

-

News2 days ago

News2 days agoIran may secure a deal before Trump’s deadline – or face Israeli strikes in Tehran – analysis

-

Business4 days ago

Business4 days agoFCT Minister reveals how he would aggressively pursue revenue collection, tours infrastructure