News

CDS lauds Nigeria Navy for local production of maritime chart

The Chief of Defence Staff, General Abayomi Gabriel Olonisakin has lauded the Nigerian Navy Hydrographic Office (NNHO) for the local production of maritime chart covering some parts of Nigerian waters, saying local resources was most needed at this time.

In a statement issued by Major General John Enenche, Coordinator, Defence Media Operations of the Nigeria Defence Headquarters, on Thursday, Olonisakin explained that the charts have been certified and recognised by International Institutions.

The statement read: “The fact is that the recent products of the NNHO, harbour and operational charts, are certified and recognized by international institutions.

“This achievement is coming at a time when the need to utilize indigenous resources has been underscored by recent global events.

“It could be recalled that the NN recorded a significant operational milestone with the production of the second indigenous navigational chart of some parts of Nigerian waters by the Nigerian Navy Hydrographic Office (NNHO).”

The statement noted that the new chart covers parts of Badagry Creek, from Ogunkobo, through Navy Town and Mile 2 to Tin-Can Island in Lagos waters.

“Work on the chart started in 2019. With the completion of the chart, the NNHO has now commenced work on its electronic version which will be forwarded to the International Centre for Electronic Navigational Charts for validation and release.

“In the last one year, the NNHO has produced a number of nautical products which are currently used by Nigerian Navy ships and establishments. These include harbour chart of Nigerian Navy Ship BEECROFT and Nigerian Naval Dockyard Limited water fronts, port guide of Lagos harbour and operations charts of the entire Eastern Naval Command. Others are maneuvering sheets for tactical navigation and a number of training charts among others.

“The International Hydrographic Community, particularly the United Kingdom Hydrographic Office (UKHO), has acknowledged the strides made by the NN in chart production.

“Consequently, the UKHO has accepted gradual hand over of the survey data covering Nigerian waters which are held in their archive and also to adopt NNHO’s charts rather than producing new ones. This is a confirmation that NNHO’s nautical products meet international (IHO) standards.

“The NNHO wishes to maintain this standard to facilitate safety of navigation within Nigerian waters and seamless takeover of the charting functions of Nigerian waters from UKHO.

“In line with the coordination role of the NN in Hydrography, the NNHO is also currently developing a harmonized Standard Operating Procedures to guide all hydrographic survey activities conducted in Nigerian waters by private survey companies and sister government agencies.

“This would ensure that data received from any of these survey companies/government agencies are accurate enough to be included in a chart”, the statement concluded.

News

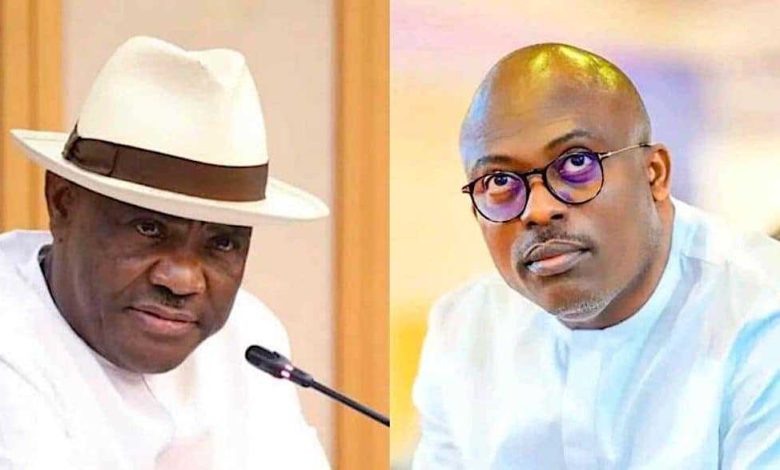

Rivers Chief of Staff reveals how Wike’s camp offered N5bn bribe to impeach Fubara

The Chief of Staff to the suspended Rivers State Governor, Edison Ehie, has revealed how he was offered the sum of N5 billion to coordinate the impeachment of his principal, Siminalayi Fubara.

He stated this on the popular Channels Television on Sunday Politics, claiming that he has evidence stored on his phone to substantiate his claims.

