Economy

Budget deficit rises 370%, hits N47tn under Buhari government

The total budget deficit under the President, Major General Muhammadu Buhari (retd.), is set to hit N47.43tn, according to an analysis of the Federal Government’s data from the Budget Office of the Federation.

According to investopedia, a budget deficit happens when expenses exceed revenue.

The budget data analysed cover the actual budget deficits and projections for 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022, and 2023 fiscal years.

According to data, deficit financing has risen by 370.54 per cent from N2.41tn in 2016 to N11.34tn in 2023.

In Q3 and Q4 of 2015, total deficit financing amounted to N841.48bn, it rose to N2.41tn in 2016, N3.81tn in 2017, N3.65tn in 2018, N4.18tn in 2019, N6.59tn in 2020, N6.44tn in 2021.

While the total deficit for 2022 has not been released, the budget office expects deficit to hit N8.17tn (of which N6.37tn had been spent as of November 30, 2022). The office also anticipates a high deficit financing of N8.17tn for the 2023 fiscal year.

Between Q3, Q4 of 2015, 2016, 2017, 2018, 2019, 2020, the first three quarters of 2021, and the first four months of 2022, the Federal Government spent N23.66tn on personnel costs, pensions, overhead costs, presidential amnesty programme, other service-wide votes, and special interventions.

It also spent N14.13tn on servicing domestic and foreign debts, as well as N10.47tn on capital expenditure.

Explaining the government budget deficit, an economic expert, Professor Akpan Ekpo, said, “This shows that expenditure has eclipsed the revenue, because they have to borrow, which is why there is a deficit.

“They can’t raise enough domestic resources to finance spending. That gap is a deficit. Talking about GDP, by the rules, it should not be more than a certain percentage of GDP, but it has exceeded that.”

According to the former Coordinating Minister for the Economy and Minister of Finance, Dr Ngozi Okonjo-Iweala, there is a need to keep the budget deficit under three per cent of GDP because of the Fiscal Responsibility Act, 2007, and in accordance with the international norm.

The country’s budget deficit to the GDP ratio had risen from 1.69 per cent in 2015 to 2.37 per cent in 2016. It increased to 2.85 per cent in 2018, 2.92 per cent of GDP in 2019. The Federal Government expects the deficit to GDP ratio to be 5.03 per cent of the 2023 budget.

The Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed, had disclosed that the government was struggling to raise revenue for its expenditure.

In a document titled ‘Public Consultation on the Draft 2023 – 2025 MTFF/FSP,’ she said, “Revenue generation remains the major fiscal constraint of the federation. The systemic resource mobilisation problem has been compounded by recent economic recessions.”

While defending the 2022 budget, she stated, “If we just depend on the revenues that we get, even though our revenues have increased, the operational expenditure of the government, including salaries and other overheads, is barely covered or swallowed up by the revenue.

“So, we need to borrow to be able to build these projects that will ensure that we’re able to develop on a sustainable basis. Nigeria’s borrowing has been of great concern and has elicited a lot of discussions. But if you look at the total size of the borrowing, it is still within healthy and sustainable limits.”

The PUNCH recently reported that the Federal Government borrowed N6.31tn from the CBN through Ways and Means Advances in 10 months of 2022. This pushed total borrowing from the CBN from N17.46tn in December 2021 to N23.77tn in October 2022.

World Bank had raised concerns over the financing of budget deficit through the CBN’s Ways and Means.

In its December 2022 update, the global bank said “Moreover, financing of the fiscal deficit through Ways and Means continues to fuel inflation by increasing liquidity in the money market.

“The CBN’s inflation target of six–nine percent, which has not been achieved since 2016, remains unlikely to be met in the near term.”

With deficit financing at estimated at 5.2 percent of GDP for 2022, the bank disclosed that the Federal Government remains in breach of the legally stipulated level set in the Fiscal Responsibility Act (2007).

It further said that Nigeria’s GDP growth rate would continue to be outpaced by other emerging economies, with inflation growing, and fiscal deficits increasing.

The PUNCH report stated that the government could sell or concession the Tafawa Balewa Square in Lagos as well as all the National Integrated Power Projects in Olorunsogo, Calabar II, Benin (located at Ihorbor), Omotosho II, and Geregu II plants, and some other government assets to fund its budgets.

$15.62bn Eurobond repayments

Meanwhile, Buhari may pass on $16.62bn Eurobond loan repayments to the next government, according to government data.

These repayments will be made almost every year until about 2038, according to the public presentation of the approved 2023 budget by the Minister of Finance, Budget and National Planning.

The document showed that repayment of $500m is expected in 2023 and $1.12bn in 2025.

The other payments include $1.5bn in 2027 and $1.25bn each year from 2028 to 2030

There is also a $1bn repayment by 2031 and $1.5bn each between 2032 and 2033.

It also noted that $4.75bn would be paid from 2038 onward.

In 2021, The PUNCH reported that commercial loans obtained by Nigeria through Eurobonds rose from $1.50bn as of December 31, 2015, to $10.87bn as of December 31, 2020, indicating a $9.37bn or 625 per cent increase in five years.

The debt stock remained at $1.5bn from 2015 to 2016 but rose to $6bn by 2017, indicating a $4.5bn or 300 per cent rise within a year.

It further rose to $10.87bn in 2018, signifying an increase by $4.87bn or 81 per cent. It remained at this figure till the end of 2020.

However, showed $15.62bn as of September 2022, according to data from the Debt Management Office.

