Business

FAAC: FG, States, LGCs share N1.142 trillion revenue for February

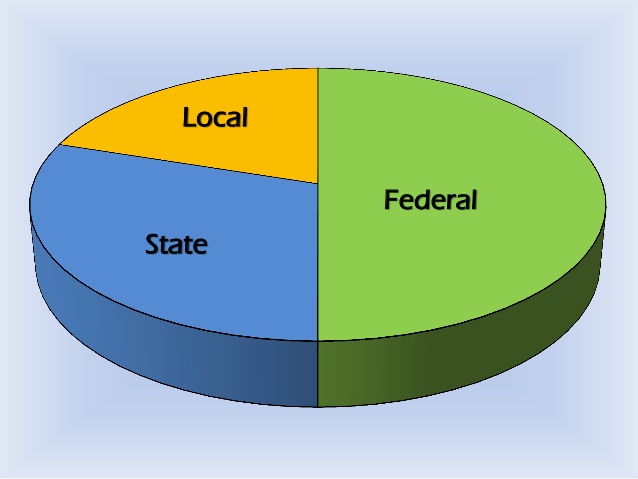

The three tiers of government have shared the sum of N1.152 trillion statutory for the month of February, 2024.

The tiers of government are, the Federal, States and Local Government Councils.

The revenue was shared on Thursday by the Federation Account Allocation Committee (FAAC) from a gross total of N2.326 trillion at a meeting presided by the Minister of Finance and Coordinating Minister for the Economy, Wale Edun.

The committee under the chairmanship the Minister of Finance and Coordinating Minister of the Economy, Wale Edun made the disbursement at its February 2024 meeting.

A statement signed by the Director of Press and Public Relations in the ministry, Mohammed Manga indicated that the Federal Government received N352.409 Billion, the States received N366.950b the Local Government Councils got N267.153b, while the Oil Producing States received N166.244b as Derivation, (13% of Mineral Revenue).

He pointed out that the stated amount is inclusive of Gross Statutory Revenue, Value Added Tax (VAT), Electronic Money Transfer Levy (EMTL), and Exchange Difference (ED).

“The sum of N66.456 Billion was given for the cost of collection, N856.937 Billion allocated for Transfers Intervention and Refunds, while the sum of N250.000 Million was saved.

The Communique issued by the Committee at the end of the meeting indicated that the Gross Revenue available from the Value Added Tax (VAT) for February 2024, was N460.487 Billion, which was an increase from the N420.733 Billion distributed in the preceding month, resulting in an increase of N39.755 Billion.

“From that amount, the sum of N18.420 Billion was allocated for the cost of collection and the sum of N13.262 Billion given for Transfers, Intervention and Refunds.

“The remaining sum of N428.806 Billion was distributed to the three tiers of government, of which the Federal Government got N64.321 Billion, the States received N214.403 Billion, Local Government Councils got N150.082 Billion.

According to the statement, the Gross Statutory Revenue of N1,192.428b received in the month was higher than the sum of N1,151.808b received in the previous month of January 2024, N40.620 billion.

Explaining further he said from that amount, the sum of N47.404b was allocated for the cost of collection, a total sum of N843.675b for Transfers, Intervention and Refunds and a total of N200.000b saved.

“The remaining balance of N101.349b was distributed as follows to the three tiers of government: Federal Government got the sum of N7.351b, States received N3.729b, while the sum of N87.394 Billion was allocated to LGCs as Derivation (13% Mineral Revenue).

“Also, the sum of N15.789b from Electronic Money Transfer Levy (EMTL) was distributed to the three (3) tiers of government as follows: the Federal Government received N2.274b, States got N7.578b, LGCs received N5.305b, while N0.632b was allocated for Cost of Collection.

The Communique also disclosed N657.444b from Exchange Difference was shared with the Federal Government receiving N278.463b, States got N141.240b, while the sum of N108.891b was allocated to LGCs, N78.850b was given for Derivation (13% of Mineral Revenue) and the sum total of N50.000b was saved.

“Petroleum Profit Tax (PPT), Value Added Tax (VAT), Import Duty, Excise Duty and Customs External Tarrif levies (CET) increased significantly, while Oil and Gas Royalties increased marginally.

“Electronic Money Transfer Levy (EMTL) and Companies Income Tax (CIT) recorded considerable decreases.”

According to the Communique, the total revenue distributable for the current month of February 2024, was drawn from Statutory Revenue of N101.349b, Value Added Tax (VAT) of N428.806b, N15.157b from Electronic Money Transfer Levy (EMTL), and N607.444b from Exchange Difference, bringing the total distributable amount for the month to N1.152 trillion.

