Economy

Senate gives SEC more regulatory powers, pass Bill on Investments and Securities for third reading

The Senate Wednesday passed for third reading , Investments and Securities (Repeal and Enactment) Bill 2024.

Passage of the bill for third reading by the Senate, followed consideration and adoption of recommendations made to that effect by its Committee on Capital Market, Chaired by Senator Osita Izunaso (APC Imo West).

The Committee in the report, informed the Senate that repeal and enactment bill , when signed into law , will make the Securities and Exchange Commission (SEC), the apex regulatory authority for the Nigerian Capital Market.

Objectives of the proposed law, as clearly stated in the bill, are strategically streamlined within the contemplation of emerging global best practices in Investments and Securities by protecting the integrity of the security market against all forms of market abuse and insider dealings , preventing unauthorized, illegal, unlawful, fraudulent and unfair trade practices, relating to securities and investments.

The report reads: “That the extant law as revolutionary as it was at its inception, after many years of its operation, requires systemic substantial updates to align with the evolving financial markets and regulatory frameworks globally, in order to make it more attractive to both local and foreign investors;

“That the enactment of this proposed legislation will undoubtedly provide significant opportunity to drive the growth of the capital market and diversification, thereby creating a conducive atmosphere for investors in the Nigerian Capital Market.

“That the Bill contemplates to address modern forms of financial malpractices and reinforce investors’ protection by engendering robust regulations around market abuses, insider trading and governance standards for publicly traded companies

“That the Bill envisages regulatory framework for digital currencies and fintech activities, including the supervision of blockchain and cryptocurrency transactions to support the integration of innovative technologies within the scope of the capital market.

“That the Bill seeks to set a clear-cut delineation of roles amongst regulatory bodies in order foster transparency and reduce regulatory overlap, thereby enhancing the operational efficiency of Nigeria’s Securities and Exchange Commission;

“That the Bill seeks to support the introduction and regulation of diversified financial instruments, including derivatives, Exchange Traded Funds (ETFs) and other sophisticated products, which are essential for meeting the needs of a broad investor base and increasing market depth; and

“That the passage of the Bill will bring about diversity and growth in the capital market, through market offerings that would form the foundation for economic expansion, thereby creating job opportunities within the Nigerian Capital Market”.

The Senate accordingly after clause by clause consideration of the bill , passed it for third reading .

Economy

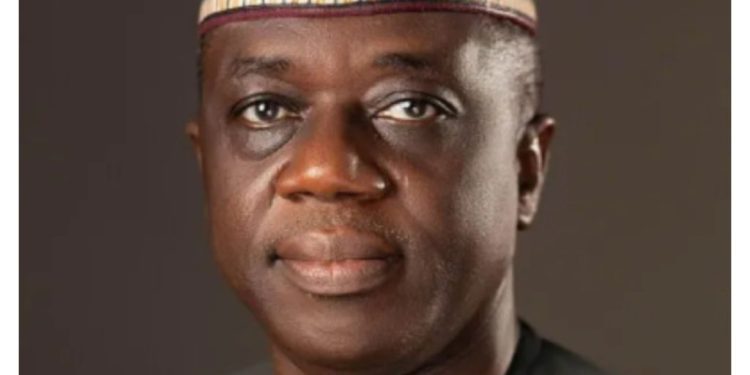

Newly appointed Accountant-General, Ogunjimi assumes office, pledges fairness to staff

The Accountant General of the Federation, Shamsedeen Babatunde Ogunjimi who was appointed by President Bola Ahmed Tinubu last week has assumed office on Monday.

In a brief ceremony marking his assumption at the Treasury Office in Abuja, he promised to be fair to staff of the office which he said, they would not be intimidated or victimized during his tenure of office.

In his maiden address to the entire staff of the Office of the Office of the Accountant General of the Federation, he called for unity, professionalism and commitment in order to achieve the objectives of the office.

He recalled how he suffered victimisaton in hands of previous Chief Executives where he worked, he promised that it would not be the case as he was elevated as the Accountant General of the Federation.

He said: “It is good to be back, this is our home, nobody will drive us out. I want everybody to have the spirit of togetherness.

“I am not in any group, I am not going to polarize the house.

“If I fail, everyone here has failed. I am ready to commit myself to the service of the public.”

The Accountant General called on staff to let the past go and forge a new spirit in order to move the office forward for the good of the nation and the current administration.

“During my interview for this job, when I was asked what I would do differently to change the image of the Treasury House, I wanted to put the question back to you.

“What will you do differently to correct the image of the OAGF? The question is to all staff members.

“Everyone of us must work to change the perception of the country’s treasury.

“I have been a victim of the chief executive officer firing directors he or she doesn’t like.

He assured the staff of the Treasury House of cooperation they haven’t seen in their lifetime professional career, saying, ‘I don’t like him. Please remove him’, I am not going to be that leader,” he said.

CAPITAL POST recalled that President Bola Tinubu last week approved the appointment of had last week approved the appointment of Mr Babatunde Ogunjimi as the country’s new Accountant General thereby putting to rest the guesswork of who should be the next occupier of the Treasury House.

Economy

NASENI embarks on nationwide campaign to promote Made-in-Nigeria products

The National Agency for Science and Engineering Infrastructure (NASENI) has announced plans to launch a nationwide sensitization campaign to promote the adoption of Made-in-Nigeria products, highlighting the transformative impact of locally engineered innovations on the nation’s economy.

