Economy

18 States paying outgoing governors jumbo pensions owe N3 trillion debt

No fewer than 18 outgoing state governors will retire into lives of luxury with generous pension benefits despite mounting debts and unpaid workers’ salaries.

The PUNCH investigations showed that the governors, who will hand over to their successors on May 29, 2023, would be leaving behind at least N3.06tn debt for the incoming administrations.

According to data from the Debt Management Office, the debt figure of these states included N2.27tn domestic loans and $1.71bn foreign borrowing.

The foreign debt is about N787.51bn, using the exchange rate of the Central Bank of Nigeria, which was N460.53 per dollar as of May 14, 2023).

The debt figure was as of December 2022, which was the latest figure by the DMO.

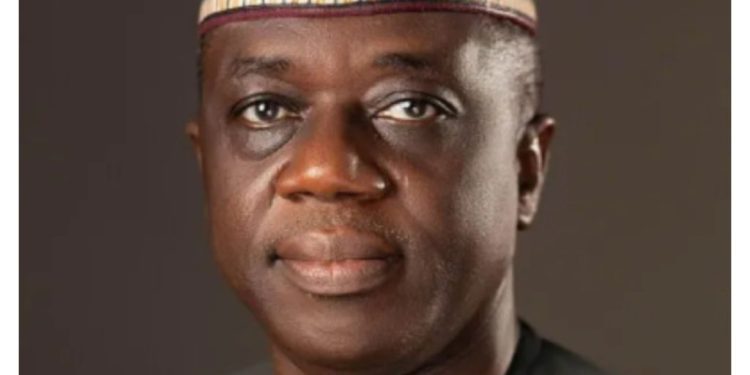

The outgoing governors include Nyesom Wike (Rivers State), Ifeanyi Okowa (Delta State), Udom Emmanuel (Akwa Ibom State), Abdullahi Ganduje (Kano State), Badaru Abubakar (Jigawa State), Bello Matawalle (Zamfara State), Ben Ayade (Cross River State), Okezie Ikpeazu (Abia State),and David Umahi (Ebonyi State).

Such perks include one duplex in any city of their choice within Nigeria, one sport utility vehicle and a backup car replaceable every two years, an office with four aides, two security personnel and monthly salaries, among others. Each of the four domestic workers will earn N100,000 monthly.

Akwa Ibom, which had N219.27bn domestic debt and $44.85m foreign debt, reportedly spends an average of N267.78m yearly on ex-governors and their deputies and Governor Emmanuel and his deputy are expected to enjoy the same as the state’s Pension Act, 2014 provides.

They are also entitled to the replacement of official and utility vehicles every four years.

Kano had N122.36bn and $100.67m foreign debt. However, Ganduje and his deputy are entitled to 100 per cent of their basic salaries, a six-bedroom house and free medical treatment for themselves and members of their families upon handover on May 29, 2023.

The law guiding pension rights for former governors and deputy governors also states that they will get well-equipped offices.

The Jigawa State ‘Former Public Officers Pension and other Benefits Law No. 15 of 2015’ stipulates that a governor who successfully completes his term without impeachment will be entitled to a monthly pension equivalent to the current salary of the current governor, two brand new vehicles to be provided by the state government and to be replaced after every four year, six-bedroom fully furnished house, two personal assistants not below grade level 10, two drivers selected by the governor and to be paid by the state, a fully furnished office in any location of choice and fully paid medical treatment within Nigeria and abroad.

The deputy governor is also to get a monthly pension equivalent to the incumbent’s salary, one assistant not below level eight, one brand new vehicle, a four-bedroom flat and an office in a location of his choice.

However, the state had N43.95bn domestic debt and $26.99m foreign debt.

Matawalle lost his re-election bid and will complete his four-year tenure on May 28, 2023, leaving N112.2bn domestic debt and $28.86m foreign debt.

The ‘Grant of Pension to Governor or Deputy Governor (Amendment Law), 2006’ made provisions for pension and other benefits to former governors. It provided a pension for life equivalent to the salary of the incumbent, two personal staff members, two vehicles replaceable every four years, two drivers, and free medical for former governors, their deputies and their immediate family members in Nigeria or abroad.

It stipulated N7m monthly for former governors and N2m to former deputy governors, but former governor Abdul-aziz Yari reviewed it to N10m and N5m monthly, respectively. However, the law was repealed by the state House of Assembly on November 26, 2019.

Also, findings revealed that the outgoing governor, Bello Matawalle, owes workers two months’ salaries. Matawalle of the APC has been urged by the NLC and the TUC in the state to settle all outstanding salaries before handing over to Dauda Lawal of the PDP.

Despite having N90.6bn domestic debt and $36.56m foreign debt, Tambuwal is expected to inherit the Sokoto State Pension Law, which makes provision for N200m every four years for former governors, while his deputy is entitled to perks amounting to N180m, being monetisation for other entitlements, including domestic aides, residences and vehicles that can be renewed after every four years.

