Business

Banks, FIRS differ over windfall tax

Nigerian banks are in a tango with the Federal Inland Revenue Service (FIRS) over how much should be paid in a one-off foreign exchange windfall tax, two weeks after an initial deadline elapsed.

President Bola Tinubu last July sought lawmakers’ approval for a 50 percent tax on banks’ realised foreign exchange gains following the naira devaluation in 2023.

Both chambers of parliament passed the bill seeking the one-off tax, with the Senate raising the rate to 70 percent. The banks were to be debited by the CBN on December 31 2024.

The banks and the FIRS however can’t seem to agree on the tax due, two weeks after the payment deadline.

“The banks are having a quiet tango with the FIRS on the windfall tax issue at the moment,” a source familiar with the matter said.

“The banks are arguing with the FIRS on the calculated sums of tax due and are reverting with their own calculations based on the same principles the FIRS is basing its numbers,” another source said.

“All banks were going to be debited on December 31 by the CBN based on FIRS numbers but the coordinating minister of the economy said no,” the source further said.

“Most of the banks now live in fear of being hammered anytime from now by the CBN based on whatever FIRS wants to do.”

The banks were big beneficiaries of Tinubu’s foreign exchange reform in 2023, which led to an initial 40 percent devaluation of the currency.

Four of Nigeria’s five largest banks recorded huge foreign exchange revaluation gains in 2023, with First Bank of Nigeria Holdings the only exception.

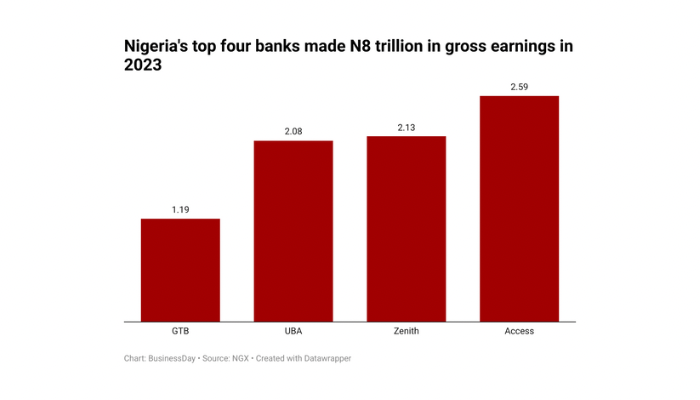

Access Bank, Zenith Bank, Guaranty Trust Bank and United Bank for Africa saw their combined gross earnings more than double to N8 trillion in 2023.

Profit before tax for the four banks jumped more than two-fold to N2.9 trillion, according to the results declared for the year.

Gains made from currency revaluation account for as much as a third or more of their entire profit for the year under consideration, according to the credit-rating agency Moody’s, which covers the top nine Nigerian lenders.

The windfall tax was always going to stir up controversy, according to Alicia Adefarasin, a senior legal counsel at a Lagos-based law firm.

“The levy may amount to double taxation, given that it is paid on the realised profits from all foreign exchange transactions of banks which are usually reported as part of the banks’ income for which relevant taxes are paid,” Adefarasin said.

“It is not clear whether the obligation to pay the levy will supersede the banks’ obligation to pay income tax under Section 9 of the Companies Income Tax Act on profit realised from foreign exchange transactions in each year,” Adefarasin noted.

The retroactive nature of the law was flagged by multiple experts even before the bill was passed.

Professional services firms, KPMG & PWC, both anticipated legal disputes from the proposed tax because it was retroactive and not in line with Nigeria’s tax system.

“Nigeria’s tax policy frowns at retroactive application of tax laws. It is, therefore, surprising, that the government has chosen to implement these windfall taxes retroactively,” Wale Ajayi, partner and head of Tax, Regulatory and People Services, said.

“Various reports have indicated that the government may realise about N6.2 trillion from the windfall tax. However, there is no publicly available policy-costing document on this. This lack of transparency has been the bane of policy formulation in the country. It is always important that the public be presented with a tax expenditure statement showing how much will be generated from the introduction of a new tax,” Ajayi added.

Government’s defence

The government defended the implementation of the windfall tax as both a strategic imperative and a standard practice among advanced economies, referencing examples from the European Union and the United Kingdom.

Some countries implemented windfall taxes on excess corporate profits of energy companies triggered by the COVID-19 pandemic. In the UK, the initial duration of the windfall tax was for 2 years, starting from January 2023 before it was extended.

