Business

Abuja Chinese Supermarket: House of Reps wades in to settle crisis

Following crisis rocking the Abuja Chinese Supermarket over the alleged discrimination of Nigerians from patronizing, Nigeria’s House of Representatives has waded in inorder to calm nerves.

The House Committee on China/Nigeria Parliamentary Friendship Group, which is undertaking to intervene in the matter, called on Nigerians to remain calm, urging them to allow full fledged investigations into the allegation.

Recalled that it was widely reported on Sunday via a viral video, that a certain Chinese supermarket located at Umaru Ya’Adua road, within the China General Chamber of Commerce in Abuja, was operating a policy which discriminated against Nigerians from patronising the super store.

Although the Owners of the supermarket denied the discrimination allegations, the Nigerian Government, through the Federal Competition and Consumer Protection Commission, on Monday, sealed the Abuja-based Chinese supermarket.

While reacting on Wednesday, the Nigerian Parliament, in a statement jointly signed by Hon. Jaafaru Yakubu,

Chairman, House Committee on China/Nigeria Parliamentary Friendship Group and the Spokesperson of the House, Hon. Akin Rotimi Jnr., while condemning any form of discriminations, also underscores the importance of the mutual relationship that exists between Nigeria and the Republic of China.

“As a committee tasked with fostering positive and mutually beneficial relations between Nigeria and China, we want to emphasize that such discriminatory practices, if substantiated by relevant authorities, go against the principles of friendship and cooperation that our two countries have worked hard to cultivate over the years.

“We believe in the importance of mutual respect and understanding between nations, and we condemn any form of discrimination or prejudice.

“Nigeria and China share a longstanding relationship characterized by mutual respect, cooperation, and friendship. Over the years, this relationship has been strengthened through various bilateral partnerships, economic collaborations, and cultural exchanges, benefiting both countries immensely.

“It is important to note that Nigeria and China have enjoyed fruitful collaborations in various sectors, including infrastructure development, trade, education, and healthcare. The ongoing partnership between our two countries has led to the completion of major projects, with many others ongoing.

“Furthermore, the Chinese Embassy in Nigeria continues to promote excellent China/Nigeria relations through socio-cultural exchanges and scholarships for many Nigerian students. These initiatives have played a significant role in enhancing mutual understanding and friendship between our two peoples”, the statement said.

The Nigeria’s Parliament therefore, expressed commitment, to conducting a thorough investigation into the matter, pledging to work diligently to gather all relevant information and ensure redress where necessary.

The House also urged “all parties involved to approach these issues with sensitivity and open-mindedness, and to work towards finding peaceful and constructive solutions”, saying, “it is crucial that we do not let isolated incidents tarnish the strong bonds of friendship that exist between Nigeria and China”.

To ensure that all Nigerians are treated justly, fairly and respectfully in any foreign establishment in Nigeria, the House of Representatives vowed to monitor the situation closely and work with relevant stakeholders.The Green Chamber also assured Nigerians of continuous commitment to “promoting cultural exchange, economic cooperation, and mutual understanding between our two nations”.

Business

Flutterwave, FIRS collaborate to digitize tax collection in Nigeria

A leading African payments technology company, Flutterwave and the Federal Inland Revenue Service, FIRS have concluded collaborative discussion to digitize tax collection in Nigeria.

The collaboration is a step initiated by the FIRS to simplify tax compliance by offering multiple payment options, real-time reporting, and offline capabilities for those with limited internet access.

Meanwhile, Flutterwave CEO Olugbenga ‘GB’ Agboola stressed the firm’s commitment to ensure the using of technology to enhance efficiency, transparency, and economic growth by digitizing government tax collections.

Agboola said: “At Flutterwave, we are committed to leveraging technology to drive efficiency and economic growth. By making tax payments easier and more transparent, we are helping to digitize government collections and support national development which is in line with our mission,” he said

The partnership enables businesses and individuals to pay taxes, levies, and other statutory fees through Flutterwave’s secure and efficient digital infrastructure.

Driving transparency and accessibility

The integration introduces several enhancements, including Flutterwave’s Senior VP, Olufunmilayo Olaniyi, highlighted the importance of public sector collaboration in advancing digital payments, fostering trust, and driving innovation in Nigeria.

“Working with the public sector is pivotal to shaping the future of digital payments in Nigeria. This underscores our commitment to delivering solutions that serve Nigerians better, foster trust, and drive impactful innovation through strategic collaboration.”

What you should know

The Nigerian government has been implementing several measures to enhance tax compliance and efficiency, including digital reporting and e-invoicing systems. In line with these efforts, the Federal Inland Revenue Service (FIRS) is set to pilot its “e-Invoice” platform in July 2025 to streamline invoice management and improve real-time visibility into business transactions.