Section 2 (2) of the Sokoto State Grant of Pension (Governor and Deputy Governor) Law, 2013 states, “The total annual pension to be paid to the governor and deputy governor shall be at a rate equivalent to the annual total salary of the incumbent governor or deputy governor of the state, respectively.”

In Plateau State, the incoming governor, Caleb Muftwang of the PDP, will be forced to settle outstanding salaries owed by his predecessor, Simon Lalong of the APC. The state is currently on shutdown due to the indefinite strike declared by the NLC and the Trade Union Congress.

In Taraba State, almost all categories of workers are being owed. From lecturers in the state-owned university to teachers. The Taraba State NLC, during the 2023 Labour Day celebration, urged the governor to settle the six months’ salaries of local government employees and five months for primary school teachers before handing over to the incoming administration.

In Cross River State, the incoming governor, Bassey Otu, will face angry environmental workers in the state. Recently, the environmental workers protested the failure of the government to pay their four months’ salaries.

The National Vice-President of the TUC, Tommy Etim, called on all the affected governors to clear “their tables” and pay all outstanding salaries before handing over to their successors.

Etim, who is also the National President of the Association of Senior Civil Servants said, “As they are leaving, they should clear their tables and pay all outstanding salaries. These governors need to know that salary is a right and not a privilege. Failure to pay will also be a huge burden on the incoming administrations.

“Also, the governors have all set up transition committees; they must include what they owe in their handover notes. Let everybody know. However, in order to avert industrial crises, they must settle the outstanding salaries and other entitlements. They should do this to redeem their images. They must clear the salaries.”

A fiscal transparency analyst, Victor Agi, kicked against the huge amount provided to ex-political officeholders as retirement benefits.

“What we are doing is, we are deliberately plunging our country into a coma. A time will come and we are close to it when all we are generating as internally generated revenue will just be enough salaries and pensions, and only take care of political officeholders without any infrastructural development. We must condemn in strong terms the spending of the little resources we have to better the lives of politicians at the detriment of the states.”

Punch

Economy

Newly appointed Accountant-General, Ogunjimi assumes office, pledges fairness to staff

The Accountant General of the Federation, Shamsedeen Babatunde Ogunjimi who was appointed by President Bola Ahmed Tinubu last week has assumed office on Monday.

In a brief ceremony marking his assumption at the Treasury Office in Abuja, he promised to be fair to staff of the office which he said, they would not be intimidated or victimized during his tenure of office.

In his maiden address to the entire staff of the Office of the Office of the Accountant General of the Federation, he called for unity, professionalism and commitment in order to achieve the objectives of the office.

He recalled how he suffered victimisaton in hands of previous Chief Executives where he worked, he promised that it would not be the case as he was elevated as the Accountant General of the Federation.

He said: “It is good to be back, this is our home, nobody will drive us out. I want everybody to have the spirit of togetherness.

“I am not in any group, I am not going to polarize the house.

“If I fail, everyone here has failed. I am ready to commit myself to the service of the public.”

The Accountant General called on staff to let the past go and forge a new spirit in order to move the office forward for the good of the nation and the current administration.

“During my interview for this job, when I was asked what I would do differently to change the image of the Treasury House, I wanted to put the question back to you.

“What will you do differently to correct the image of the OAGF? The question is to all staff members.

“Everyone of us must work to change the perception of the country’s treasury.

“I have been a victim of the chief executive officer firing directors he or she doesn’t like.

He assured the staff of the Treasury House of cooperation they haven’t seen in their lifetime professional career, saying, ‘I don’t like him. Please remove him’, I am not going to be that leader,” he said.

CAPITAL POST recalled that President Bola Tinubu last week approved the appointment of had last week approved the appointment of Mr Babatunde Ogunjimi as the country’s new Accountant General thereby putting to rest the guesswork of who should be the next occupier of the Treasury House.

Economy

NASENI embarks on nationwide campaign to promote Made-in-Nigeria products

The National Agency for Science and Engineering Infrastructure (NASENI) has announced plans to launch a nationwide sensitization campaign to promote the adoption of Made-in-Nigeria products, highlighting the transformative impact of locally engineered innovations on the nation’s economy.

As part of the initiative, the agency is organizing strategic focus group meetings across the six geopolitical zones of the country to galvanize support for indigenous products.

Speaking at the North Central zonal meeting in Abuja on Wednesday, the Coordinator, Implementation and Management Office (IMO) of NASENI, Yusuf Kasheem, emphasized the importance of supporting local products to drive economic growth.

“When Nigerians embrace the initiative, we do more than purchase goods—we invest in our future. We create jobs, stimulate economic growth, and reduce our reliance on imported alternatives,” Kasheem said.

He further highlighted that the widespread adoption of locally made products is a step toward a stronger, more self-sufficient Nigeria.

