Economy

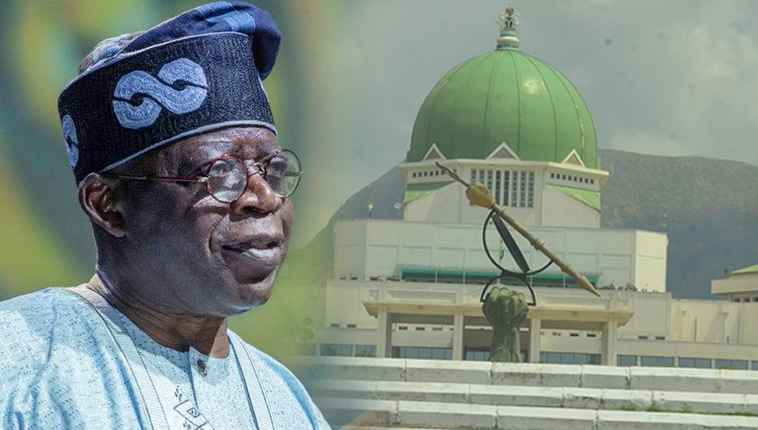

End “dollarisation of the country”, to tackle hardship Delta Senator to President Tinubu

The Senator representing Delta North Senatorial District in the 10th Senate, Ned Nwoko has identified dollarisation of the country as cause of economic woes.

The lawmaker who spoke with journalists at the National Assembly in Abuja advised President Bola Tinubu to end the use of dollars for local transactions as means of strengthening the economy.

He identified other three areas he expected President Tinubu to have a strong will to correct as a matter of urgency to end the hardship Nigerians are currently facing.

He said, first and foremost, government must take control over interest rates and come out emphatically to say that interest rate will no longer be as usual, that it’s going to be three or four percent, starting from 1st March for example, and everybody will adjust, as well as the banks.

So with this, if the banks use to make a profit of five hundred million a day they can now be making one hundred million a day and it’s still good.

and it so that youth entrepreneur can have access to loans with minimum interest rates of not more than five percent.

He also said that exchange rate has become a hydra headed issue in the country because of our over relying on foreign currencies.

This he said has resulted to a situation where even peti traders in remote villages selling garri, palm oil and so on are talking about exchange rates.

Meanwhile, he said, exchange rates ordinarily should be something that concern foreign transaction, but because of our over relying on foreign currencies our people are fully aware that naira has no value again.

So what to do to tackle the issue of over dependency in dollars should be our main point to addressing the current mess in the country.

According to him, “If we are sincere to ourselves we know that we have real economic problems resulting in unbearable hardship for the people.

There is no need pretending as if some money or fiscal policy can turn things around. In Nigeria we know that nothing goes up that will come down again especially in connection with interest and exchange rates and these are the bedrock of any economy.

“We must understand that we don’t have credit economy. A Credit economy is an economy where people are able to borrow with some minimum conditions. For you to borrow, there must be an interest rate that is manageable.

In most countries they have interest rates of between three to six percent but in Nigeria it’s between twelve to thirty percent. And not only that, they also ask of collateral; properties, how can one acquire all these in the first place to be able to access a loan

“So, there are problems that can be handle in a simple manner and for me the first thing is for President Tinubu to crash interest rates and which does not take the government any policy to do.

All over the world no Government leave interest rate to be determine by the banks because they will only think about their profit and not the customers because customers are not their concern..”

Sen. Nwoko went down memory lane when he said, “After our independence in 1960, our colonial masters tied us down economically to their own manipulation.

They compel our people to open accounts in their various countries. and accounts have come to be known as foreign reserve, in order words our savings are not in Africa or Nigeria in particular, neither are there manage in Nigeria, rather there are been manage by the western world, and our governments are not seeing anything wrong with that, why?

Our people are yet to see that at 63 after independence we should be seeking for economic independent and not this type of baby economy where our savings or reserves are not use to develop our country, rather they are being used to develop western world.

He noted that the western world made it so hard that we must export our raw materials to them so that they can finish it and sell it back to us at hundred percent cost. Suffice it to say that we add no value to our raw materials.

The lawmaker said, “I feel if we must address some issues fundamentally i told the Senate committee on finance, banking, agriculture and national planning had a public hearing during their public hearing that, we must encourage President Tinubu to be decisive with his decisions- we must close these foreign reserve accounts.

We have about 46 billion dollars on the accounts and that money is not been used by Nigerians”

He said the so called traders are less than half percent of the population of Nigeria, so because of less than a half population of over two hundred million Nigerians you are keeping such huge amount of money in foreign accounts.

“If we close the foreign accounts and bring the money down to Nigeria, we can now use the money to give out loans to youth entrepreneur, they are many youths who are jogging to survive and we know no loan, no grant absolutely nothing for them.

“If we have that can of money in the country it will change a lot of things because youth will collect loans and some condition attack to it and probably pay between three and seven percent of it. The money could be given to five banks to manage.

He stated further that, another very important issue that needs urgent attention for our currency to have value is that, all foreign workers in Nigeria should start receiving their salary in naira.

According to him, “All foreign workers in Nigeria are paid in dollars; whether they work in Oil companies, construction companies, hotels, barbing salon or even cleaners.

That in itself is discriminating and has to stop”

“When you travel to America or UK and you are working there, they pay everybody in dollars or pounce, so what happens that we can’t pay those working in our country in naira.

The unfortunate thing is that the salary those foreign workers received each can equal almost a hundred Nigerians working in same establishment with them.

Sen. Ned emphatically advocated that the government of Tinubu should stop the use of dollars in Nigeria, saying that there is no country in the world that dua currency is allow except Nigeria

“Once dollar is prohibited in the country, for instance, domiciliary accounts closed down, all businesses in Nigeria are transacted in naira including the sale of crude oil and gas, naira would definitely be valued.

“If it becomes mandatory for everything to be transacted in naira, you know what’s going to happen, there will be demand in naira as such our currency will bounce back to reckoning. And

foreigners coming into the country will look for how to get naira and not dollars because they are coming here to use naira.

“It will take a strong will by President Tinubu to make the announcement, though some persons may be saying British, America will fight or that, but the onus now will be on the president to chose between America, British and Nigerians,”he said.

Meanwhile, Sen. Ned urged president Tinubu to forget about IMF, World Bank and look inwardly and solve the problem we are into locally.