Economy

BREAKING: FAAC shares ₦1.1trillion revenue to three tiers of government for December 2023

Nigeria’s three tiers of government got a whopping revenue if N1.127 revenue distributed among them by the Federation Account Allocation Committee, FAAC, for the month of December 2023.

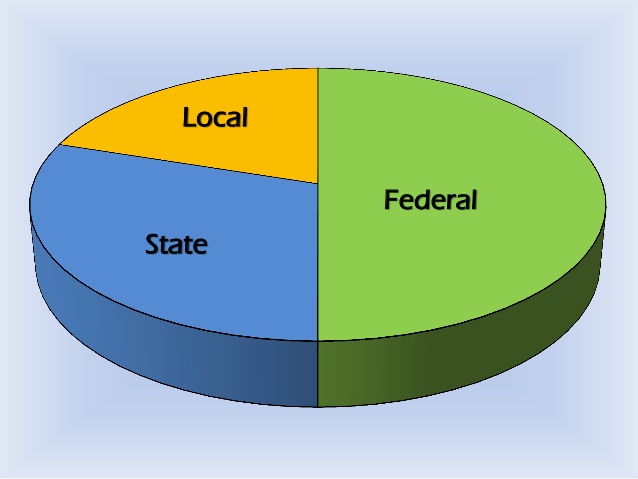

The three arms of government are the Federal, State and Local Government Councils.

The distribution was contained in a communique issued at the end of the committee’s January meeting, chaired by the Accountant General of the Federation, Dr Oluwatoyin Madein.

In the detail, the communique showed that the ₦1.127 trillion total distributable revenue comprised distributable statutory revenue of ₦363.188 billion, distributable Value Added Tax (VAT) revenue of ₦458.622 billion, and Electronic Money Transfer Levy (EMTL) revenue of ₦17.855 billion.

It also comprised Exchange Difference revenue of ₦287.743 billion.

“Total revenue of ₦1,674 billion was available in the month of December 2023. Total deduction for cost of collection was ₦62.254 billion; total transfers, interventions and refunds was ₦484.568 billion.

“Gross statutory revenue of ₦875.382 billion was received. This was lower than the ₦882.56 billion received in the month of November 2023 by ₦7.178 billion.

“The gross revenue available from VAT was ₦492.506 billion. This was higher than the ₦360.455 billion available in the month of November 2023 by ₦132.051 billion,” it said.

The communique also said that from the ₦1.127 trillion total distributable revenue, the federal government received ₦383.872 billion, the state governments received ₦396.693 billion and the LGCs received ₦288.928 billion.

“A total sum of ₦57.915 billion (13 per cent of mineral revenue) was shared to the benefiting states as derivation revenue.

“From the ₦363.188 billion distributable statutory revenue, the federal government received ₦173.729 billion, the state governments received ₦88.118 billion and the LGCs received ₦67.935 billion.

“The sum of ₦33.406 billion (13 per cent of mineral revenue) was shared to the benefiting states as derivation revenue,” it said.

“The federal government received ₦68.793 billion, the state governments received ₦229.311 billion and the LGCs received ₦160.518 billion from the ₦458.622 billion distributable VAT revenue.

“From the ₦17.855 billion EMTL, the federal government received ₦2.678 billion, the state governments received ₦8.928 billion and the LGCs received ₦6.249 billion,” it said.

It said that in the month of December 2023, Companies Income Tax (CIT), excise duty, Petroleum Profit Tax (PPT), VAT and EMTL increased significantly, while oil and gas royalties decreased substantially.

“Import duty and CET levies decreased marginally. The balance in the ECA was $473.754 million.