News

SPDC N600 million contract debt: Tension mounts in Niger Delta communities

Tension is rising daily in Bayelsa and other parts of Niger Delta over a whopping contract debt of N600 million owed a local contractor by Shell Petroleum Company.

CAPITAL POST gathered, penultimate week, that youths in Ekeremor Local Government Council and Shell Petroleum Development Company (SPDC) are locked in altercation over N290,394,000 and $34,164,000 amounting to over N600 million in Nigeria’s local currency. This was the contractual amount of services rendered by Omire and Associates for the supply of a Tugboat and Water barge for the repair of Shell’s damaged oil installations at Brass Creek Swamp 2 in Bayelsa State.

Shell, a multinational oil company which is notorious for owing debt has been indebted to the company since 2008 till date. Of regret, is that all entreaties by the host communities, the company and the youth to persuade payment of the debt proved abortive, even as the upper and lower relevant Committees of the National Assembly’s intervention through public hearings has been ignored with impunity by Shell Petroleum Development Company.

A citizen of Niger Delta and the community leader in charge of the Company, Mr. Finidi Jahbless in some documents sighted by CAPITAL POST has written to both Chambers of the National Assembly, the presidency, the Minister of Petroleum Resources and Security Agencies over the flagrant abuse of Nigerian laws by the erring Shell Petroleum.

Investigation by CAPITAL POST revealed that the host community of Ekeremor Local Government and the youths were angry because of what they described as injustice against a local company. A resident in Bayelsa, who pleaded anonymity said, “after a contract was awarded to Omire and Associates, the company thereafter obtained a loan of N5.5 million from First Bank at an interest rate of 22%, the Shell Petroleum Development Company criminally and illegally substituted the contract with their own subsidiary company.” According to him, “the Omire and Associates has already begun the execution of the contracts as Tugboats and Barge have been mobilised to site.”

In collaboration with the concerned indegene who don’t want his name in print, documents seen by CAPITAL POST indicated that Tugboats and Barge were mobilised to site by Omire and Associates which it commenced repairs in accordance with contract Ref. No. NGO1003128 (A29) and PO Ref. No. 4510149777.

The company in several petition to the National Assembly and agencies of government decried harassment, intimidation, seizure of Tugboat and Barge equipment. It said the conduct of the multinational oil company constitutes an infraction in the contractual agreement, it entered into which bothers on illegal termination of contracts. It further posited that Shell Petroleum Development Company was involved in unwholesome practices against the host communities that manifested racism, white supremacist, exploitation and brutal expropriatory of policies often carried out by foreign multinational oil companies.

Part of the document further reads: “It is inconceivable that SPDC can visit this kind of insensitive, dismissive and crudely exploitative actions on citizens of Europe, America or other advanced countries without facing punitive sanctions of hefty Court penalties.

“For instance, SPDC was forced to pay colossal fines running into billions of sterling for massive oil leak off the coast of Scotland where it was carrying out oil drilling activities some years ago.”

“However, when it comes to the case of the third world countries, the reverse is the case as the regulatory, judicial or even legislative authorities are slow or hesitant to wield the big stick against the wayward oil majors’ reckless, apathetic and oppressive activities.”

In the document made available to CAPITAL POST by Omire and Associates, the firm wondered how the multinational oil company would defy the Senate and House of Representatives Committee on Public Petitions, Ethics and Priviledges’s summon for eleven times.

The company lamented that if a foreign firm could flagrantly abuse the peoples parliaments which oversights it as a matter of its legislative powers, the development should be better imagined that said.

The local contracting company also averred that several invitations by the Public Complaints Commission (PCC) to Shell was ignored.

However as at last weekend, various groups in Ekeremor Community in Bayelsa State, were meeting, and perfecting strategies on how to confront Shell Petroleum Development Company.

It was not certain if the planned attack would be against Shell Petroleum installations across the region, but our correspondent reports that there is palpable tension in the local communities over the weekend that suggested that anything can happen, if the relevant government agencies didn’t intervene immediately.

