Economy

2022 Budget: Buhari seeks supplementary budget of N2.557 trillion for petrol subsidy

The Senate has received President Muhammadu Buhari’s request for a supplementary budget of N2.557 trillion to accommodate fuel subsidy for the year 2022.

The request shows the Federal government’s readiness to continue with payment of fuel subsidy to petroleum marketers as against the initial plan to remove fuel subsidy which gulps nearly N250 billon monthly.

The leadership of the Senate had recently intervened in the planned removal of subsidy which has generated tension across the country with the Nigeria Labour Congress, NLC, and the Trade Union Congress, TUC, threatening to go on strike.

The Minister of State for Petroleum Resources Timipre Sylva and his counterpart in the ministry of Finance Hajia Zainab Ahmad as well as the Group Managing Director NNPC limited Mele Kyari met with the National Assembly leadership when the need for amendment of the appropriation Act was discussed to provide extension of subsidy provision beyond June 2022.

The President therefore requested the senate to amend the 2022 Appropriation Act passed by the National Assembly in December, 2021.

The request was contained in a letter dated February 10, 2022, and read during plenary by the Senate President, Ahmad Lawan.

Buhari in his request said it was imperative to remove all capital projects that were replicated in the 2022 Appropriation Act.

He disclosed that 139 out of the 254 projects in the budget totaling N13.24 billion had been identified for deletion.

Buhari, therefore, requested the National Assembly to amend the Appropriation Act to provide for Capital Expenditures in the sum of N106,161,499,052 billion naira; and N43,870,592,044 billion naira for Recurrent Expenditures.

Buhari underscored the need to reinstate four capital projects totaling N1.4 billion in the Executive proposal for the Federal Ministry of Water Resources; and N22.0 billion cut from the provision for the Sinking Fund to retire mature loans needed to meet government’s obligations under already Issued Bonds.

The full text of the letter entitled, “Submission of the 2022 Appropriation Amendment Proposal”, reads:

“As I indicated at the signing of the 2022 Appropriation Act, I forward herewith the Proposals for amendment of the 2022 Appropriation Act (as detailed in Schedules I-V), for the kind consideration and approval by the Senate.

“Let me seize this opportunity to once again express my deep gratitude to the leadership and members of the Senate for the expeditious consideration and passage of the 2022 Appropriation Bill as well as the enabling 2021 Finance Bill.

“It has become necessary to present this amendment proposal considering the impacts of the recent suspension of the Petroleum Motor Spirit (PMS) subsidy removal and the adverse implications that some changes made by the National

Assembly in the 2022 Appropriation Act could have for the successful implementation of the budget.

“It is important to restore the provisions made for various key capital projects in the 2022 Executive Proposal (see details in Schedule l) that were cut by the National Assembly. This is to ensure that critical ongoing projects that are cardinal to this administration, and those nearing completion, do not suffer a setback due to reduced funding.

“It is equally important to reinstate the N25.81 billion cut from the provision for the Power Sector Reform Programme in order to meet the Federal Government’s commitment under the financing plan agreed with the World Bank.

“In addition, it is necessary to reinstate the four (4) capital projects totaling N1.42 billion in the Executive Proposal for the Federal Ministry of Water Resources that were removed in the 2022 Appropriation Act.

“Furthermore, there is critical and urgent need to restore the N3 billion cut from the provision made for payment of mostly long outstanding Local Contractors’ Debts and Other Liabilities as part of our strategy to reflate the economy and spur growth (see Schedule I).

“You will agree with me that the inclusion of National Assembly’s expenditures in the Executive Budget negates the principles of separation of Powers and financial autonomy of the Legislature. It is therefore necessary to transfer the National Assembly’s expenditures totaling N16.59 billion in the Service Wide Vote to National Assembly Statutory Transfer provision (see Schedule l).

“It is also imperative to reinstate the N22.0 billion cut from the provision for Sinking Fund to Retire Mature Loans to ensure that government can meet its obligations under already issued bonds as and when they mature.

