Economy

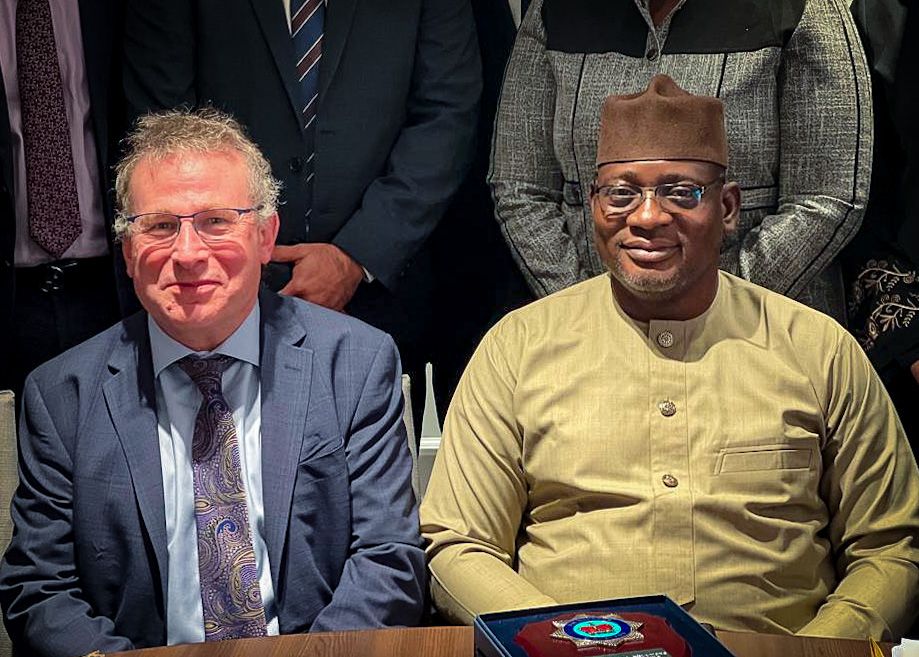

FIRS Chairman, Nami solicits cooperation of three tiers of government in attempt to digitalise tax collection

The Chairman of Nigeria’s Federal Inland Revenue Service (FIRS), Muhammad Nami has sought for cooperation of the three tiers of government as the agency moves to digitalise tax collection processes, stating that Nigeria like other nations runs a tax driven economy.

Speaking in his welcome address at the First Annual National Tax Dialogue event, in Abuja, he underscored the importance of the dialogue, saying: “The universal collapse of traditional government revenue sources and the consequential resort to tax is a testimony.

“The well-known arms race among nations is gradually giving way to “tax-race”. The international struggle for and against digital services tax is just the beginning of the tax race. It is a race for all nations – developed or developing. And for Nigeria, it is “a must-win” race.”

He pointed out the need for cooperation as the FIRS would match on to digitalise the tax process fully.

His words: “The FIRS started the journey to automation several years ago when it launched “Project Fact”. Several other initiatives were launched to further take advantage of evolving technology in taxpayer registration, online payment platforms, remote filing of returns, etc. However, there was very limited success with the various initiatives due to inadequate statutory framework.

“A quantum leap was achieved with the 2020 Finance Act which copiously provided legal grounds for deployment of technology in tax administration. The Service is grateful to the President, the leadership of the National Assembly, the Honourable Minister of Finance, Budget and National Planning and all other stakeholders that worked together to enact the necessary laws.

“The Service is taking advantage of the new law to embark on studies (with the assistance of friendly tax authorities and international tax organisations) with a view to developing a robust digitalisation roadmap. The roadmap will enable the Service to digitalise its whole operations (end-to-end) in a systematic, coherent and efficient manner.

“There is so much to look forward to in the coming years. The FIRS is starting this decade with the resolve to leapfrog tax administration into the digital age. Ladies and gentlemen, we are banking on your continued support as we embark on this onerous journey.”

CAPITAL POST earlier reports that the Federal Inland Revenue Service (FIRS) collected N4,952,243,711,728.37 in total tax revenue in the year 2020, thus meeting a landmark achievement which represents approximately 98% of the national tax target of N5.076 trillion set for the FIRS by the Federal Government.

This was disclosed by the Executive Chairman of the Federal Inland Revenue Service, Mr. Muhammad Nami during a press conference in his office.

While briefing the press, Mr Nami pointed out that this near 100% collection feat was all the more remarkable when placed against the backdrop of the debilitating effects of COVID-19 on the Nigerian economy; the all-time low price of crude oil in the international market; business disruptions and lootings during the #EndSars protests; generous tax waivers granted by the FIRS to ease the impact of the COVID-19 shutdown; additional tax exemptions granted to small companies in the 2019 Finance Act; and insecurity in some parts of the country.

While analysing the significance of the 2020 performance, he further noted that the FIRS recorded this feat at a time when the price of oil hit an all-time low.

“In other words, oil which used to contribute over 50% in tax returns through the Petroleum Profits Tax in previous years, accounted for only 30.6% contribution to the tax revenue generated in 2020.”

Nami also added that the non-oil tax collection was 109% in 2020, which is 9% higher than the previous year.

FITS boss attributed the FIRS revenue generation success in 2020 to a number of reforms initiated by the Board and Management of the Service under his leadership.

In the conference release which was made available to CAPITAL POST on Tuesday by the Director of Communications and Liaison, Abdullahi Ismaila Ahmad, said the reforms included capacity building for members of the staff; improved staff welfare package; promotion and proper placement of staff; deployment of appropriate technology for tax operations; segmentation of taxpayers to ease tax compliance; and continuous collaboration with relevant stakeholders, among others.

Mr. Nami then commended “the conscientious taxpayers in the country and dedicated members of staff of the FIRS nationwide for their support and devotion to work which made this performance possible despite the numerous obstacles encountered by the Service in 2020”.

The Executive Chairman added: “The FIRS is optimistic this current fiscal year 2021 will be better than 2020. We shall perform exceedingly well given that our Service reforms are expected to yield greater dividends, especially as different parts of tax administration is being automated.

“We are also optimistic that exploration activities will improve in the oil sector and increase the prospect of higher tax revenue from the sector.

“Similarly, the ongoing reforms by the Service together with increased stakeholder collaborations will brighten the prospect of improved voluntary compliance and consequently higher tax revenue generation for the country this year and beyond.”