As part of the initiative, the agency is organizing strategic focus group meetings across the six geopolitical zones of the country to galvanize support for indigenous products.

Speaking at the North Central zonal meeting in Abuja on Wednesday, the Coordinator, Implementation and Management Office (IMO) of NASENI, Yusuf Kasheem, emphasized the importance of supporting local products to drive economic growth.

“When Nigerians embrace the initiative, we do more than purchase goods—we invest in our future. We create jobs, stimulate economic growth, and reduce our reliance on imported alternatives,” Kasheem said.

He further highlighted that the widespread adoption of locally made products is a step toward a stronger, more self-sufficient Nigeria.

Kasheem reiterated NASENI’s dedication to leveraging technology and innovation to boost national prosperity.

“In just over a year, through strategic partnerships both locally and internationally, NASENI has introduced 35 commercially viable Made-in-Nigeria products. These innovations span critical sectors and reflect our commitment to excellence and self-reliance, he said”

Among the highlighted products are Solar Irrigation Systems, Home Solar Systems, Lithium Batteries, Electric Vehicles, Laptops, Smartphones, Animal Feed Mill Machines, and Energy-Efficient Street Lamps—each designed to improve various aspects of the economy and daily life.

In her remarks, the Executive Director of Business Development at NEXIM Bank, Hon. Stella Okotete, described the promotion of Made-in-Nigeria products as a national imperative.

“By increasing the quality, branding, and competitiveness of our products, we enhance our foreign exchange earnings, create jobs, and strengthen the value chain across key sectors such as manufacturing, agriculture, solid minerals, and services,” Okotete stated.

To support the initiative, Okotete disclosed that NEXIM Bank had introduced targeted interventions such as single-digit interest loans for export manufacturing and value addition, along with export credit facilities to improve financing access for Small and Medium Enterprises (SMEs).

The campaign aims to foster a culture of pride and reliance on locally made products, positioning Nigeria as a hub for technological innovation and economic self-sufficiency.

Economy

FAAC: N1.703 trillion revenue shared among FG, states, LGCs for January

A total sum of N1.703 trillion from the Federation Account Allocation Committee (FAAC) was shared among the Federal, States and Local Government Councils as the January 2025 Federation Account Revenue.

This was disclosed at the FAAC meeting held in Abuja on Friday.

The N1.703 trillion total distributable revenue comprised distributable statutory revenue of N749.727 billion, distributable Value Added Tax (VAT) revenue of N718.781 billion, Electronic Money Transfer Levy (EMTL) revenue of N20.548 billion and Augmentation of N214 billion.

A communiqué issued by FAAC stated that total gross revenue of N2.641 trillion was available in the month of January 2025.

The total deduction for the cost of collection was N107.786 billion, while total transfers, interventions, refunds, and savings were N830.663 billion.

According to the communiqué, gross statutory revenue of N1.848 trillion was received for the month of January 2025. This was higher than the sum of N1.226 trillion received in the month of December 2024 by N622.125 billion.

Gross revenue of N771.886 billion was available from VAT in January 2025. This was higher than the N649.561 billion available in the month of December 2024 by N122.325 billion.

The communiqué stated that from the N1.703 trillion total distributable revenue, the federal government received a total sum of N552.591 billion, and the State Governments received a total sum of N590.614 billion.

The Local Government Councils received a total sum of N434.567 billion, and a total sum of N125.284 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N749.727 billion distributable statutory revenue, the communiqué stated that the Federal Government received N343.612 billion, and the State Governments received N174.285 billion.

The Local Government Councils received N134.366 billion, and the sum of N97.464 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N718.781 billion distributable VAT revenue, the Federal Government received N107.817 billion, the State Governments received N359.391 billion, and the Local Government Councils received N251.573 billion.

A total sum of N3.082 billion was received by the federal government from the N20.548 billion Electronic Money Transfer Levy (EMTL). The State Governments received N7.192 billion, and the Local Government Councils received N10.274 billion.

From the N214 billion Augmentation, the Federal Government received N98.080 billion, and the State Governments received N49.747 billion.

The Local Government Councils received N38.353 billion, and a total sum of N27.820 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

In January 2025, VAT, Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies increased significantly while Electronic Money Transfer Levy (EMTL) and Oil and Gas Royalty decreased considerably.

-

Politics1 week ago

Politics1 week agoBenue APC: Support group leaders accuses Benue Chief Judge of interference

-

News1 week ago

News1 week agoSexual Harassment: Social media abuzz as Natasha hails ex-Gov Fayemi for standing for the truth

-

Opinion6 days ago

Opinion6 days agoEmbattled Natasha: Again, where have the elders in Kogi gone?

-

Politics1 week ago

Politics1 week agoAnambra guber: APC opts for indirect primary

-

Crime1 week ago

Crime1 week agoEdo Gov’t demolishes kidnappers’ hideouts in Ekpoma, Uromi

-

News7 days ago

News7 days agoAnambra Primaries: INEC warns against sudden changes

-

Foreign4 days ago

Foreign4 days agoNorth Korea: A country not like others with 15 strange things that only exist

-

News1 week ago

News1 week agoPrime Green Projects and Innovation moves to change home ownership, launches ‘Vision 1 million Ire Homes’