Oil and Gas

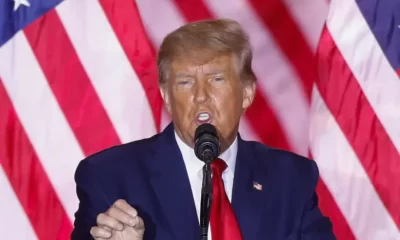

Oil bounces after Trump uses the ‘oldest middle oil trick in the book’ to Kickstart prices

Oil prices gained ground on Thursday after US President Donald Trump issued a bellicose tweet leading to supply fears in the key oil producing region of the Middle East.

The international oil price recovery followed President Trump’s remarks that he instructed the US Navy to “shoot down” Iranian gunboats if they harassed American ships at sea.

“It is perhaps the oldest Middle East oil trick in the book: you want higher oil prices, threaten to start breaking things,” analysts at Rabobank said in a morning note.

Both Brent and WTI oil jumped in Thursday trading after falling to historic lows earlier in the week.

Watch oil trade live on Markets Insider.

Oil prices recovered on Thursday, after a bellicose Wednesday tweet from US President Donald Trump sparked fears about oil supply in the Middle East.

US crude-oil prices rose 10% to $15.30 a barrel in early European trading. Brent crude oil, the global benchmark equivalent, advanced 7.6% to $21.80 a barrel in early European trading.

Earlier in the week, Brent crude dropped to a two-decade low and US oil fell into negative territory for the first time in history.

The rebound in oil prices followed a fresh prospect of US-Iran tension as President Trump said on Wednesday he instructed the US Navy to “shoot down and destroy” Iranian gunboats that “harass our ships at sea.”

I have instructed the United States Navy to shoot down and destroy any and all Iranian gunboats if they harass our ships at sea.

“It is perhaps the oldest Middle East oil trick in the book: you want higher oil prices, threaten to start breaking things,” analysts at Rabobank said in a morning note.

Tensions in the Middle East can lead to crude oil price increases as that would indicate a potential disruption to oil shipments around the world and cause possible supply shortages.

“The ripple effects from lower oil prices are going to continue to be felt in both some obvious and some unusual places,” the Rabobank analysts said.

China is believed to be a big winner from the oil-price war, they said, and cited a report from Caixin that states China sold the May oil contract to wealthy retail investors using fund names like “crude oil treasure,” who subsequently got crushed.

AFP