The balance in the Excess Crude Account (ECA) as at March 2024 stands at $473,754.57.

In his opening remarks at the meeting, Wale Edun said in the fiscal side, there is a move to raise the forex trading.

He pointed out that President Bola Ahmed Tinubu led administration in its avowed determination to achieve and ensure rapid and sustained economic growth in the country has commenced the intervention programme which is a direct payment to about 15 -17 million poorest and vulnerable Nigerians, after carefully making sure that the system is fraud free, using the Biometric Registration and Digital Registering.

He explained that there is an increase in revenue as he commended the revenue generating agencies for their hard work

Business

APC support group trains over 50 women entrepreneurs

The National Progressives Hub (NPH), a support group for the ruling All Progressives Congress (APC), has trained over 50 women entrepreneurs running Micro, Small, and Medium-sized Enterprises (MSMEs) to enhance their financial inclusion and business growth.

The women, selected from NPH and other support groups, participated in the training held in the Asokoro area of Abuja on Tuesday.

The National Coordinator of NPH, Hon. Bukie Okangbe, stated that the event was part of activities to celebrate the 2025 International Women’s Day.

“It is a business clinic. We brought in experts and trainers to conduct the training, including facilitators from the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN). This initiative is designed for APC women and every party member to celebrate Women’s Month. We also want women to be aware of government policies,” she emphasized.

Kingsley Ndimele, a Business Consultant and Financial Economist, noted that while businesses in Nigeria are performing fairly well, there is significant room for improvement, particularly in addressing policy gaps, access to information, and knowledge acquisition.

“I am here to train small business owners on how to grow and scale their enterprises. Although businesses in Nigeria are making progress, challenges persist due to policies, government intervention, and the business owners themselves.

“The average Nigerian entrepreneur has the potential to perform better if key issues such as policy framework, infrastructure, and knowledge gaps are addressed. Growing a business requires a certain level of knowledge capacity. If you lack that capacity, no matter how much funding you receive, you may not succeed,” he explained.

He also highlighted the issue of funding as a shared responsibility between the government and entrepreneurs.

“The Nigerian government has been supporting MSMEs through funding and capacity-building initiatives. However, the question remains: Are Nigerian entrepreneurs ready to maximize these opportunities? Do they meet the eligibility criteria?” he asked.

A representative of the Director-General of SMEDAN, Peter Adeshina, stated that the training aimed to educate small business owners on structuring their enterprises to access available opportunities.

“SMEs are critical to economic prosperity and growth, and our role is to support them. A business clinic is like a medical clinic—when you visit, you receive treatment, feel revitalized, and can then expand and succeed.

“Our objective here is to provide guidance on structuring businesses for growth. Currently, finance in Nigeria is costly due to high interest rates. However, there are measures SMEs can take to secure affordable loans and grants.

“For instance, formalizing a business—something as simple as registering it—can determine whether one can access opportunities or not. Business owners should also open dedicated business accounts to establish a credit history, making them more trustworthy to investors,” he advised.

He also expressed optimism that the training would enhance SMEs’ operations.

“At the end of this event, we expect SMEs to function more effectively. With the information provided, they will be able to restructure their businesses, abandon ineffective practices, and embrace growth.

“Accessing SMEDAN opportunities requires registration with the agency. Fortunately, SMEDAN has state offices nationwide where business owners can seek support. We anticipate that, after this exercise, more entrepreneurs will be better positioned for success,” he added.

Also, the Senior Special Adviser to the Minister of State for Industry, Trade, and Investment, Adeshile Deji, encouraged the trainees to engage in continuous capacity-building programs from relevant agencies to enhance their skills and business operations.

Business

Kano residents benefit from Fidelity Food Bank initiative

Over 1,500 residents have benefited from a Fidelity Food Bank outreach in Kabuga community, Dala Local Government Area of Kano state.

The Corporate Social Responsibility (CSR) initiative, executed in partnership with Misnoory Foundation, saw staff of the bank distribute essential food items to support people during the holy month of Ramadan.

Commenting on the distribution event, Divisional Head, Brands and Communications, Fidelity Bank Plc, Dr Meksley Nwagboh, emphasized the bank’s dedication to supporting its host communities through impactful projects.

“Social responsibility is at the heart of who we are as a bank. Our Fidelity Food Bank initiative is one of the way we drive social welfare in our host communities. The initiative was launched to support the vulnerable and alleviate the impact of hunger in the society as part of our contribution to Sustainable Development Goal 2, which aims to achieve zero hunger.

