Business

Banks, FIRS differ over windfall tax

Nigerian banks are in a tango with the Federal Inland Revenue Service (FIRS) over how much should be paid in a one-off foreign exchange windfall tax, two weeks after an initial deadline elapsed.

President Bola Tinubu last July sought lawmakers’ approval for a 50 percent tax on banks’ realised foreign exchange gains following the naira devaluation in 2023.

Both chambers of parliament passed the bill seeking the one-off tax, with the Senate raising the rate to 70 percent. The banks were to be debited by the CBN on December 31 2024.

The banks and the FIRS however can’t seem to agree on the tax due, two weeks after the payment deadline.

“The banks are having a quiet tango with the FIRS on the windfall tax issue at the moment,” a source familiar with the matter said.

“The banks are arguing with the FIRS on the calculated sums of tax due and are reverting with their own calculations based on the same principles the FIRS is basing its numbers,” another source said.

“All banks were going to be debited on December 31 by the CBN based on FIRS numbers but the coordinating minister of the economy said no,” the source further said.

“Most of the banks now live in fear of being hammered anytime from now by the CBN based on whatever FIRS wants to do.”

The banks were big beneficiaries of Tinubu’s foreign exchange reform in 2023, which led to an initial 40 percent devaluation of the currency.

Four of Nigeria’s five largest banks recorded huge foreign exchange revaluation gains in 2023, with First Bank of Nigeria Holdings the only exception.

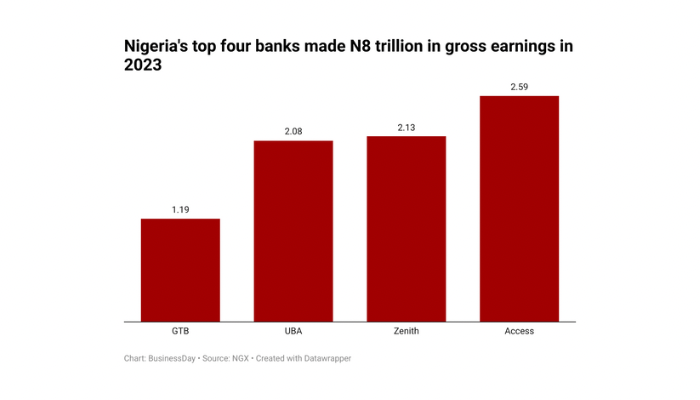

Access Bank, Zenith Bank, Guaranty Trust Bank and United Bank for Africa saw their combined gross earnings more than double to N8 trillion in 2023.

Profit before tax for the four banks jumped more than two-fold to N2.9 trillion, according to the results declared for the year.

Gains made from currency revaluation account for as much as a third or more of their entire profit for the year under consideration, according to the credit-rating agency Moody’s, which covers the top nine Nigerian lenders.

The windfall tax was always going to stir up controversy, according to Alicia Adefarasin, a senior legal counsel at a Lagos-based law firm.

“The levy may amount to double taxation, given that it is paid on the realised profits from all foreign exchange transactions of banks which are usually reported as part of the banks’ income for which relevant taxes are paid,” Adefarasin said.

“It is not clear whether the obligation to pay the levy will supersede the banks’ obligation to pay income tax under Section 9 of the Companies Income Tax Act on profit realised from foreign exchange transactions in each year,” Adefarasin noted.

The retroactive nature of the law was flagged by multiple experts even before the bill was passed.

Professional services firms, KPMG & PWC, both anticipated legal disputes from the proposed tax because it was retroactive and not in line with Nigeria’s tax system.

“Nigeria’s tax policy frowns at retroactive application of tax laws. It is, therefore, surprising, that the government has chosen to implement these windfall taxes retroactively,” Wale Ajayi, partner and head of Tax, Regulatory and People Services, said.

“Various reports have indicated that the government may realise about N6.2 trillion from the windfall tax. However, there is no publicly available policy-costing document on this. This lack of transparency has been the bane of policy formulation in the country. It is always important that the public be presented with a tax expenditure statement showing how much will be generated from the introduction of a new tax,” Ajayi added.

Government’s defence

The government defended the implementation of the windfall tax as both a strategic imperative and a standard practice among advanced economies, referencing examples from the European Union and the United Kingdom.

Some countries implemented windfall taxes on excess corporate profits of energy companies triggered by the COVID-19 pandemic. In the UK, the initial duration of the windfall tax was for 2 years, starting from January 2023 before it was extended.

Analysts suggest that the government rushed to secure the funds without conducting technical consultations with key stakeholders, a step that could have streamlined the process. Such consultations might have also bolstered public confidence in the fairness and justification of the tax.

“They should go and increase oil output. No country charges 75 percent corporate tax on anything,” a bank shareholder said.

“The idea of unearned income is communist,” the shareholder who did not want to be named said.

Pressed for cash

The Tinubu administration’s push for alternative revenue sources stems from the urgent need to stabilise Nigeria’s economy amid severe fiscal challenges.

