Economy

The Mimi-Adzape Orubibi tax reforms: Redefining the structure of tax administration in Benue State

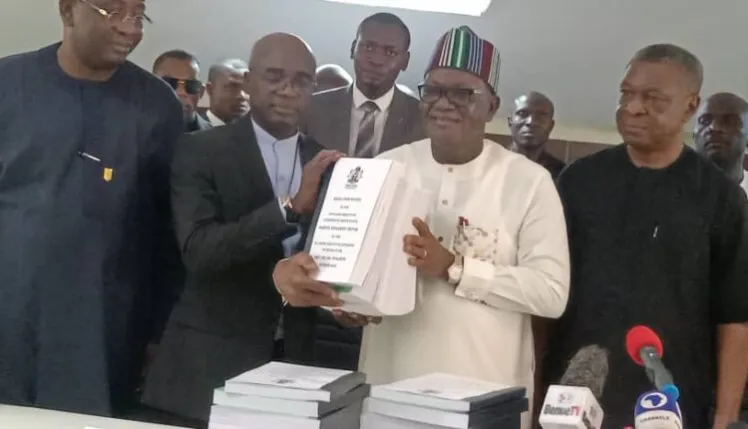

In fulfilment of the mandate and vision of the Benue State governor, Dr Samuel Ortom to revamp and ramp up the State internally generated tax revenue so as to reduce dependency on the federal allocations, the Chairman of the State’s revenue agency, Mrs Mimi Adzape Orubibi has in the over 3 years transversed the State revenue agency as a collosus, implemented series of bold, precise and targeted tax reforms that are fast redefining the structure of tax administration in Benue state, while remarkably raising the prospects for enhancing internally revenue generations.

Now taxes are levied by the States on their citizens and businesses to raise funds for the provision of public works and services. In Nigeria, each State has the potential to fund its budget from its internally generated revenues.

Regrettably, Benue like most States of the federation has operated a very broken, lax, and ineffective revenue generation that contributes less than 10 percent to the annual state’s budget.

Years of easy oil money from the federal coupled with a succession of wasteful and visionless leaderships that lacked the capacity for innovations and creativity, did little to deepen and strengthen the state’s tax administration.

Today, the consequences of the years of waste, lack of plannings for the future have come round to haunt the State and the administration of Dr.Samuel Ortom.

With no savings from the golden era of oil prices, burdened by a chokingly inherited State debt profile of over 90 billion naira and with the over 60 percent fall in federal allocations due to falling oil prices that accounts for 90 percent of its revenue, Benue State has found itself in an acutely strained financial revenue position where it is battling to meet recurrent expenditures, talkless of embarking on any physical or development projects.

Although, the challenges remain and will take time to clear, Mrs Orubibi, the elegant and passionate first female boss of the state’s tax agency appears set and ready prior to her appointment to get down to work with the right reforms measures and policies to transform the State revenue areas from potential to reality; the capacity of the state; tax administration systems to contribute significantly to the revenue profiles of the state.

She has in her first coming made an initial impacts by showing clearity of vision, a good understanding of what needs to be done and daily goes about her work with passionate commitments to make a difference by reforming and repositioning the state’s tax systems as a key alternative source of revenue.

Determined to meet the governors target of raising internally generated revenues in the state from an average of 250 million to over 2 billion, Mrs.Orubibi has with the active support of governor Ortom introduced unprecedented tax reforms that have the potential to reset the revenue potential of the State and this is what it is doing really right now in the State.

The governor, who is acclaimed to be a known recruiter of leaders in various field is an avid believer that the best should lead all institutions in the State without regrets, appointed back Mrs Orubibi to her position after initial political differences to her position and he has never regretted this because he knows that the reforms if sustained and deepened within the next two years left of his administration of the State, they would balance, if not totally reverse the lopsided trend that is now in favour of federal allocations.

Some of these reforms includes the historic introduction of an electronic payment systems to block systemic revenue leakages, boost transparency and accountability to the people. Until this new system, tax collection agent now used network point of sale, P.O.S.machines to issue receipts for all taxes collected and all revenue generating points in the State.

The payment system is intelligently designed to remotely track-using an embedded sim card that is connected to a telecom network and record each transaction made on the device.This provision makes it near fool-proof to fraudulent manipulation by unscrupulous tax agents.

Since its implementations in some pilot locations like Makurdi, the electronic payment systems has helped to substantially close avenues for revenue leakages like cloning of tax receipts and non-declarations of taxes by revenue agents close.

This bold move is very significant to the state plans to maintain a tight rein in monies collected and is helping to significantly boost tax collection efforts in Benue state. It is estimated by tax experts that the state was loosing over seventy percent of collected revenues due to systemic vulnerability of the previous manual system of tax collection.

She has widened the tax bracket to include individual and businesses in the informal sector. Those within this groups includes traders and market women, cab drivers, okada riders, barbers, shops and other small businesses.

To reduce the burden of one-time payment for this group of small entrepreneurs, Mrs.Orubibi has introduced a covenient pocket-friendly and innovative daily tax payment plan called pay small-small. This plan allows tax payers to pay as low as fifty naira per day in staggered payments over an extended period of time.

The widening of the tax brackets to include the informal sector is very significant because the informal-sector although loose,scattered and not really organised when put together represents a very huge untapped source of revenues for the government.

Musa Wada, a public affairs analyst writes from

Abuja