Kasheem reiterated NASENI’s dedication to leveraging technology and innovation to boost national prosperity.

“In just over a year, through strategic partnerships both locally and internationally, NASENI has introduced 35 commercially viable Made-in-Nigeria products. These innovations span critical sectors and reflect our commitment to excellence and self-reliance, he said”

Among the highlighted products are Solar Irrigation Systems, Home Solar Systems, Lithium Batteries, Electric Vehicles, Laptops, Smartphones, Animal Feed Mill Machines, and Energy-Efficient Street Lamps—each designed to improve various aspects of the economy and daily life.

In her remarks, the Executive Director of Business Development at NEXIM Bank, Hon. Stella Okotete, described the promotion of Made-in-Nigeria products as a national imperative.

“By increasing the quality, branding, and competitiveness of our products, we enhance our foreign exchange earnings, create jobs, and strengthen the value chain across key sectors such as manufacturing, agriculture, solid minerals, and services,” Okotete stated.

To support the initiative, Okotete disclosed that NEXIM Bank had introduced targeted interventions such as single-digit interest loans for export manufacturing and value addition, along with export credit facilities to improve financing access for Small and Medium Enterprises (SMEs).

The campaign aims to foster a culture of pride and reliance on locally made products, positioning Nigeria as a hub for technological innovation and economic self-sufficiency.

Economy

FAAC: N1.703 trillion revenue shared among FG, states, LGCs for January

A total sum of N1.703 trillion from the Federation Account Allocation Committee (FAAC) was shared among the Federal, States and Local Government Councils as the January 2025 Federation Account Revenue.

This was disclosed at the FAAC meeting held in Abuja on Friday.

The N1.703 trillion total distributable revenue comprised distributable statutory revenue of N749.727 billion, distributable Value Added Tax (VAT) revenue of N718.781 billion, Electronic Money Transfer Levy (EMTL) revenue of N20.548 billion and Augmentation of N214 billion.

A communiqué issued by FAAC stated that total gross revenue of N2.641 trillion was available in the month of January 2025.

The total deduction for the cost of collection was N107.786 billion, while total transfers, interventions, refunds, and savings were N830.663 billion.

According to the communiqué, gross statutory revenue of N1.848 trillion was received for the month of January 2025. This was higher than the sum of N1.226 trillion received in the month of December 2024 by N622.125 billion.

Gross revenue of N771.886 billion was available from VAT in January 2025. This was higher than the N649.561 billion available in the month of December 2024 by N122.325 billion.

The communiqué stated that from the N1.703 trillion total distributable revenue, the federal government received a total sum of N552.591 billion, and the State Governments received a total sum of N590.614 billion.

The Local Government Councils received a total sum of N434.567 billion, and a total sum of N125.284 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

On the N749.727 billion distributable statutory revenue, the communiqué stated that the Federal Government received N343.612 billion, and the State Governments received N174.285 billion.

The Local Government Councils received N134.366 billion, and the sum of N97.464 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

From the N718.781 billion distributable VAT revenue, the Federal Government received N107.817 billion, the State Governments received N359.391 billion, and the Local Government Councils received N251.573 billion.

A total sum of N3.082 billion was received by the federal government from the N20.548 billion Electronic Money Transfer Levy (EMTL). The State Governments received N7.192 billion, and the Local Government Councils received N10.274 billion.

From the N214 billion Augmentation, the Federal Government received N98.080 billion, and the State Governments received N49.747 billion.

The Local Government Councils received N38.353 billion, and a total sum of N27.820 billion (13% of mineral revenue) was shared to the benefiting States as derivation revenue.

In January 2025, VAT, Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty and CET Levies increased significantly while Electronic Money Transfer Levy (EMTL) and Oil and Gas Royalty decreased considerably.

-

News14 hours ago

News14 hours agoBill to establish National Cashew Production and Research Institute in Kogi passes first reading in Senate

-

Security5 days ago

Security5 days agoNigerian Coast Guard: Citizens warned against extortion as passage of bill is being awaited

-

Entertainment1 week ago

Entertainment1 week agoActor Baba Tee apologises to Ijoba Lande for having sex with his wife

-

Foreign1 week ago

Foreign1 week agoNorth Korea: A country not like others with 15 strange things that only exist

-

Politics1 week ago

Politics1 week agoGanduje, Barau receive Atiku support groups in 19 Northern States as APC Chairman declares death sentence on PDP, NNPP

-

Politics5 days ago

Politics5 days agoRetired military officer, colonel Gbenga Adegbola, joins APC with 13,000 supporters

-

Health1 week ago

Health1 week agoPresident Tinubu appoints Chief Medical Directors for medical centres across the country

-

Politics4 days ago

Politics4 days agoCPDPL accuses Adeyanju of orchestrating smear campaign against FCT Minister Wike