“Consequently, we have distributed more than 150,000 food packs at outreach events like this across the country since April 2023 when we launched the initiative. Our outreach in Kabuga is designed to support women, widows, children and the community with food items for the Ramadan season.”

On her part, the Founder, Misnoory Foundation, Maryam Isa Inuwa stated that, “The commitment of the foundation towards poverty alleviation and various humanitarian support to society’s most vulnerable members perfectly aligns with the Fidelity Bank initiative.

“Fidelity Bank is one of the major sponsors of our humanitarian outreaches to the needy in the society. The foundation is delighted to count on the bank as a long-standing partner.

“We seek to touch the lives of many people in need through our various humanitarian efforts across different communities and today, it is the turn of Kabuga community to benefit from the Fidelity Food Bank program”.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards.

It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

Business

Fidelity Bank equips entrepreneurs for global trade success with EMP 18

Tier-one lender, Fidelity Bank Plc, has once again highlighted the importance of promoting non-oil exports as it recently hosted the 18th edition of its dedicated capacity development training tagged Export Management Programme (EMP 18). The programme, which was held recently in Lagos provided a platform for entrepreneurs interested in exploring global trade opportunities to scale and acquire relevant expertise.

Hosted in partnership with the Lagos Business School (LBS), the 5-day intensive program focused on equipping entrepreneurs with the skills and knowledge needed to explore international market opportunities and strengthen their capacity to thrive in the export sector.

“At Fidelity Bank, our strategy to enhance non-oil exports is guided by the significant opportunities it offers to our customers and the national economy. This is why we offer a comprehensive suite of financial, advisory, and market-access solutions for businesses aiming to engage in international trade.

“Our market-access initiative, EMP, launched in 2016, has trained over 1,600 entrepreneurs. Today, we completed the 18th cohort with high-caliber participants and a 150% oversubscription. This indicates a promising future for Nigeria’s non-oil exports,” explained Isaiah Ndukwe, Divisional Head of Export and Agriculture at Fidelity Bank Plc.

Facilitated by key industry experts in the exports space, EMP 18 took participants through several sessions focused on critical areas in global trade such as Export Finance Instruments, Export Documentation, Accessibility of Export Markets, amongst others.

A key feature of the training was a facility tour of one of Nigeria’s busiest Export Processing Terminals (EPT) located in Ikorodu, Lagos state. The full-day visit, which was anchored by officials of the Nigerian Customs Service (NCS), gave participants a first-hand feel of the necessary procedure and requirements for securing regulatory approval for exporting from Nigeria.

One of the program participants, Patrick Ulayi Awu-Patricks, Managing Director/Chief Executive Officer, Alliance & Frontier Limited, commended Fidelity Bank for its leadership in deploying capacity-building initiatives in the non-oil exports sector. In a discussion with journalists, he stated that EMP 18 provided invaluable exposure to the opportunities in the export business noting that, “There are lots of non-oil exports opportunities and entrepreneurs must be able to identify and capitalize on these to be able to play effectively in the international trade space. This course has given me insights into the power of data which is essential for strategic decision-making.”

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 8.5 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the Export Finance Bank of the Year at the 2023 BusinessDay Awards; the Banks and Other Financial Institutions (BAFI) Awards; Best Payment Solution Provider Nigeria 2023; and Best SME Bank Nigeria 2022 by the Global Banking and Finance Awards. It was also recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence 2023 and the Best Domestic Private Bank in Nigeria by the Euromoney Global Private Banking Awards 2023.

-

News1 week ago

News1 week agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Politics1 week ago

Politics1 week agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

Opinion1 week ago

Opinion1 week agoSule Lamido, PDP, and the politics of defection.

-

Foreign6 days ago

Foreign6 days agoHouthis declare Ben-Gurion Airport ‘no longer safe’ after renewed Gaza fighting

-

Politics1 week ago

Politics1 week agoYahaya Bello deceptively arranging recall of Senator Natasha, desperate to replace her – Constituents

-

Politics1 week ago

Politics1 week agoAtiku, El-rufai, Obi condemn Tinubu’s suspension of Rivers Governor, demand reversal

-

News7 days ago

News7 days agoWhy Christ Embassy’s Pastor Chris holds Abuja mega crusade – Fisho

-

News6 days ago

News6 days agoUmeh denies receiving $10,000 with other 42 Senators to support state of emergency in Rivers