“The cuts made from provisions for the recurrent spending of Nigeria’s Foreign Missions, which are already constrained, are capable of causing serious embarrassment to the country as they mostly relate to office and residential rentals.

“Similarly, the reductions in provisions for allowances payable to personnel of the Nigerian Navy and Police Formations and Commands could create serious issues for government. It is therefore imperative that these provisions be restored as proposed (see Schedule II).

“It is also absolutely necessary to remove all capital project is that replicated in the 2022 Appropriation Act; 139 out of the 254 such projects totaling N13.24 billion have been identified to be deleted from the budget.

“Some significant and non-mandate projects were introduced in the budgets of the Ministry of Transportation, Office of the Secretary to the Government of the Federation and Office of the Head of Civil Service of the Federation (see Schedule III).

There are several other projects that have been included by the National Assembly in the budgets of agencies that are outside their mandate areas. The Ministry of Finance, Budget and National Planning has been directed to work with your relevant Committees to comprehensively identify and realign all such misplaced projects.

“It is also necessary to restore the titles/ descriptions of 32 projects in the Appropriation Act to the titles contained in the Executive Proposal for the Ministry of Water Resources (see Schedule IV) in furtherance of our efforts to complete and put to use critical agenda projects.

“The Appropriation Amendment request is for a total sum of N106,161,499,052 (One hundred and six billion, one hundred and sixty-one million, four hundred and ninety-nine thousand, and fifty-two Naira only) for Capital Expenditures and N43,870,592,044 (Forty-three billion, eight hundred and seventy million, five hundred and ninety-two thousand, and forty-four Naira only) for Recurrent Expenditures.

“I therefore request the National Assembly to make the above amendments without increasing the budget deficit. I urge you to roll back some of the N887.99 billion of projects earlier inserted in the budget by the National Assembly to accommodate these amendments.

“However, following the suspension of the PMS subsidy removal, the 2022 Budget Framework has been revised to fully provide for PMS subsidy (see Schedule V).”

An additional provision of N2.557 trillion will be required to fund the petrol subsidy in 2022. Consequently, the Federation ACCOunt (Main Pool) revenue for the three tiers of government is projected to decline by N2.00 trillion, while FGN’s share from the Account is projected to reduce by N1.05 trillion. Therefore, the amount available to fund the FGN Budget is projected to decline by N969.09 billion.

“Aggregate expenditure is projected to increase by N45.85 billion, due to additional domestic debt service provision of N102.5 billion net of the reductions in Statutory Transfers by N56.67 billion, as follows: NDDC, by N12.61 billion from N102.78 billion to N90.18 billion; NEDC, by N5.90 bilion from N48.08 billion to N42.18 billion; UBEC, by N19.08 billion from N112.29 billion to N93.21 billion; Basic Health Care Fund, byN 9.54 billion from N56.14 billion to N46.60 billion; and NASENI, by N9.54 billion from N56.14 billion to N46.60 billion.

“Total budget deficit is projected to increase by N1.01 trillion to N7.40 trillion, representing 4.01% of GDP. The incremental deficit will be financed by new borrowings from the domestic market.

“Equally, it is imperative that Clause 10 of the 2022 Appropriation Act which stipulates that the Economic and Financial Crimes Commission (EFCC) and the Nigerian Financial Intelligence Unit (NFIU) are authorized to charge and defray from all money standing in credit to the units as revenues, penalties or sanctions at 10% for technical setup and operational cost at the units in this financial year be repealed.

“This clause is in conflict with the Act establishing these Agencies, as well as some other laws and financial regulations of the government. These are neither Revenue Generating Agencies nor Regulatory Bodies that generate revenue or charge penalty fees. They are fully funded (Personnel, Overhead and Capital) by Government through Budgetary provisions.

“The Fiscal Responsibility Act 2007, as well as the Finance Act 2021, require these Agencies to remit fully any recovered funds to the Consolidated Revenue Fund (CRF). This clause may lay a dangerous precedence, and spark clamours for similar treatment by other anti-corruption agencies.