Analysts suggest that the government rushed to secure the funds without conducting technical consultations with key stakeholders, a step that could have streamlined the process. Such consultations might have also bolstered public confidence in the fairness and justification of the tax.

“They should go and increase oil output. No country charges 75 percent corporate tax on anything,” a bank shareholder said.

“The idea of unearned income is communist,” the shareholder who did not want to be named said.

Pressed for cash

The Tinubu administration’s push for alternative revenue sources stems from the urgent need to stabilise Nigeria’s economy amid severe fiscal challenges.

Oil exports, traditionally the government’s primary revenue and foreign exchange earner, have faltered over the past three years due to persistent sabotage and large-scale theft along pipelines leading to export terminals. Since 2021, daily exports have averaged just 1.3 million barrels—well below the country’s OPEC quota of 1.78 million barrels and the 2 million barrels required to balance Nigeria’s budget for its population of over 220 million.

With oil revenues declining steadily since 2016, the previous administration under President Muhammadu Buhari resorted heavily to borrowing, resulting in a national debt of N134 trillion ($92 billion) and pushing the debt-to-GDP ratio to 50 percent, surpassing the official target of 40 percent.

Now facing a projected deficit of N13 trillion in the 2025 budget, the Tinubu administration is under pressure to bridge the funding gap. The proposed tax on banks is expected to generate up to N6.2 trillion, covering 47 percent of the deficit.

BusinessDay

Business

Flutterwave, FIRS collaborate to digitize tax collection in Nigeria

A leading African payments technology company, Flutterwave and the Federal Inland Revenue Service, FIRS have concluded collaborative discussion to digitize tax collection in Nigeria.

The collaboration is a step initiated by the FIRS to simplify tax compliance by offering multiple payment options, real-time reporting, and offline capabilities for those with limited internet access.

Meanwhile, Flutterwave CEO Olugbenga ‘GB’ Agboola stressed the firm’s commitment to ensure the using of technology to enhance efficiency, transparency, and economic growth by digitizing government tax collections.

Agboola said: “At Flutterwave, we are committed to leveraging technology to drive efficiency and economic growth. By making tax payments easier and more transparent, we are helping to digitize government collections and support national development which is in line with our mission,” he said

The partnership enables businesses and individuals to pay taxes, levies, and other statutory fees through Flutterwave’s secure and efficient digital infrastructure.

Driving transparency and accessibility

The integration introduces several enhancements, including Flutterwave’s Senior VP, Olufunmilayo Olaniyi, highlighted the importance of public sector collaboration in advancing digital payments, fostering trust, and driving innovation in Nigeria.

“Working with the public sector is pivotal to shaping the future of digital payments in Nigeria. This underscores our commitment to delivering solutions that serve Nigerians better, foster trust, and drive impactful innovation through strategic collaboration.”

What you should know

The Nigerian government has been implementing several measures to enhance tax compliance and efficiency, including digital reporting and e-invoicing systems. In line with these efforts, the Federal Inland Revenue Service (FIRS) is set to pilot its “e-Invoice” platform in July 2025 to streamline invoice management and improve real-time visibility into business transactions.

Amid these regulatory shifts, Flutterwave has been strengthening its presence in Nigeria’s financial ecosystem through strategic collaborations. Beyond facilitating tax payments, the company has expanded its role in digital innovation and security. It recently partnered with the National Information Technology Development Agency (NITDA) and Alami to drive digital transformation and empower SMEs in the tech and creative industries.

Also in 2024, Flutterwave deepened its commitment to financial security by partnering with the Economic and Financial Crimes Commission (EFCC) to establish a Cybercrime Research Center at the EFCC Academy.

Business

20 new millionaires emerge from Fidelity Bank GAIM 6 promo

Fidelity Bank Plc has announced 20 new millionaires at the 2nd and 3rd monthly draws of its Get Alert in Millions Season 6 (GAIM 6) promo held at the bank corporate head office in Lagos.

The 20 lucky winners, randomly selected through an electronic draw across Lagos, North, Abuja, South-West, South-South, and South-East zones, will be rewarded with the sum of one million naira each.

Speaking at the draws, the promo Chairperson and Executive Director for Lagos and South-West, Fidelity Bank Plc, Dr. Ken Opara represented by the Regional Bank Head, Ikoyi, Chetachi Okechukwu, noted that the GAIM 6 promo was designed to reward customers’ loyalty, encourage a savings culture, and promote financial inclusion across the country.

