News

NDDC: N139.317 billion probe: MD shuns Public Account Committee, as several companies risk sanction

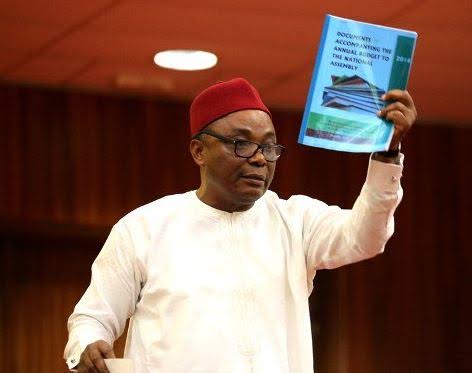

Managing Director of Niger Delta Development Commission (NDDC), Prof. Kemebradikumo Pondei on Wednesday shunned the House of Representatives’ investigative hearing into the N139.317 billion misappropriated between 2013 and 2018.

Details of the queries were contained in the 96 page special periodic checks on the activities and programmes on NDDC for the period 1st January 2013 to 30th June, 2018.

Chairman, House Committee on Public Accounts, Hon. Wole Oke who announced the absence of the NDDC at the scheduled hearing, resolved to adjourn sitting to Thursday.

According to the report, the 626 contractors engaged by the Commission for the execution of contracts worth N309,172,941,001.86, received total sum of as mobilization fees worth N61,468,160,743.03 in Abia (32 projects), Akwa Ibom (64 projects), Bayelsa (80 projects), Cross River (29 projects), Delta (99 projects), Edo (51 projects), Imo (33 projects), Ondo (50 projects), Rivers (106 projects) and 82 other regional projects.

Some of the queries include: “waste of public fund due to collection of mobilization fees without reporting to project sites by Contractors – N61,468,160,743.03”; “irregularities in the contract for completion of NDDC headquarters building, Port Harcourt – N16.223 billion”; “Irregularities in the execution of contract awarded to Messrs Setraco Nigeria Ltd for the construction of Gbaregolor-Gbekbor-Ogulagha road phase 1 – N16,157,782,480.20; unauthorized revision and variation of contract sum without due process and payment above completion level on the contract for construction of Kaa-Ataba road and bridges – N10,930,414,996.45.

Others include: irregularities in the supply of 3,852 doses of hepatitis B vaccines and 1,570 doses of typhoid vaccines (28) and supply of Lassa Fever kits in 23 Lots to NDDC warehouse in Port Harcourt and distribution, transportation and storage – N2.527 billion; Excessive payment of imprest to the NDDC Executive Board members – N1.358 billion; Engagement of external solicitors in contrast to extant provisions – N1.583 billion; Award of contract of emergency contracts without stating the contract prices – N3.002 billion; Payments of rent to a legal advocate on a property that belong to River State Government but released to Federal Government to house NDDC headquarters – N1.225 billion; appointments of special and personal assistants for members of Governing Board and payment of their salaries and allowances at government expenses – N1.006 billion, among others.

In its recommendations, the Auditor General of the Federation, Mr. Anthony Ayine stated that the sum of N61,468,160,743.03 should be recovered from the 626 contractors in line with Financial Regulation No. 3104 which provides that under no circumstances should payments be made for job not executed and any amount involved shall be recovered from the said contractor and shall be blacklisted and referred to the Economic and Financial Crimes Commission for prosecution.

On the N100 billion spent on emergency contracts in 2018, the AGF also observed that the Commission “concentrated most of its efforts on the award of emergency contract in the period under review while most of the planned/budget and ongoing projects are not given needed priority.”

Breakdown of the emergency contracts awarded showed that N58.137 billion was spent in 2017, N20.867 billion spent in 2016 while N1.689 billion spent in 2015, respectively, adding that “most of the emergency contracts are executed at an average cost of N500 million and above. None of these emergency contracts can be termed as emergency indeed because there was no evidence of the communities in which they were sited are calling for the projects.”

On the unauthorized N10.930 billion contract variation, the AGF recommended that: “The Managing Director should be sanctioned for non-adherence to laid down due process on the variation and revision of the contract price from N3,062,385,032.98 to N10,930,414,996.45 which was 357% increase from the initial contract sum.

Recall that the AGF had in its 60-page audit query report for 2008-2012 earlier submitted to the House Committee on Public Accounts queried the Commission over N70 billion and secrecy shrouded in the multi-million dollar revenues paid by oil firms since inception.

The query was part of numerous audit query issued by the oAuGF including the sum of N31.453 billion ‘some payment of 2012 not verified due to non-presentation of payment vouchers and bank mandates; non-remittance of N29 billion before 2008; N5.69 billion payment vouchers from Access Bank Account Number 0015078045 not presented for audit, and payments by unrecognized oil companies into the Commission’s final accounts to the tune of N3,280,818,832, among others.

Other audit queries include: unexplainable transfer of N3.118 billion to an undisclosed Union Bank account, dormant fixed deposit account and current account in enterprise Bank with the sum of N68.432 million, N1.4 billion in an abandoned credit and entrepreneurship development scheme fund distributed among participating banks (non-agricultural component); unaccounted fixed deposit account; N92 million contract awarded for services not required, N309 million withheld by banks that failed to implement NDDC credit and entrepreneurship development scheme and N1.546 billion payment for the broadcast of NDDC Today Programme.

On the N3.280 billion audit query paid by ‘Unrecognised oil companies into its final accounts, the Commission explained that: “All contributions received from the oil companies were paid directly into our Union Bank account in Port Harcourt and the offshore account in United Kingdom and in recent years, very few were remitted into the First Bank Port Harcourt Account and the offshore account in United Kingdom. These transactions were done without any human interference from NDDC, hence the possibility of manipulation or fraud is very remote.”

In its response, as contained in the 60-page response document to the oAuGF’s audit queries seen by Nigerian Tribune, the Commission to the N936,770,112.83 over-payment on VAT before 2008, argued that VAT on all payments due to contractors and consultants on projects, supplies and others service are calculated and paid to the relevant tax authorities at the end of each month. It is a deduction from contractor’s bill unless specified in the bill of quantities or supplier’s invoice.