Oil exports, traditionally the government’s primary revenue and foreign exchange earner, have faltered over the past three years due to persistent sabotage and large-scale theft along pipelines leading to export terminals. Since 2021, daily exports have averaged just 1.3 million barrels—well below the country’s OPEC quota of 1.78 million barrels and the 2 million barrels required to balance Nigeria’s budget for its population of over 220 million.

With oil revenues declining steadily since 2016, the previous administration under President Muhammadu Buhari resorted heavily to borrowing, resulting in a national debt of N134 trillion ($92 billion) and pushing the debt-to-GDP ratio to 50 percent, surpassing the official target of 40 percent.

Now facing a projected deficit of N13 trillion in the 2025 budget, the Tinubu administration is under pressure to bridge the funding gap. The proposed tax on banks is expected to generate up to N6.2 trillion, covering 47 percent of the deficit.

BusinessDay

Business

Fidelity Bank distributes food packs to FCT communities

As part of its Corporate Social Responsibility (CSR) initiatives, leading financial institution, Fidelity Bank Plc, recently donated food packs to Federal Capital Territory (FCT) Abuja residents.

Themed, the Fidelity Food Bank initiative, the outreach saw the bank’s officials distribute the food items to seven communities in the Mabushi district of the FCT.

Speaking at the distribution event, the Executive Director, North, Fidelity Bank Plc, Mr. Sufiyanu Garba, emphasized the bank’s commitment to community development and its alignment with Sustainable Development Goal 2, which seeks to eradicate hunger.

“This initiative stems from our deep-seated responsibility to support underserved communities and contribute to the fight against hunger in Nigeria,” said Mr. Garba. “At Fidelity Bank, we firmly believe that by addressing the root causes of poverty and hunger, we can make a meaningful impact on the lives of those in need. While we may not be able to solve all societal challenges, our contributions are making a difference, as evidenced by the positive feedback we continue to receive.”

He further reiterated the bank’s commitment to empowering communities, stating, “We recognize the importance of fostering growth and prosperity within the communities where we operate. By investing in their well-being, we contribute to the creation of a more sustainable and equitable society.”

The Fidelity Food Bank is one of the key pillars of the bank’s CSR strategy, focusing on health and social welfare. As a nationwide project, the initiative seeks to provide food relief to underserved communities across Nigeria, with a particular focus on supporting women and children.

Expressing appreciation for the initiative, the District Head of Mabushi Community, Mr. Hassan Danagna, commended Fidelity Bank for its generosity and its impact on the community.

“Fidelity Bank’s support to our community is unprecedented, and we are deeply grateful for this initiative, which provides relief to vulnerable households and less privileged families,” said Mr. Danagna. “Given the current economic challenges, this support is timely, particularly as we approach the holy month of Ramadan.”

One of the beneficiaries, Mr. Mukhtar Mohamed, also expressed his gratitude to the bank, acknowledging the significant impact of food distribution.

Fidelity Bank Plc is a full-fledged commercial bank with over 9.1 million customers who are serviced across its 251 business offices and various digital banking channels in Nigeria and the United Kingdom.

The Bank is the recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine. Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

Business

CBN pumps $197.7m to stabilise FX market

The Central Bank of Nigeria has injected $197.71m into the foreign exchange market on Friday, April 4, 2025, as part of its commitment to ensuring adequate liquidity and maintaining orderly market functioning.

This was disclosed in a statement on Saturday by the Director of the Financial Markets Department, Dr Omolara Omotunde-Duke, reiterating the bank’s stance on maintaining market integrity and operational transparency.

The statement read, “In line with its commitment to ensuring adequate liquidity and supporting orderly market functioning, the CBN facilitated market activity on Friday, April 4, 2025, with the provision of $197.71m through sales to authorised dealers. This measured step aligns with the bank’s broader objective of fostering a stable, transparent, and efficient foreign exchange market.”

The CBN said the intervention was in line with its broader objective of fostering a stable, transparent, and efficient foreign exchange market.

It added that it remained focused on sustaining liquidity levels to support smooth market operations amid ongoing global economic adjustments.

The apex bank said the decision to boost liquidity in the FX market came against the backdrop of significant shifts in the global macroeconomic landscape, which had affected many emerging markets and developing economies, including Nigeria.

It noted that the recent introduction of new import tariffs by the United States on goods from several economies had triggered adjustments across global markets.

It added that crude oil prices—a major revenue source for Nigeria—had dropped by over 12 per cent, settling at approximately $65.50 per barrel.

The CBN said the downturn posed challenges for oil-exporting countries, influencing exchange rate dynamics and market sentiment.

The CBN stressed that it would continue to monitor both global and domestic market conditions. It expressed confidence in the resilience of Nigeria’s foreign exchange framework, which it said was designed to adjust appropriately to changing economic fundamentals.

The bank also urged all authorised dealers to strictly adhere to the principles outlined in the Nigerian FX Market Code, promoting transparency and upholding the highest standards in their transactions with clients and market counterparties.

Meanwhile, Nigeria’s official exchange rate fell to N1,600/$1 at the end of trading on April 4, 2025, as the tariffs imposed during the Trump era continued to impact global markets.