According to Opara, “Fidelity Bank is dedicated to the financial well-being of our customers and this commitment inspired the launch of the GAIM Promo, designed to cultivate a strong culture of savings.

“Through this promo, customers have the chance to win substantial cash prizes up to N10 million by saving and transacting with their Fidelity Bank Savings accounts. In addition to the monetary rewards, winners will receive complimentary financial advisory services to secure and grow their wealth for the future.”

The monthly draws was monitored by the representatives of relevant regulatory bodies, including the South-West Zonal Coordinator, Federal Competition and Consumer Protection Council (FCCPC), Mrs. Aboluwade Margaret; and the Principal Legal Officer, Lagos State Lotteries and Gaming Authority, Oyinkan Kusamotu.

Since the campaign launched in November 2024, Fidelity Bank has disbursed N19.75 million to 869 customers across different categories. The GAIM 6 campaign, which will run until August 2025, is set to reward lucky customers with a total of N159 million.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards. It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

Business

NYSC members win millions in Fidelity GAIM 6 Promo

Fidelity Bank Plc has reaffirmed its commitment to financial inclusion, youth empowerment, and promoting a healthy savings culture by rewarding nine National Youth Service Corps (NYSC) members with N500,000 business grants each.

The grants were awarded under the Get Alert in Millions Season Six (GAIM 6) promo, an initiative designed to reward loyal customers with cash prizes totalling N159 million.

The promo, which runs from November 2024 to August 2025, targets various categories of customers, including NYSC members, students, and general customers.

Mr. Osita Ede, Divisional Head of Product Development at Fidelity Bank Plc, stated that this season of the GAIM promo aims to enhance the opportunities for loyal customers to win.

“When we launched the GAIM 6 promotion in November 2024, we unequivocally stated that this campaign season is intended to promote inclusivity. Consequently, we have increased the total prize money to N159 million and added additional draws, beyond the weekly and monthly draws featured in previous seasons.

“Now, we have specific draws catering to various segments of our customer base including women, students, youth corps members, and traders. It is important to note that these categories of customers also stand the chance to win millions of naira in the monthly and grand draws which we will be hosting till 20 August 2025,” explained Ede.

Nine NYSC customers were selected through a random electronic draw in the first quarter of the GAIM 6 campaign across the country. They are: Oluwatosin Emmanuel Olowolayemo and Ekpeno Aniekan George, both Youth Corps members in Akwa Ibom State; Derryk Chidubem Okafor, Enugu State; Aliyu Idris Adamu, Kaduna State; Bomane-Aziba Koromo, FCT_Abuja; Asabe Grace Adamu, Bornu State; David Agbai Agwu, Osun State; Abdullahi Opeyemi Olajuwon, Lagos State and Eghosa George Orhue, Ekiti State.

Expressing his gratitude and excitement, one of the recipients of the entrepreneurship grant, Chidubem Okafor, appreciated Fidelity Bank for the grant, noting that the funds will enable him to achieve his entrepreneurial dreams.

His words, “At first, I thought it was a scam when they introduced the initiative at our orientation camp, but today, I am truly honored to receive this support from Fidelity Bank. This grant will go a long way in helping me achieve my entrepreneurial dreams, and I promise to make the most of it,”

Similarly, David Agwu, who also emerged a winner in the draw, expressed his surprise at the unexpected win, saying, “When I received the call, I thought it was a prank. I never applied for anything, so it was hard to believe. But when they sent me proof, I realized it was real. I am truly grateful for this opportunity. My plan is to invest the money in vocational training and digital skills development, particularly in fashion and painting in order to establish a sustainable business”.

Beyond the N500,000 entrepreneurship grant, the winners will also enjoy free business advisory and training sessions at the newly launched Fidelity SME Hub, located at 22, Lanre Awolokun Street, Gbagada Phase 2, Lagos.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 251 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards. It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

-

News3 days ago

News3 days agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

Security1 week ago

Security1 week agoNigerian Coast Guard: Citizens warned against extortion as passage of bill is being awaited

-

Politics1 week ago

Politics1 week agoRetired military officer, colonel Gbenga Adegbola, joins APC with 13,000 supporters

-

Politics1 week ago

Politics1 week agoCPDPL accuses Adeyanju of orchestrating smear campaign against FCT Minister Wike

-

News3 days ago

News3 days agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News3 days ago

News3 days agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

News2 days ago

News2 days agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Sports4 days ago

Sports4 days agoMerino gives Arsenal win over Chelsea