“Also, the Clause 11 which stipulates that “Notwithstanding the provisions of any other law in force, Nigerian Embassies and Missions are authorised to expend funds allocated to them under the Capital components without having to seek approval of the Ministry of Foreign Affairs” should likewise be repealed. It too is inconsistent with extant Financial Regulations and the Public Procurement Act, which set thresholds for approving officers and Parastatal / Ministerial Tenders Boards for awards of Contracts for the procurement of goods and Services. This also amounts to an intrusion of the Legislature into what is an executive function.

“Given the urgency of the request for amendments, I I seek the cooperation of the National Assembly for expeditious legislative action on the 2022 Appropriation Amendment Proposal in order to sustain the gains of an early passage of the budget.

“Please accept, Distinguished Senate President, the assurances of my highest consideration.”

Economy

2025 Revenue: FG, States, LGAs share N1.678 trillion

A total sum of N1.678 trillion, being February 2025 Federation Account Revenue, has been shared to the Federal Government, States and the Local Government Councils.

The revenue was shared at the March 2025 Federation Account Allocation Committee (FAAC) meeting held in Abuja; chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The meeting was attended by the Accountant General of the Federation, Shamseldeen Ogunjimi.

The total distributable revenue of N1.678 trillion comprised distributable statutory revenue of N827.633 billion, distributable Value Added Tax (VAT) revenue of N 609.430 billion, Electronic Money Transfer Levy (EMTL) revenue of N35.171 billion, Solid Minerals revenue of N28.218 billion and Augmentation of N178 billion.

According to a communiqué issued by the Federation Account Allocation Committee (FAAC), total gross revenue of N2.344 trillion was available in the month of February 2025. Total deduction for cost of collection was N89.092 billion while total transfers, interventions, refunds and savings was N577.097 billion.

The communiqué stated that gross statutory revenue of N1.653 trillion was received for the month of February 2025. This was lower than the sum of N1.848 trillion received in the month of January 2025 by N194.664 billion.

Gross revenue of N654.456 billion was available from the Value Added Tax (VAT) in February 2025. This was lower than the N771.886 billion available in the month of January 2025 by N117.430 billion.

The communiqué stated that from the total distributable revenue of N1.678 trillion, the Federal Government received total sum of N569.656 billion and the State Governments received total sum of N562.195 billion.

The Local Government Councils received total sum of N410.559 billion and a total sum of N136.042 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N827.633 billion distributable statutory revenue, the communiqué stated that the Federal Government received N366.262 billion and the State Governments received N185.773 billion.

The Local Government Councils received N143.223 billion and the sum of N132.374 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N609.430 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N91.415 billion, the State Governments received N304.715 billion and the Local Government Councils received N213.301 billion.

A total sum of N5.276 billion was received by the Federal Government from the N35.171 billion Electronic Money Transfer Levy (EMTL). The State Governments received N17.585 billion and the Local Government Councils received N12.310 billion.

From the N28.218 billion Solid Minerals revenue, the Federal Government received N12.933 billion and the State Governments received N6.560 billion.

The Local Government Councils received N5.057 billion and a total sum of N3.668 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

The Augmentation of N178 billion was shared as follows: Federal Government received N93.770 billion, the State Governments received N47.562 billion and the Local Government Councils received N36.668 billion.

In February 2025, Oil and Gas Royalty and Electronic Money Transfer Levy (EMTL), increased significantly while Value Added Tax (VAT), Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies recorded decreases.

Economy

Protesters urge president Tinubu to protect Diaspora housing investments along Lagos-Calabar coastal highway

A group under the aegis of Renewed Hope Concern Citizens (RHCC) on Friday staged a peaceful protest, calling for President Bola Tinubu’s intervention in protecting housing investments owned by Nigerians in the diaspora along the Lagos-Calabar coastal highway.

The protesters gathered in front of the United States Embassy in Abuja, carrying banners with inscriptions such as; Minister of Works, Senator Umahi should revert to the original gazetted alignment as promised. Enough is Enough; Association of Nigerian Diaspora Investors (ANDI) has cried enough, please intervene to save their energy to promote, support, and assist the Renewed Hope Administration; Renewed Hope Concern Citizens want Diaspora Investments to be protected and given adequate attention among others

“As committed stakeholders in the nation’s economic progress, we have consistently supported the government’s vision, particularly in revitalizing Nigeria’s infrastructure and energy sector. While we acknowledge the administration’s positive strides, recent developments have raised concerns about the misalignment of energy policies, particularly regarding the 2006 Gazetted alignment.

