Economy

28 govs pile up N5.8tn debts for incoming govts

In the fourth highest debtor position is Cross Rivers, with N175.2bn domestic debt and $215.75m external debt.

It is followed by Ogun with N241.78bn domestic debt and $122.73m foreign debt.

Others include Bauchi (N144.28bn domestic debt and $172.76m external debt); Enugu (N89.89bn and $123.02m); Kano (N125.19bn and $109.42m); Abia (N104.57bn and $95.63m) and Adamawa (N122.48bn and $77.01m).

Other debtor states are Akwa Ibom (N219.62bn and $46.567m), Benue (N143.37bn and $30.47m), Borno (N96.33bn and $18.7m), Delta (N272.61bn and $60.05m), Ebonyi (N67.06bn and $59.84m), Gombe (N139.1bn and $46.93m), Jigawa (N44.41bn and $27.61m), Katsina (N62.37bn and $55.82m), Kebbi (N60.13bn and $42.40m), Kwara (N109.55bn and $45.94m), and Nasarawa (N72.63bn and $53.73m).

Also on the list are Niger (N98.26bn and $69.27m), Oyo (N160.07bn and $76.97m), Plateau (N151.90bn and $33.74m), Sokoto (N85.58bn and $37.13m), Taraba (N90.81bn and $22.28m), Yobe (N92.86bn and $23.09m) and Zamfara (N109.69bn and $29.33m).

The FCT had a domestic debt of N112.49bn and external debt of $25.38m.

The PUNCH observed that these states and the FCT owed up to 81.72 per cent of the N5.36tn sub-national domestic debts and 69.08 per cent of $4.56bn external debts.

Speaking with our correspondent on Thursday over the phone, the Director, Portfolio Management Department of the DMO, Dele Afolabi, noted that each state was expected to send in quarterly information on their domestic debts.

He added that by being transparent with their debt profiles, states would be able to access more funding.

The PUNCH observed that the debt servicing is done by the Federal Government but it is deducted from the federal allocation to the states.

States’ debts

In its December 2022 edition of the Nigeria Development Update, the World Bank noted that states’ debts would rise above 200 per cent of the revenue generated in 2022 and 2023.

The report read, “Debt levels for an average state are estimated to increase from 154.6 per cent of revenues in 2021 to above 200 per cent of revenues in both 2022 and 2023.”

According to the Washington-based bank, the increase in debts will be due to low allocation from the Federation Account, which will likely weaken the fiscal condition of the states.

But the state Commissioner of Information, Mr Gbenga Omotoso, insisted that the debts were sustainable and would not hinder any development after May 29, adding that what the debts were used for was what mattered.

He said, “The debts are more than sustainable. Recently, Lagos State got a Fitch AA+ rating and what it means is that we are running our finances very well and we are super creditworthy. I think we are the only state in Nigeria to have had such a rating.

“Apart from that, people say Lagos State debt is high but the problem is not the high domestic or foreign debts but what they are used for. The United States of America has the highest debt profile in the world, yet many are flocking there. To borrow money to pay salaries is bad but to borrow it to fund projects that will generate revenue and provide jobs is good.

“Lagos has a high debt profile because it has embarked on and executed a lot of infrastructural and transport projects, among many that will in turn generate income. We have not expended up to 50 per cent of our Gross Domestic Product so we still have enough room to borrow money and that is why you see that people are turning over to Lagos because they know that the state is creditworthy.

“There is no way you can embark on the big projects that the Lagos State Government has executed without borrowing money. Where will the cash come from? Look at the Blue Rail, can you imagine the number of people it will be conveying daily and the jobs it has created? So there is no way you can fund that kind of project without borrowing money at all.

“This will never affect any development after May 29. In fact, if anything, it will bring more developments. By the time you say you save billions of naira to build a railway, even the people who should ride on it would have died, so one needs to find a way of funding it, and the better way is to borrow money, and local financial institutions are coming to Lagos to lend money to the government because they know the economy has a bright future.”

When contacted about the debts Governor Wike would be leaving for the incoming administration, the Rivers State Commissioner for Finance, Isaac Kamalu said he was in a meeting and could not comment.

Kaduna government

Similarly, there was no reaction from the Kaduna State Government when asked about its plans to address the huge debts on Thursday.

The Special Adviser on Media and Communication to the governor, Mr. Muyiwa Adekeye could not be reached on the phone and he did not respond to the query sent to him on the Whatsapp platform.

Officials of Ogun State Government kept mum as both the state Commissioner for Information and Strategy, Waheed Odusile and Chief Press Secretary to the state governor, Kunle Somorin did not respond to calls or messages sent to their phones.

Meanwhile, the All Progressives Congress in Delta State has kicked against alleged plan by Governor Okowa to borrow N40b.

The party in a statement on Thursday warned all commercial banks and lending institutions in the country to be wary of the outgoing PDP government in the state.

The party said, ‘’It has come to the notice of the public and to the knowledge of the All Progressive Congress that the government of Delta state is yet again negotiating a loan facility for N40b.’’