The impeachment of the governor has been the desire of the 27 lawmakers loyal to Nyesom Wike, a former governor of Rivers and a current Minister of the Federal Capital Territory, hence, the claim, if substantiated would have been linked to the camp of the Minsiter, Nyesom Wike.

“I can also open my phone to show you, in the beginning of October 2023, when they approached me with a bribe of N5 billion. It is here in my phone.

“It was for impeachment. It’s here. I have it and I have printed it and distributed it, in case, in their evil imagination, they decide to attack me. I already have a son and a brother,” he said.

According to Ehie, the mouth watering offer was made while he was serving as the majority leader of the Rivers State House of Assembly.

Reacting to claims that the embattled governor told him to bomb the State House of Assembly, he denied, saying that Fubara never told him to do so, while he challenged the former Head of Service prove evidence.

His denial was at the backdrop of claims by the former Head of Service of Rivers State, George Nwaeke that he witnessed a bag of money being handed over to Ehie at the Government House to organize the bombing of the House of Assembly complex to avoid impeachment of the governor.

Nwaeke however, said, he didn’t the amount of money in the bag that was handed over to the Ehie.

Dismissing the claims as false and politically motivated, Ehie said, “It is very important to clarify that I had no hand and was not part of the burning down of the Rivers State House of Assembly.

“Like everyone else, I woke up in the early hours of 30th of October 2023 to hear of the burning down of the Rivers State House of Assembly.”

Ehie stated that he had instructed his lawyers to file a lawsuit against Nwaeke for criminal libel.

“I will not join issues completely with Mr. George Nwaeke because I have already instructed my lawyers to file an issue of criminal libel against him, and I hope he is very prepared to substantiate his claims and his allegations,” he said.

He further alleged that Nwaeke had sought financial assistance from him on the same day he resigned as head of service.

Rivers State has been in turmoil since Fubara’s fallout with his predecessor and current Minister of the Federal Capital Territory Nyesom Wike.

On March 18, President Bola Tinubu declared a state of emergency in the state and suspended both the governor and his deputy.

Subsequently, on March 26, the sole administrator of Rivers State, Ibok-Ete Ibas, suspended all political officeholders in the state.

News

Plane carrying Israeli students to Poland makes emergency landing in Turkey

The Education Ministry said it is in contact with security and education officials and is coordinating with admins and parents.

A plane carrying a group of 150 Israeli students on a trip to Poland made an intermediate landing in Antalya, Turkey, the Education Ministry said on Monday.

The landing was made following concerns about a technical malfunction, and for reasons of caution, a decision was made to stop in accordance with aviation rules.

N12 reported that a bird had entered the plane’s engine during the flight.

The high school student delegation – from Ein Kerem High School in Jerusalem – was en route to Poland on a standard school trip to learn about the events of the Holocaust. They were accompanied by security personnel from the Shin Bet, as is customary for any delegation to Poland.

The Education Ministry said that they are in continuous contact with security and education officials and are in coordination with school administrations and parents.

The Auschwitz-Birkenau concentration camp in Poland. September 19, 2021. (credit: NATI SHOHAT/FLASH90)

It was reported that all the students “are feeling well, staying in a safe and protected area within the airport, and are closely accompanied by the teaching staff who are with them at all times.”

In addition, the ministry was informed that a replacement plane is on its way to them, and it is estimated that at 3:00 p.m., they will take off for Krakow to continue their educational journey.

Holocaust learning

Israeli school trips to Poland typically take place in the winter and the summer, and, according to Education Minister Yoav Kisch, aim to allow “students to commemorate the victims of the Holocaust, to be exposed to the atrocities that took place, and to prove the victory and resurrection over the attempt to destroy the Jewish people.”

In November 2023, the ministry announced it would cancel the winter Poland trips due to the rise of antisemitism worldwide in the aftermath of the Israel-Hamas war.

News

FY 2024: Fidelity Bank records a 210.0% growth in PBT to N385.2bn

…Declares a total dividend of N2.10 per share

Lagos, Nigeria, March 29, 2025: Leading financial institution, Fidelity Bank Plc, released its 2024 full-year Audited Financial Statements, reporting a 210% growth in Profit Before Tax to N385.2 billion.

