Economy

Shehu Sani, Ndume differ over tax reforms

The battle for the soul of the proposed tax reform bill before the National Assembly is tilting towards controversy day by day as the former Senator representing Kaduna Central Senatorial District, Shehu Sani was of the belief that the reform would serve the interest of the Northern region better than what is being insinuated.

There have been disquiet among the northerners particularly the elite, the politically exposed among them, some lawmakers in the upper and lower legislative Chambers of the National Assembly who expressed misgivings that the bill would be injurious to the northern interest if it was allowed to see the light of the day.

The confidence crisis was instigated after President Ahmed Tinubu in October, forwarded an executive bill to the National Assembly urging lawmakers to consider and pass four tax reform bills which include the Nigeria tax bill, the tax administration bill, and the joint revenue board establishment bills.

But reacting to the bills at different fora and through a statement which he personally signed, Senator representing Borno South Senatorial District, and former Chief Whip, Mohammed Ali Ndume opposed the bill and described it as ‘ill-timed’ given that Nigerians are currently in economic crisis.

According to him, it does not make ‘political sense’ presenting the tax reform bills to the lawmakers for now. Though, he admitted that he hasn’t read the bills, he allayed fears that the tax reform bill would increase domestic expenditure of Nigerians.

In his words: “I can tell you that it will be dead on arrival. We don’t need to study the bill,” he said.

“The general thing is that Nigerians are not willing to talk, hear or pay any tax now considering the situation we have faced because this is the government of the people.

“Right now, people can’t even afford what to eat. People are struggling to survive. Let people live first before you start asking them for tax.”

Reacting to the position of Senator Ndume, Shehu Sani, a Civil Rights Activist described Ali Ndume as a lazy lawmaker who has not read a copy of the bill, but has blindly opposed it thereby attempting to deny Nigerians of the advantages inherent in the bill.

Sani said, there are six geopolitical zones and four regions of the country, wondering what are those issues in the bill that the North should fear, adding that the North should be ready to confront its fears and conquer them.

He insisted that the tax reform bills were not inimical to the north as being portrayed by Ndume and his likes rather the North stands at advantage in the reform proposal that would place the Value Added Tax, VAT right in hands of each state to control.

For instance, “there is a provision where companies are to pay value added tax to the host State instead of sending it to a single account that would not be shared among the 36 States including the Federal Capital Territory.”

“Its in fact economically beneficial and fair to all parts. People should keep aside sentiments and read the Bill carefully.

“It’s a comprehensive and bold move to harmonise and simplify tax administration and streamline its operations and enforcement. The Bill will actually generate and safeguard more revenue for the country and the States.

“It will also combat the corruption in the so-called tax waivers granted to business cabals. There is nowhere in the document where any region will be shortchanged or taxes will be increased or jobs will be lost.

Sani insisted that the reform could create a paradigm shift from the past and outdated tax system to a robust way of generating revenue which it takes a courageous president to do, particularly, as it will address business cabals who could do anything to evade tax remittances and seek unnecessary tax waivers.

He warned that the economy would be taken aback if the tax reform bills were truncated, condemning Northern State Governors’ rejection of the reform. He advised the State Governors to engage consultants to study the bill, if they had no time to do it themselves and backtracks on their decision.