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

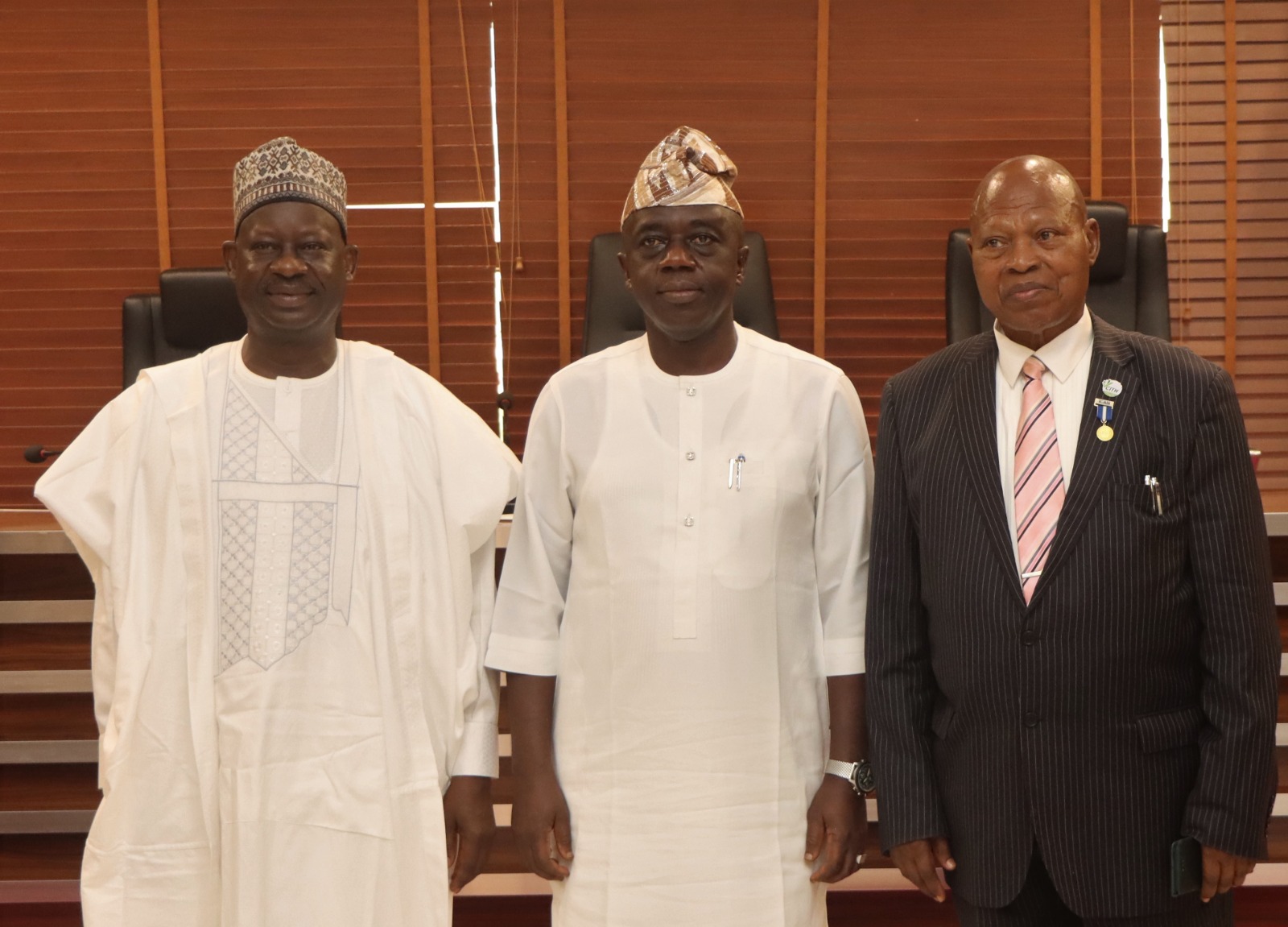

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

Politics1 week ago

Politics1 week agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

Foreign7 days ago

Foreign7 days agoHouthis declare Ben-Gurion Airport ‘no longer safe’ after renewed Gaza fighting

-

Politics1 week ago

Politics1 week agoYahaya Bello deceptively arranging recall of Senator Natasha, desperate to replace her – Constituents

-

News1 week ago

News1 week agoWhy Christ Embassy’s Pastor Chris holds Abuja mega crusade – Fisho

-

Politics1 week ago

Politics1 week agoAtiku, El-rufai, Obi condemn Tinubu’s suspension of Rivers Governor, demand reversal

-

News1 week ago

News1 week agoUmeh denies receiving $10,000 with other 42 Senators to support state of emergency in Rivers

-

Business1 week ago

Business1 week ago20 new millionaires emerge from Fidelity Bank GAIM 6 promo

-

Crime1 week ago

Crime1 week agoGhana’s anti-drug agency nabs Nigerian drug kingpin, Uchechukwu Chima, seizes $2.1m worth of cocaine, heroin