Amid these regulatory shifts, Flutterwave has been strengthening its presence in Nigeria’s financial ecosystem through strategic collaborations. Beyond facilitating tax payments, the company has expanded its role in digital innovation and security. It recently partnered with the National Information Technology Development Agency (NITDA) and Alami to drive digital transformation and empower SMEs in the tech and creative industries.

Also in 2024, Flutterwave deepened its commitment to financial security by partnering with the Economic and Financial Crimes Commission (EFCC) to establish a Cybercrime Research Center at the EFCC Academy.

Business

20 new millionaires emerge from Fidelity Bank GAIM 6 promo

Fidelity Bank Plc has announced 20 new millionaires at the 2nd and 3rd monthly draws of its Get Alert in Millions Season 6 (GAIM 6) promo held at the bank corporate head office in Lagos.

The 20 lucky winners, randomly selected through an electronic draw across Lagos, North, Abuja, South-West, South-South, and South-East zones, will be rewarded with the sum of one million naira each.

Speaking at the draws, the promo Chairperson and Executive Director for Lagos and South-West, Fidelity Bank Plc, Dr. Ken Opara represented by the Regional Bank Head, Ikoyi, Chetachi Okechukwu, noted that the GAIM 6 promo was designed to reward customers’ loyalty, encourage a savings culture, and promote financial inclusion across the country.

According to Opara, “Fidelity Bank is dedicated to the financial well-being of our customers and this commitment inspired the launch of the GAIM Promo, designed to cultivate a strong culture of savings.

“Through this promo, customers have the chance to win substantial cash prizes up to N10 million by saving and transacting with their Fidelity Bank Savings accounts. In addition to the monetary rewards, winners will receive complimentary financial advisory services to secure and grow their wealth for the future.”

The monthly draws was monitored by the representatives of relevant regulatory bodies, including the South-West Zonal Coordinator, Federal Competition and Consumer Protection Council (FCCPC), Mrs. Aboluwade Margaret; and the Principal Legal Officer, Lagos State Lotteries and Gaming Authority, Oyinkan Kusamotu.

Since the campaign launched in November 2024, Fidelity Bank has disbursed N19.75 million to 869 customers across different categories. The GAIM 6 campaign, which will run until August 2025, is set to reward lucky customers with a total of N159 million.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards. It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

