Features

Industry Consumer Advisory Forum: NCC’s initiative at combating e-fraud on telecom platform

The Nigerian Communications Commission, NCC, continue to roll out measures targeted at protecting the interest of consumers and building consumers’ confidence in using telecommunication products and services.

This is driven by not just the mandate of the nation’s telecom number one regulatory agency, but in “walking the talking”, the NCC had in 2003 established the Industry Consumer Advisory Forum (ICAF) to pursue the interest of consumers.

Speaking at the 2nd quarter, 2023 open forum of the Industry Consumer Advisory Forum, which held at the Radisson Blu Hotel, Ikeja, Lagos, recently, the Chairman of ICAF, Mazi Akpa Emeka stated that the establishment of the forum was in response to the need to protect the interest of telecom consumers within the ambit of the Act that established the Nigeria Communications Commission.

He said: “Pursuant to the NCA 2003, the Commission, driven by its Consumer-centric initiatives to ensure fair treatment as well as an acceptable Quality of Experience for consumers of ICT products and services, established the Industry Consumer Advisory Forum (ICAF).

“ICAF is not completely independent of the Commission but has been established as part of the Commissions strategy to achieve its mandate for protection and promotion of the interests of Consumers against unfair practices; including but not limited to matters relating to tariffs and charges for the availability of quality communications services, equipment and facilities.

“On behalf of the entire membership of the Industry Consumer Advisory Forum (ICAF) of the NCC, I wish to once again welcome you all to the 2023 open forum of the NCC which tends to bring together the Regulators, Service Providers and Consumers of Telecommunication Products and Services.”

The event which has its theme: “Combating E-Fraud on Telecom Platform: Building Consumer Confidence in the Digital Economy Protocol”, Mr Emeka emphasized that the “Nigerian Communications Act (NCA 2003) generally provides for the protection and promotion of interests of Consumers including Differently Abled Persons and the Elderly.”

It was in pursuit of the integral part of the NCA that the NCC had over the years kept the forum going, while members of the ICAF which comprise of representatives of different groups and organizations were untiring of their activities, adding that this year’s theme was apt and timely.

The ICAF was envisioned in 2003 in response to the dynamics of e-fraud as digital means of transaction continue to widen, he said: “Fraud has escalated as digital adoption has increased. The situation requires that organizations simultaneously combat fraud and provide customers with a seamless digital experience.

“Digital adoption leapfrogged a decade in days during the COVID-19 pandemic, accelerating the shift to digital and multichannel client service that began in the 2010s.

“The pandemic-driven boost to e-commerce is estimated to have exceeded $200 billion in 2020 and 2021. Increased digital adoption has enabled new forms of fraudulent activity and amplified the importance of effective fraud management for promoting growth and meeting customers’ increasing expectations for digital experiences. Although most companies have improved their digital user interface and experience, many have struggled to effectively enhance fraud controls without impairing the client experience.

“Many organizations report that they are being overwhelmed by the sheer volume of fraud attempts. In financial services, for example, many banks are so inundated by fraudsters that they cannot meet online origination targets; they are unable to verify identities and authenticate customers while combating fraud.

“At the same time, fraud threat vectors have become significantly more sophisticated. They include nation-state actors, organized criminals, cyber terrorists, and insiders, as well as local fraud rings. Advances in technology present challenges as fraud attacks occur with greater frequency, speed, and effectiveness.

“Commonly used methods include phishing (Phishing occurs when a hacker pose as a trusted figure who uses carefully created emails to trick you into visiting a malicious website, downloading a corrupt file or handing over your password before using that information to gain access to a business network or your personal information), destructive malware, social engineering, deep fakes, and fraud-as-a-service exploit kits.

“Faster movement of money usually increases the risk of fraud, and real-time disbursements are set to double within the year and beyond as economic hardship gets tougher. Risk rises further when unsuspecting customers inadvertently share their authentication details with fraudsters targeting their devices and accounts.

“The evolution of fraud threats has undermined the effectiveness of a reactive approach to combating fraud, which essentially focuses on stopping schemes one by one through manual reviews. The 2023 2nd quarter open forum of the Industry Consumer Advisory Forum (ICAF) decided to bring this issue to bear as it affects consumers a great deal.”

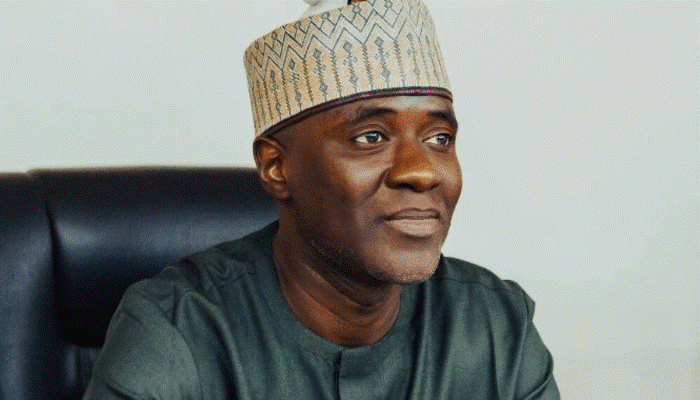

At the event that featured stakeholders and experts in the telecommunication industry, the Vice Executive Chairman and CEO of the NCC, Prof. Umar Danbatta, said, the onus fall on the Commission to ensure a type-approving communications equipment to ensure conformity with the global standards.

This he maintained has made the Commission to collaborate with Mobile Network Operators to ensure the safety of their network and conduct regular checks and assessment to verify compliance and encourage a culture of cybersecurity within the industry.