According to the Bank’s results released on the Nigerian Exchange (NGX) on Friday, 28 March 2025, Gross Earnings increased by 87.7% to N1,043.4bn, driven by 106.9% growth in interest and similar income to N950.6bn. The increase in Interest Income was led by a combination of improved yield on earnings assets and 51.6% expansion in earnings base to N6.3tn. This led to a Profit After Tax of N278.1 billion, representing a 179.6% annual growth.

Commenting on the results, Dr. Nneka Onyeali-Ikpe,OON, Managing Director/Chief Executive Officer, Fidelity Bank Plc said, “We are delighted with our 2024 full-year (FY) performance, which showed strong growth across key revenue lines, improved asset quality, and significant traction in our strategic business segments. Our impressive results led to a triple-digit increase (210.0%) in Profit Before Tax (PBT), rising from N124.3bn in 2023 to N385.2bn in 2024.”

A further review of the financial performance revealed that the bank’s net interest income increased by 127.1% to N629.8 billion, driven by a high-yield environment in 2024. To optimize its margin, the bank sustained its asset yields above funding cost by maintaining a high low-cost deposit profile at 92.6%. This led to an increase in its Net Interest Margin from 8.1% in 2023 FY to 12.0%.

Similarly, the bank continued to deepen its market share in both the corporate and retail segments, with customer deposits increasing by 47.9% from N4.0trn in 2023FY to N5.9trn. The increase was driven by strong double-digit growth across all deposit types. The Retail Banking Business gained significant traction with savings deposits increasing by 28.8% to N1.1trn, marking the 10th consecutive year of double-digit annual growth in savings deposits.

Despite the difficult economic terrain in 2024, the bank has continued to support the real sector of the economy by increasing its Net Loans & Advances from N3.1tn in 2023FY to N4.4tn in 2024FY.

“This remarkable performance demonstrates our capacity to deliver superior returns to our shareholders. In line with our commitment to them, we have declared a final dividend of N1.25 per share, bringing our total dividend for the 2024 financial year to N2.10 per share”, explained Onyeali-Ikpe.

Having consistently paid dividends since 2006, Fidelity Bank will pay investors a total dividend of N2.10 per share for the 2024 financial year, subject to shareholders’ approval at its Annual General Meeting (AGM) on 29 April 2024. The dividend will be paid on 29 April 2025 to shareholders whose names appear on the register of members as of 15 April 2025.

It will be recalled that the bank successfully completed the first phase of its capital raising exercise through a Public Offer and Rights Issue in 2024, which were oversubscribed by 237.92% and 137.73%, respectively. The positive result is a testament to the strength of the Bank’s franchise in the capital market. A total of N175.9bn was recognized as fresh capital in 2024 financial year from the exercise, which had a positive impact on its Capital Adequacy Ratio (CAR) at 23.5%. The bank plans to conclude the second phase by Q3 2025, ahead of the Central Bank of Nigeria’s deadline, which will further strengthen its capital base and reaffirm its attainment of Tier 1 Bank status in the Nigerian Banking Industry.

Fidelity Bank Plc is a full-fledged commercial bank with over 9.1 million customers who are serviced across its 251 business offices and various digital banking channels in Nigeria and the United Kingdom.

The Bank is the recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine.

Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

-

Foreign1 week ago

Foreign1 week agoHouthis declare Ben-Gurion Airport ‘no longer safe’ after renewed Gaza fighting

-

Security2 days ago

Security2 days agoNew Commissioner of Police in Niger, Elleman sends strong warning to criminals

-

News2 days ago

News2 days agoKogi Governor, Ahmed Usman Ododo salutes Tinubu at 74

-

News1 week ago

News1 week agoUmeh denies receiving $10,000 with other 42 Senators to support state of emergency in Rivers

-

News23 hours ago

News23 hours agoAbia: LG Chairman, Iheke accused of using soldiers to detain IRS agent, claims Governor Otti’s support

-

News2 days ago

News2 days agoPlateau LP stakeholders endorses Barr Gyang Zi’s defection to APC

-

Sports1 week ago

Sports1 week ago2026 World Cup Race: Ekong says Eagles feel great to be back in contention

-

News1 week ago

News1 week agoAgain, explosion rocks gas facility in Rivers