The Eurobond debt rose by 941.33 per cent from $1.5bn as of June 2015 to the current figure released by the DMO.

Also, the repayment amount will rise by 850 per cent from $500m by 2023 to $4.75bn by 2038 upwards.

October last year said that the amount spent by Nigeria on servicing Eurobonds and Diaspora bonds rose by 85.67 per cent between the first and the second quarter of 2022.

An analysis of data on actual external debt service payments from the DMO showed that Nigeria spent a total of $246.16m on servicing its foreign bonds in the first quarter of 2022.

By the second quarter of the same year, the total debt service cost on these loans rose to $457.01m.

Hence, the debt service rose by 86 per cent between the two periods.

An eurobond is “a debt instrument that’s denominated in a currency other than the home currency of the country or market in which it is issued,” according to Investopedia.

A Eurobond is a bond issued offshore by governments denominated in a currency other than that of the issuer’s country. Eurobonds are usually long-term debt instruments and are typically denominated in US Dollars

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

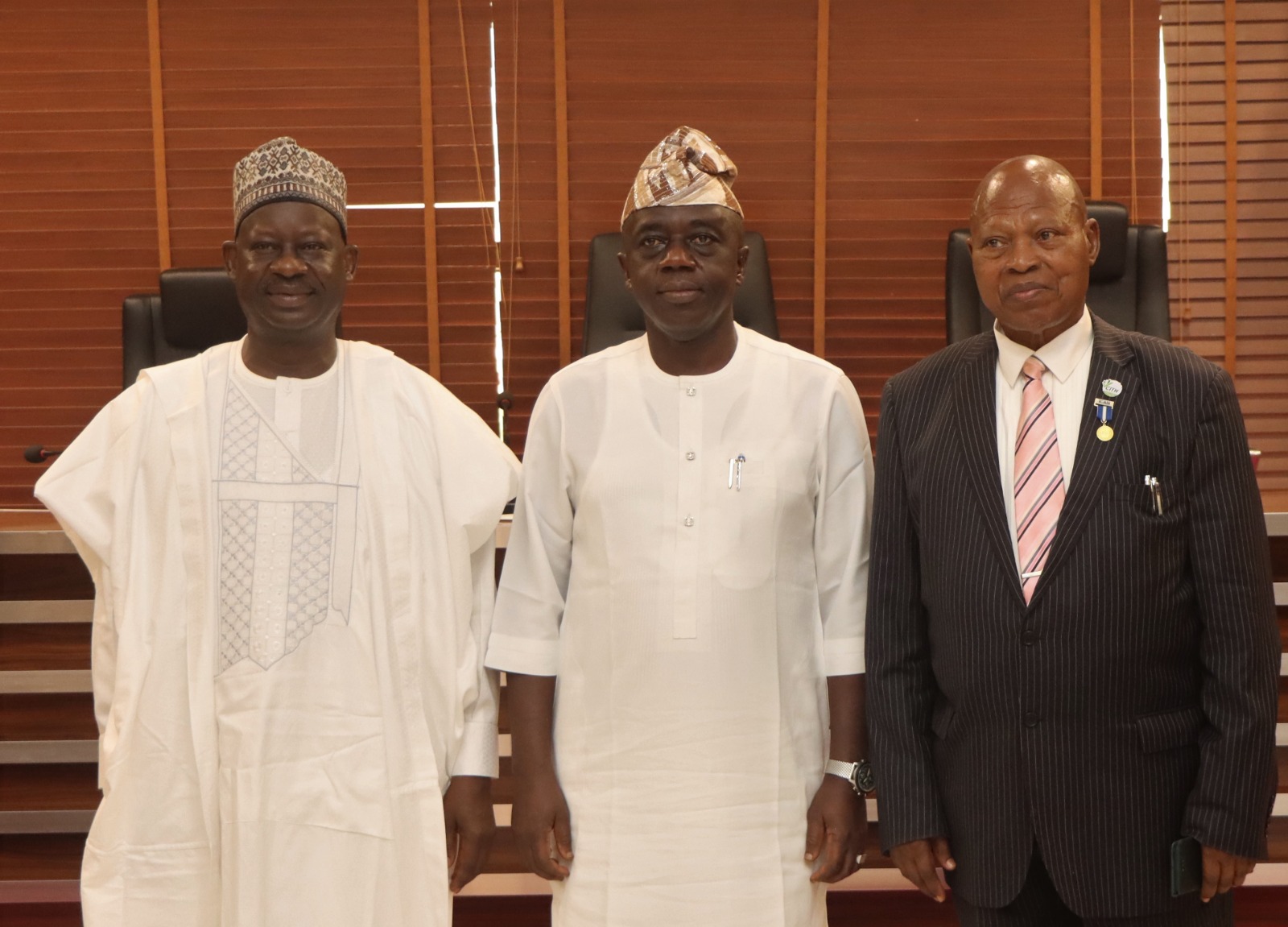

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

News5 days ago

News5 days agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

Politics1 week ago

Politics1 week agoCPDPL accuses Adeyanju of orchestrating smear campaign against FCT Minister Wike

-

News5 days ago

News5 days agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News5 days ago

News5 days agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

News4 days ago

News4 days agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Sports6 days ago

Sports6 days agoMerino gives Arsenal win over Chelsea

-

Interview6 days ago

Interview6 days agoSenators Natasha-Akpabio saga should have been resolved privately – Rev. Mrs Emeribe

-

Politics2 days ago

Politics2 days agoOpposition leaders announce coalition to challenge Tinubu in 2027