“We urgently call on the Minister of Works, Senator David Umahi, to restore the 2006 Gazetted alignment to ensure continued growth and stability in Nigeria’s energy sector,” said Hon. Tayo Agbaje, Chairman of RHCC, while addressing journalists.

The group refuted the Minister’s claim that an underground cable warranted the removal of structures in Okun Ajah, Lagos and outlined several reasons why President Tinubu’s intervention is crucial.

According to them, The 2006 Gazetted alignment has long provided a stable and predictable framework, essential for maintaining investor confidence in Nigeria’s energy sector.

“Diaspora investors contribute significantly to job creation, business growth, and the overall economy, making their protection vital to sustaining these contributions.

“The President should investigate the Minister of Works’ claim about the underground cable allegedly interfering with the 2006 Gazetted plan.

“Restoring the alignment will reinforce Nigeria’s commitment to a stable investment climate, boosting foreign investor confidence and attracting much-needed capital for infrastructure development.

“Deviating from established policies creates uncertainty, undermining both current and future foreign investments.

“Maintaining the 2006 Gazetted alignment will signal Nigeria’s dedication to long-term economic stability, further reassuring both local and international investors,” the group stated.

The RHCC reaffirmed its support for the Association of Nigeria in Diaspora Investments (ANDI) in its quest to uphold the 2006 Gazetted alignment plan of the Lagos-Calabar Coastal Highway.

They urged the government to act swiftly to protect diaspora investors, as this will strengthen Nigeria’s investment future and ensure continued economic success under the Renewed Hope Administration.

Economy

Ogunjimi promises to collaborate with ex-Accountants-General in taking treasury house to greater heights

