Editorial

Huge debts: Nigeria’s time to move away from borrowing

There is nothing wrong with any government taking loans from foreign countries. However, government should not only be transparent about such transactions, but should also channel such funds appropriately. If a loan is taken based on the need to fill infrastructural gaps, the people should be made to see how such a facility is being deployed to consistently close such infrastructural gaps. There is absolutely no justification for a nation to keep borrowing when the people are not feeling the impact of what the loans are used for.

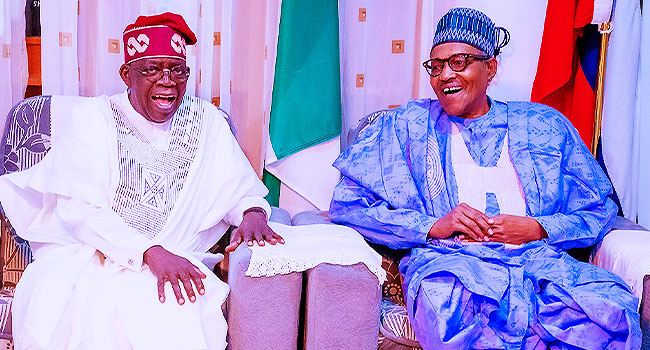

So much dust is being raised over President Buhari’s government’s insistence on continuous borrowing. So many Nigerians are worried that despite the massive borrowing by the government, not much has been recorded in terms of economic growth. Instead of the debt-funded infrastructure projects creating more job opportunities for Nigerian youths, the national unemployment rate has increased to 33.1 percent while youth unemployment has reached 42.5 percent.

Nigeria is standing on a precarious debt-induced fiscal precipice. If these loans are not prudently and strategically invested to re launch the country’s economy, then the government of Nigeria is mortgaging the future of our country. If that be the case, then Nigeria has to stop further borrowing and start to manage its current assets and liabilities. If not, the country will wake up one day to be confronted with a catastrophic debt bubble explosion.

Government must initiate an efficient system that will encourage public revenue growth by not only restoring investor confidence in the economy, but also ensuring the emergence of a secure environment for business. Government must put all hands on deck to ensure that the economy is successfully diversified through value-added exports — a stimulant for wholesome domestic economic growth.

This editorial calls to attention the fact that over the past months; debt service cost has eaten up more than 90 percent of government revenue. What this means in practical language is that more than 90 percent of what the government earns is used to pay interest on government’s loans! It is devastating that money that should have been used to develop critical infrastructures and stimulate the economy is deployed to service interests on our debt, not repaying the debt. Further borrowing will lead to more economic woes for the nation.

An alternative to foreign debt is for the government to shift its focus from external borrowing to increasing domestic revenue. Government can achieve this by expanding it’s the tax base, not necessarily by increasing tax rates as is the case with the value added tax (VAT). In order not to place more burdens on taxpayers, the government could also introduce reforms that will ease paying taxes, while eliminating multiple taxations, etc.

However, if Nigeria must borrow, we must develop good strategies on how to make the best of such loans. The country’s borrowing must be in such a way that will stimulate exponential economic benefits. It must not be business as usual where loans are obtained to satisfy some persons. When we borrow, we should do so to achieve some genuine and strategic economic targets. Considering how much we are using to service debts now, any further debt without strategic planning and discipline will make us enslave ourselves to our creditors.