News

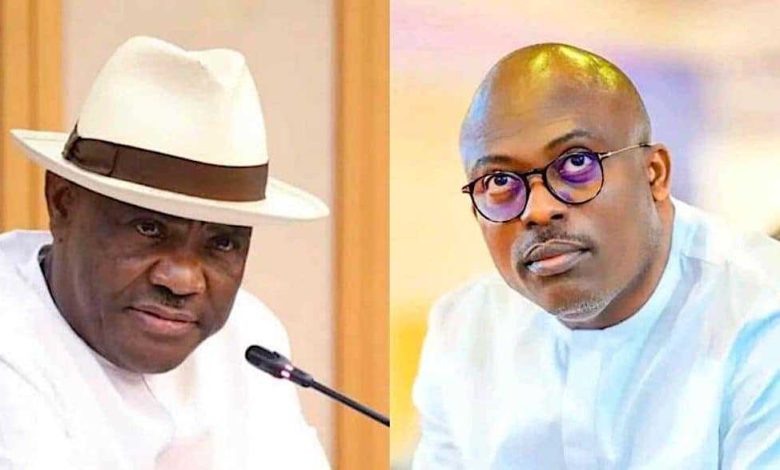

Rivers Chief of Staff reveals how Wike’s camp offered N5bn bribe to impeach Fubara

The Chief of Staff to the suspended Rivers State Governor, Edison Ehie, has revealed how he was offered the sum of N5 billion to coordinate the impeachment of his principal, Siminalayi Fubara.

He stated this on the popular Channels Television on Sunday Politics, claiming that he has evidence stored on his phone to substantiate his claims.

The impeachment of the governor has been the desire of the 27 lawmakers loyal to Nyesom Wike, a former governor of Rivers and a current Minister of the Federal Capital Territory, hence, the claim, if substantiated would have been linked to the camp of the Minsiter, Nyesom Wike.

“I can also open my phone to show you, in the beginning of October 2023, when they approached me with a bribe of N5 billion. It is here in my phone.

“It was for impeachment. It’s here. I have it and I have printed it and distributed it, in case, in their evil imagination, they decide to attack me. I already have a son and a brother,” he said.

According to Ehie, the mouth watering offer was made while he was serving as the majority leader of the Rivers State House of Assembly.

Reacting to claims that the embattled governor told him to bomb the State House of Assembly, he denied, saying that Fubara never told him to do so, while he challenged the former Head of Service prove evidence.

His denial was at the backdrop of claims by the former Head of Service of Rivers State, George Nwaeke that he witnessed a bag of money being handed over to Ehie at the Government House to organize the bombing of the House of Assembly complex to avoid impeachment of the governor.

Nwaeke however, said, he didn’t the amount of money in the bag that was handed over to the Ehie.

Dismissing the claims as false and politically motivated, Ehie said, “It is very important to clarify that I had no hand and was not part of the burning down of the Rivers State House of Assembly.

“Like everyone else, I woke up in the early hours of 30th of October 2023 to hear of the burning down of the Rivers State House of Assembly.”

Ehie stated that he had instructed his lawyers to file a lawsuit against Nwaeke for criminal libel.

“I will not join issues completely with Mr. George Nwaeke because I have already instructed my lawyers to file an issue of criminal libel against him, and I hope he is very prepared to substantiate his claims and his allegations,” he said.

He further alleged that Nwaeke had sought financial assistance from him on the same day he resigned as head of service.

Rivers State has been in turmoil since Fubara’s fallout with his predecessor and current Minister of the Federal Capital Territory Nyesom Wike.

On March 18, President Bola Tinubu declared a state of emergency in the state and suspended both the governor and his deputy.

Subsequently, on March 26, the sole administrator of Rivers State, Ibok-Ete Ibas, suspended all political officeholders in the state.

News

Plane carrying Israeli students to Poland makes emergency landing in Turkey

The Education Ministry said it is in contact with security and education officials and is coordinating with admins and parents.

A plane carrying a group of 150 Israeli students on a trip to Poland made an intermediate landing in Antalya, Turkey, the Education Ministry said on Monday.

The landing was made following concerns about a technical malfunction, and for reasons of caution, a decision was made to stop in accordance with aviation rules.

N12 reported that a bird had entered the plane’s engine during the flight.

The high school student delegation – from Ein Kerem High School in Jerusalem – was en route to Poland on a standard school trip to learn about the events of the Holocaust. They were accompanied by security personnel from the Shin Bet, as is customary for any delegation to Poland.

The Education Ministry said that they are in continuous contact with security and education officials and are in coordination with school administrations and parents.

The Auschwitz-Birkenau concentration camp in Poland. September 19, 2021. (credit: NATI SHOHAT/FLASH90)

It was reported that all the students “are feeling well, staying in a safe and protected area within the airport, and are closely accompanied by the teaching staff who are with them at all times.”

In addition, the ministry was informed that a replacement plane is on its way to them, and it is estimated that at 3:00 p.m., they will take off for Krakow to continue their educational journey.

Holocaust learning

Israeli school trips to Poland typically take place in the winter and the summer, and, according to Education Minister Yoav Kisch, aim to allow “students to commemorate the victims of the Holocaust, to be exposed to the atrocities that took place, and to prove the victory and resurrection over the attempt to destroy the Jewish people.”