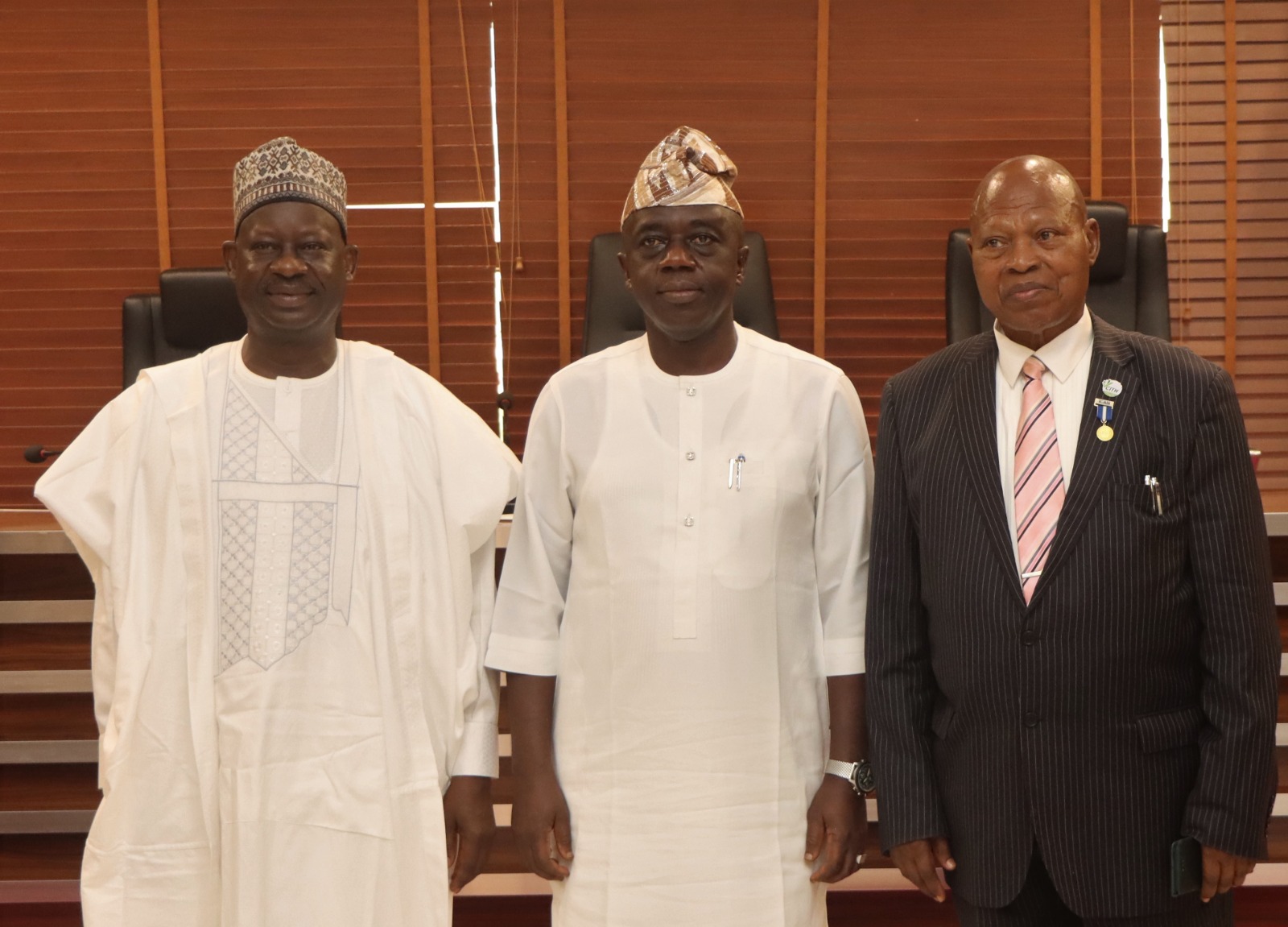

The newly appointed Accountant General

of the Federation, Mr Shamseldeen B. Ogunjimi said he would collaborate and tap from the wealth of experiences of all Former Accountants -General of the Federation to bring the nation treasury to a greater height.

Mr Ogunjimi disclosed this while receiving two Former Accountants-General of the Federation, Dr John Naiyeju and Dr Ibrahim Dankwambo in his office in Abuja.

Speaking earlier, Senator Ibrahim Dankwambo suggested the upgrading of the Treasury Academy, Orozo owned by the Office of the Accountant-General of the Federation (OAGF) to a Degree (University) awarding Institute.

Also, Dr. John K. Naiyeju charged the new Accountant-General to carry along everyone and advised him to make staff welfare his priority.

In a related development, the Accountant-General of the Federation expressed his willingness to work with all professional organisation that will bring positive development to the nation, especially, his professional and Academy colleagues of the doctorate class.

Mr Ogunjimi called on his classmates to come up with ideas and suggestions that will enhance the management of the nation’s treasury that will positively affect the economy development.

In his remarks, the Chairman Forum of Doctorate Students, Ibrahim Aliyu said that they were in Treasury House to congratulate one of their own and assured him of their support towards his successful tenure.

-

News1 week ago

News1 week agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

News1 week ago

News1 week agoReport of attack on Wike’s Port Harcourt residence false, misleading – Police

-

News1 week ago

News1 week agoShehu Sani debunks Governor Uba Sani’s alleged diversion of LG funds, challenges El-Rufai to publicly tender evidence

-

News1 week ago

News1 week agoPlateau gov’t expresses concern over violence in Shendam LGA, calls for calm

-

Politics7 days ago

Politics7 days agoOpposition leaders announce coalition to challenge Tinubu in 2027

-

Interview1 week ago

Interview1 week agoSenators Natasha-Akpabio saga should have been resolved privately – Rev. Mrs Emeribe

-

Opinion1 week ago

Opinion1 week agoSule Lamido, PDP, and the politics of defection.

-

Foreign5 days ago

Foreign5 days agoHouthis declare Ben-Gurion Airport ‘no longer safe’ after renewed Gaza fighting