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

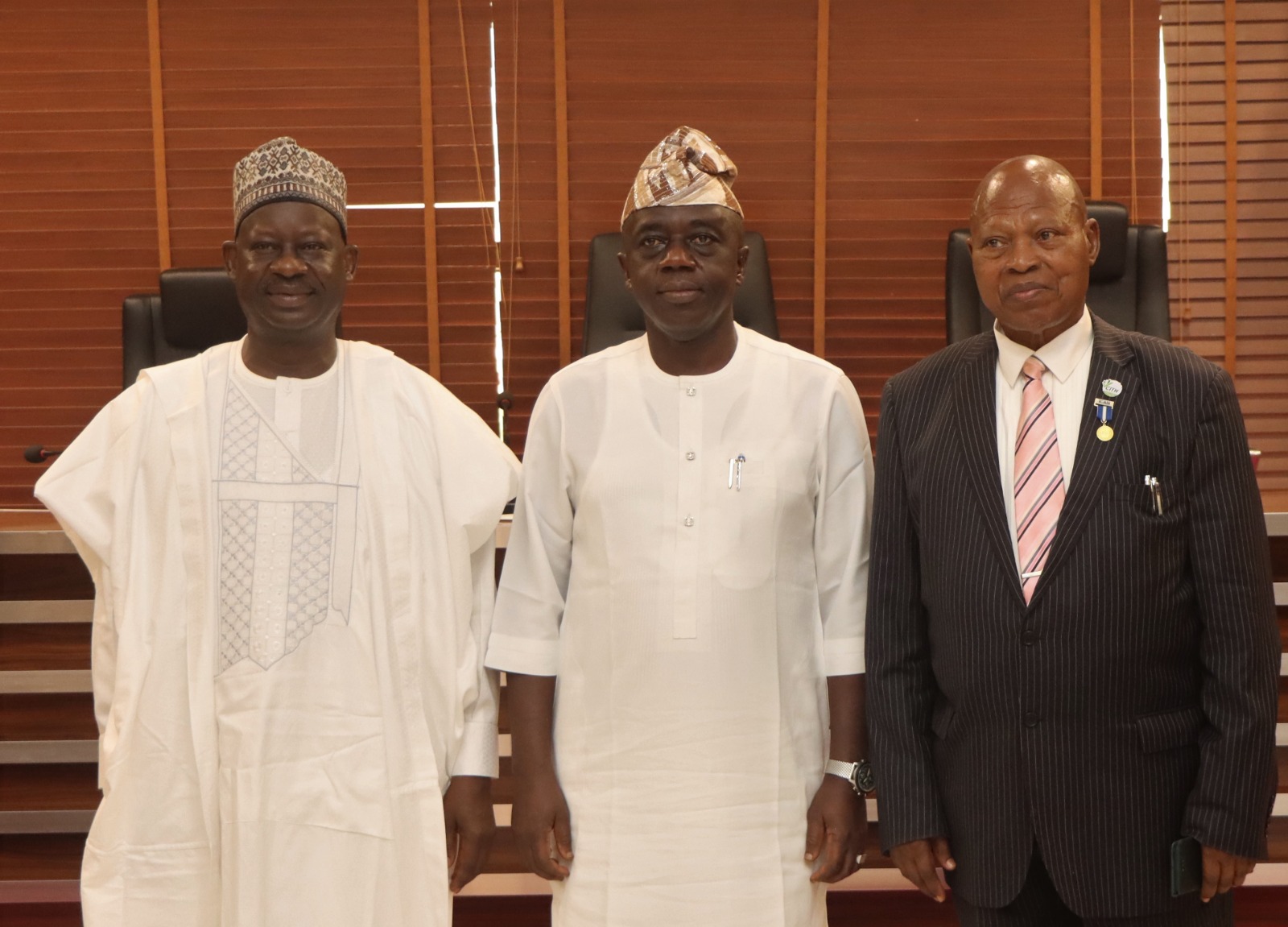

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

Politics1 week ago

Politics1 week agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

Foreign1 week ago

Foreign1 week agoHouthis declare Ben-Gurion Airport ‘no longer safe’ after renewed Gaza fighting

-

Politics1 week ago

Politics1 week agoYahaya Bello deceptively arranging recall of Senator Natasha, desperate to replace her – Constituents

-

News1 week ago

News1 week agoWhy Christ Embassy’s Pastor Chris holds Abuja mega crusade – Fisho

-

Politics1 week ago

Politics1 week agoAtiku, El-rufai, Obi condemn Tinubu’s suspension of Rivers Governor, demand reversal

-

Crime1 week ago

Crime1 week agoGhana’s anti-drug agency nabs Nigerian drug kingpin, Uchechukwu Chima, seizes $2.1m worth of cocaine, heroin

-

News1 week ago

News1 week agoUmeh denies receiving $10,000 with other 42 Senators to support state of emergency in Rivers

-

Business1 week ago

Business1 week agoFlutterwave, FIRS collaborate to digitize tax collection in Nigeria