In November 2023, the ministry announced it would cancel the winter Poland trips due to the rise of antisemitism worldwide in the aftermath of the Israel-Hamas war.

News

FY 2024: Fidelity Bank records a 210.0% growth in PBT to N385.2bn

…Declares a total dividend of N2.10 per share

Lagos, Nigeria, March 29, 2025: Leading financial institution, Fidelity Bank Plc, released its 2024 full-year Audited Financial Statements, reporting a 210% growth in Profit Before Tax to N385.2 billion.

According to the Bank’s results released on the Nigerian Exchange (NGX) on Friday, 28 March 2025, Gross Earnings increased by 87.7% to N1,043.4bn, driven by 106.9% growth in interest and similar income to N950.6bn. The increase in Interest Income was led by a combination of improved yield on earnings assets and 51.6% expansion in earnings base to N6.3tn. This led to a Profit After Tax of N278.1 billion, representing a 179.6% annual growth.

Commenting on the results, Dr. Nneka Onyeali-Ikpe,OON, Managing Director/Chief Executive Officer, Fidelity Bank Plc said, “We are delighted with our 2024 full-year (FY) performance, which showed strong growth across key revenue lines, improved asset quality, and significant traction in our strategic business segments. Our impressive results led to a triple-digit increase (210.0%) in Profit Before Tax (PBT), rising from N124.3bn in 2023 to N385.2bn in 2024.”

A further review of the financial performance revealed that the bank’s net interest income increased by 127.1% to N629.8 billion, driven by a high-yield environment in 2024. To optimize its margin, the bank sustained its asset yields above funding cost by maintaining a high low-cost deposit profile at 92.6%. This led to an increase in its Net Interest Margin from 8.1% in 2023 FY to 12.0%.

Similarly, the bank continued to deepen its market share in both the corporate and retail segments, with customer deposits increasing by 47.9% from N4.0trn in 2023FY to N5.9trn. The increase was driven by strong double-digit growth across all deposit types. The Retail Banking Business gained significant traction with savings deposits increasing by 28.8% to N1.1trn, marking the 10th consecutive year of double-digit annual growth in savings deposits.

Despite the difficult economic terrain in 2024, the bank has continued to support the real sector of the economy by increasing its Net Loans & Advances from N3.1tn in 2023FY to N4.4tn in 2024FY.

“This remarkable performance demonstrates our capacity to deliver superior returns to our shareholders. In line with our commitment to them, we have declared a final dividend of N1.25 per share, bringing our total dividend for the 2024 financial year to N2.10 per share”, explained Onyeali-Ikpe.

Having consistently paid dividends since 2006, Fidelity Bank will pay investors a total dividend of N2.10 per share for the 2024 financial year, subject to shareholders’ approval at its Annual General Meeting (AGM) on 29 April 2024. The dividend will be paid on 29 April 2025 to shareholders whose names appear on the register of members as of 15 April 2025.

It will be recalled that the bank successfully completed the first phase of its capital raising exercise through a Public Offer and Rights Issue in 2024, which were oversubscribed by 237.92% and 137.73%, respectively. The positive result is a testament to the strength of the Bank’s franchise in the capital market. A total of N175.9bn was recognized as fresh capital in 2024 financial year from the exercise, which had a positive impact on its Capital Adequacy Ratio (CAR) at 23.5%. The bank plans to conclude the second phase by Q3 2025, ahead of the Central Bank of Nigeria’s deadline, which will further strengthen its capital base and reaffirm its attainment of Tier 1 Bank status in the Nigerian Banking Industry.

Fidelity Bank Plc is a full-fledged commercial bank with over 9.1 million customers who are serviced across its 251 business offices and various digital banking channels in Nigeria and the United Kingdom.

The Bank is the recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine.

Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

-

Foreign1 week ago

Foreign1 week agoHouthis declare Ben-Gurion Airport ‘no longer safe’ after renewed Gaza fighting

-

News2 days ago

News2 days agoKogi Governor, Ahmed Usman Ododo salutes Tinubu at 74

-

Security2 days ago

Security2 days agoNew Commissioner of Police in Niger, Elleman sends strong warning to criminals

-

News1 week ago

News1 week agoUmeh denies receiving $10,000 with other 42 Senators to support state of emergency in Rivers

-

News22 hours ago

News22 hours agoAbia: LG Chairman, Iheke accused of using soldiers to detain IRS agent, claims Governor Otti’s support

-

News2 days ago

News2 days agoPlateau LP stakeholders endorses Barr Gyang Zi’s defection to APC

-

Sports1 week ago

Sports1 week ago2026 World Cup Race: Ekong says Eagles feel great to be back in contention

-

News2 days ago

News2 days agoAkpabio pays historic visit to office of SA to President on Senate Matters