Business

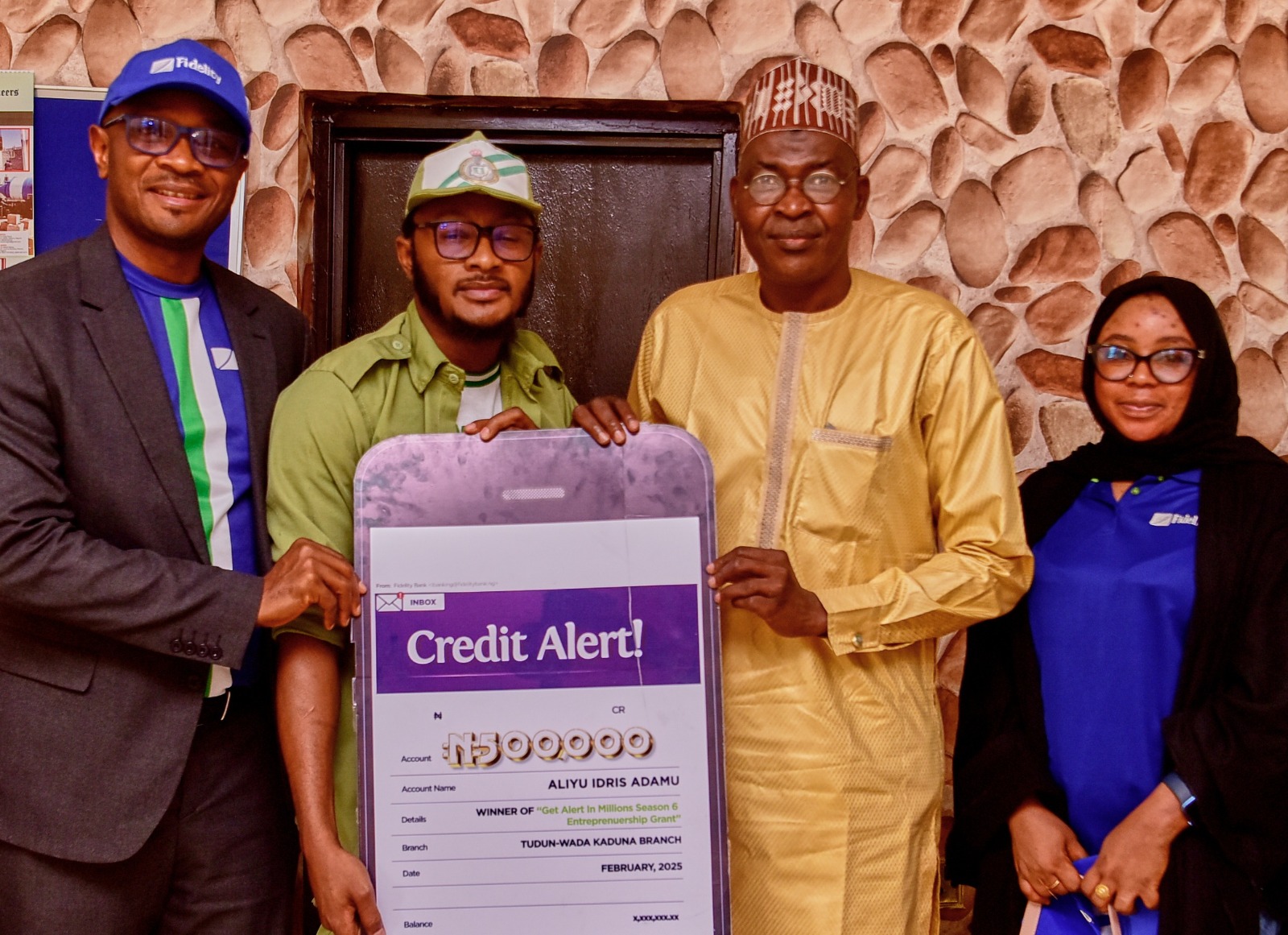

NYSC members win millions in Fidelity GAIM 6 Promo

Fidelity Bank Plc has reaffirmed its commitment to financial inclusion, youth empowerment, and promoting a healthy savings culture by rewarding nine National Youth Service Corps (NYSC) members with N500,000 business grants each.

The grants were awarded under the Get Alert in Millions Season Six (GAIM 6) promo, an initiative designed to reward loyal customers with cash prizes totalling N159 million.

The promo, which runs from November 2024 to August 2025, targets various categories of customers, including NYSC members, students, and general customers.

Mr. Osita Ede, Divisional Head of Product Development at Fidelity Bank Plc, stated that this season of the GAIM promo aims to enhance the opportunities for loyal customers to win.

“When we launched the GAIM 6 promotion in November 2024, we unequivocally stated that this campaign season is intended to promote inclusivity. Consequently, we have increased the total prize money to N159 million and added additional draws, beyond the weekly and monthly draws featured in previous seasons.

“Now, we have specific draws catering to various segments of our customer base including women, students, youth corps members, and traders. It is important to note that these categories of customers also stand the chance to win millions of naira in the monthly and grand draws which we will be hosting till 20 August 2025,” explained Ede.

Nine NYSC customers were selected through a random electronic draw in the first quarter of the GAIM 6 campaign across the country. They are: Oluwatosin Emmanuel Olowolayemo and Ekpeno Aniekan George, both Youth Corps members in Akwa Ibom State; Derryk Chidubem Okafor, Enugu State; Aliyu Idris Adamu, Kaduna State; Bomane-Aziba Koromo, FCT_Abuja; Asabe Grace Adamu, Bornu State; David Agbai Agwu, Osun State; Abdullahi Opeyemi Olajuwon, Lagos State and Eghosa George Orhue, Ekiti State.

Expressing his gratitude and excitement, one of the recipients of the entrepreneurship grant, Chidubem Okafor, appreciated Fidelity Bank for the grant, noting that the funds will enable him to achieve his entrepreneurial dreams.

His words, “At first, I thought it was a scam when they introduced the initiative at our orientation camp, but today, I am truly honored to receive this support from Fidelity Bank. This grant will go a long way in helping me achieve my entrepreneurial dreams, and I promise to make the most of it,”

Similarly, David Agwu, who also emerged a winner in the draw, expressed his surprise at the unexpected win, saying, “When I received the call, I thought it was a prank. I never applied for anything, so it was hard to believe. But when they sent me proof, I realized it was real. I am truly grateful for this opportunity. My plan is to invest the money in vocational training and digital skills development, particularly in fashion and painting in order to establish a sustainable business”.

Beyond the N500,000 entrepreneurship grant, the winners will also enjoy free business advisory and training sessions at the newly launched Fidelity SME Hub, located at 22, Lanre Awolokun Street, Gbagada Phase 2, Lagos.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 251 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards. It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

-

News6 days ago

News6 days agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

News6 days ago

News6 days agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

News6 days ago

News6 days agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News5 days ago

News5 days agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Sports1 week ago

Sports1 week agoMerino gives Arsenal win over Chelsea

-

Interview7 days ago

Interview7 days agoSenators Natasha-Akpabio saga should have been resolved privately – Rev. Mrs Emeribe

-

Politics3 days ago

Politics3 days agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

News1 week ago

News1 week agoAs Committee Chairman, I did not authorise Natasha to petition IPU over her suspension from Senate – Jimoh Ibrahim