Data from the CBN showed that the naira closed at N1,600/$1, marking a 1.9 per cent depreciation compared to the N1,569/$1 recorded the previous day.

The figure also marked the weakest level the naira had reached since December 4, 2024, when it closed at N1,608/$1. The exchange rate has now weakened by 3.9 per cent in the first four days of April, after closing March at N1,537/$1.

According to the CBN, the exchange rate closed at N1,600/$1 on Friday, marking a 1.9 per cent drop from the previous day.

The intra-day highs and lows were reported as N1,625 and N1,519 to the dollar, respectively. The intra-day high of N1,625 is also one of the highest levels recorded this year, indicating that traders priced the naira at significantly weaker levels.

Conversely, the intra-day low of N1,519/$1 suggests that some traders still priced the naira stronger, possibly betting on short-term interventions.

The NFEM rate, which represents the average exchange rate, closed at N1,567, the weakest the naira has traded this year and since December 4, 2024

Business

FCT Minister reveals how he would aggressively pursue revenue collection, tours infrastructure

Minister of the Federal Capital Territory (FCT), Barr. Ezenwo Nyesom Wike has advocated for increased revenue generation through taxes and ground rent payments in the FCT to fund impactful projects, stating the intent to aggressively pursue revenue collection within legal boundaries.

The FCT Minister made the disclosure in Abuja on Friday, March 28, 2025 during a rigorous tour of ongoing critical infrastructure projects slated for commissioning in May, coinciding with President Tinubu’s second anniversary in office.

The Minister’s itinerary included a comprehensive assessment of the 15-kilometer left-hand service carriageway of the Outer Southern Expressway (OSEX) from Ring Road 1 to Wasa Junction, Construction of the 16-kilometer one service carriageway of the Inner Northern Expressway (INEX) from Ring Road III to the Idu Industrial area connecting the Kubwa/Zuba expressway and the Abuja Division of the Court of Appeal office Complex in Dakibiu, Jabi District, and its access road from the Obafemi Awolowo Way which is is expected to be completed by September.

According to him “We are going to be very aggressive in our revenue drive to achieve more projects. When people complain that we are revoking C of Os, they need to understand that it’s from only payment of taxes that we will be able to carry out projects that will be meaningful, that will have positive impact on the lives of the people. Imagine when this road is completed, the impact it will have. It’s not something you can underestimate.

“So, we are appealing to our people. It’s not politics. It’s about being responsible and being responsive. Government has given you land for you to pay yearly annual ground rent for us to use for the development. So many people call me everyday, oh we see what you are doing. Can you extend it to our own area. Yes, we want to extend if the money is there. How the money will be there is only when you pay your taxes. So, we will be very, very aggressive within the limit of the law, in our revenue drive so that we can complete all the projects that we have started” he added.

On the progress of work across all project sites visited, the Minister expressed satisfaction with the pace and quality of work. He noted repeated visits to the INEX and commended the contractor’s progress, expressing belief in their assurance of meeting the May deadline.

According to the FCT Minister, “This is my 4th time, if I can remember very well of coming to this site. This project has been a headache for me. Like the contractor said, the job was awarded in 2014, taking us 11 years. That tells you, obviously the price can’tno longer be the same. So, when I came, there was price variation. I commend Salini Nigeria Limited on this particular project. I never believed that it would be actualized in May, but they are talking with authority and I believe them. The last time we came, we stopped at the back there but see where we are today, which means in the next few weeks, they would have completed the bridge. I’m happy with what we have seen,” stated the Minister.

The Minister emphasized the administration’s dedication to fulfilling its “Renewed Hope Agenda,” and stressed the importance of delivering dividends of democracy.

“How happy we would be in life that you made a promise and you fulfilled the promise. I have to thank Mr. President. This is really actually what we call Renewed Hope Agenda, that hope has come back to our people, and they are happy. Promises made, promises fulfilled and that’s all about dividends of democracy,” he said.

Barr. Wike reiterated the government’s commitment to building trust and confidence with contractors and the public, attributing current achievements to this approach. “You must create that level of confidence and that’s what we have done. Creating confidence in our people and the contractors. That is what is supposed to be and that’s why we are achieving what we are achieving today,” he concluded.

-

News1 week ago

News1 week agoAbia: LG Chairman, Iheke accused of using soldiers to detain IRS agent, claims Governor Otti’s support

-

News4 days ago

News4 days agoSenators Natasha, Abbo unite in peddling dangerous falsehood against me – Akpabio

-

News2 days ago

News2 days agoEchocho provides food items, cash to victims of windstorm in Kogi East

-

Politics4 days ago

Politics4 days agoAbure’s Supreme Court Sack: Peter Obi, Nenadi Usman, LP faction react

-

News1 week ago

News1 week agoKogi government bans rallies ahead of Natasha’s homecoming slated for Tuesday

-

News2 days ago

News2 days agoAt 76, Governor Ododo extols Ibrahim Idris’ statesmanship, service to Kogi

-

News1 week ago

News1 week agoIran may secure a deal before Trump’s deadline – or face Israeli strikes in Tehran – analysis

-

News1 week ago

Jungle Justice and the collapse of Law in Nigeria